2.5 — Short Run Profit Maximization

ECON 306 • Microeconomic Analysis • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/microS23

microS23.classes.ryansafner.com

Revenues

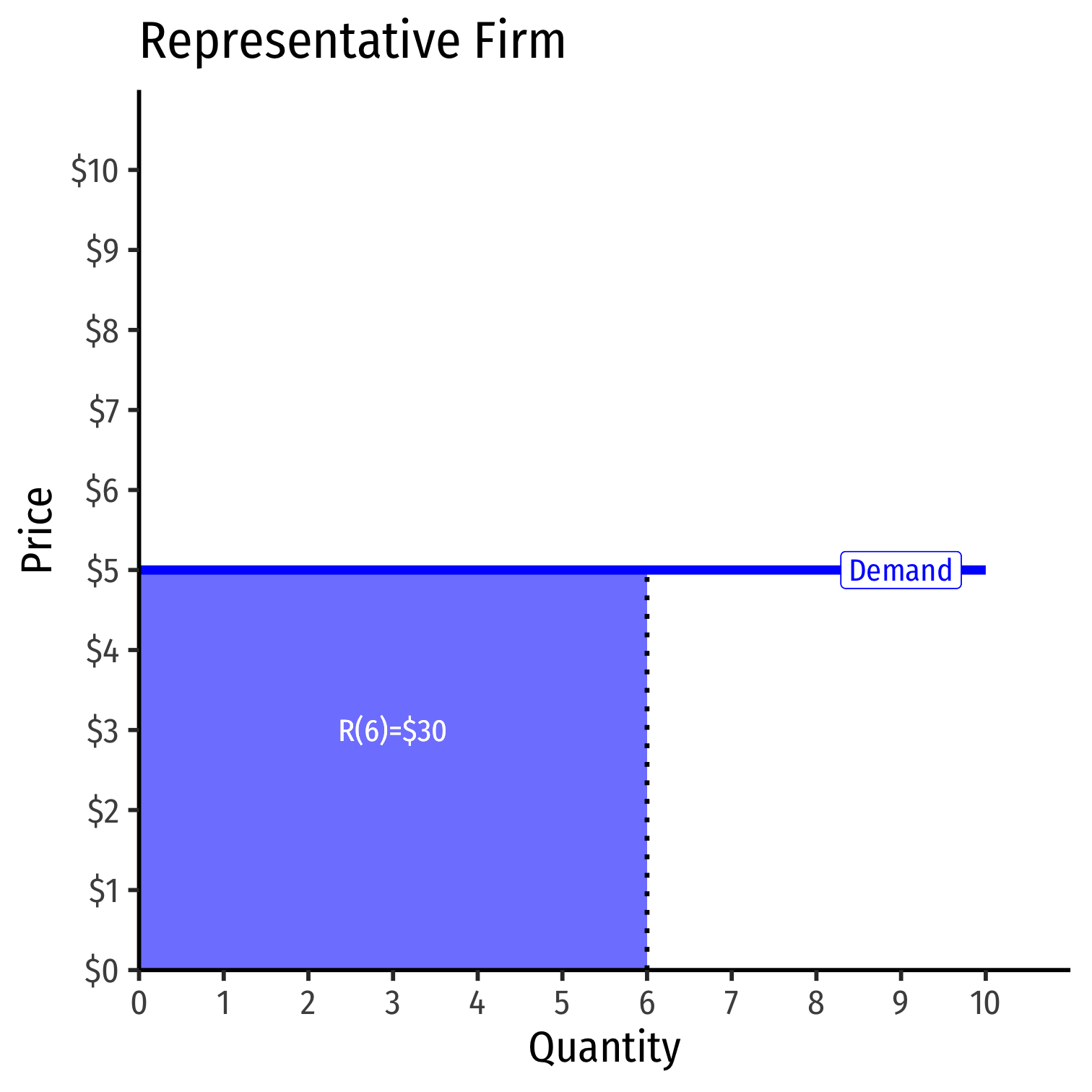

Revenues for Firms in Competitive Industries I

Revenues for Firms in Competitive Industries I

Revenues for Firms in Competitive Industries I

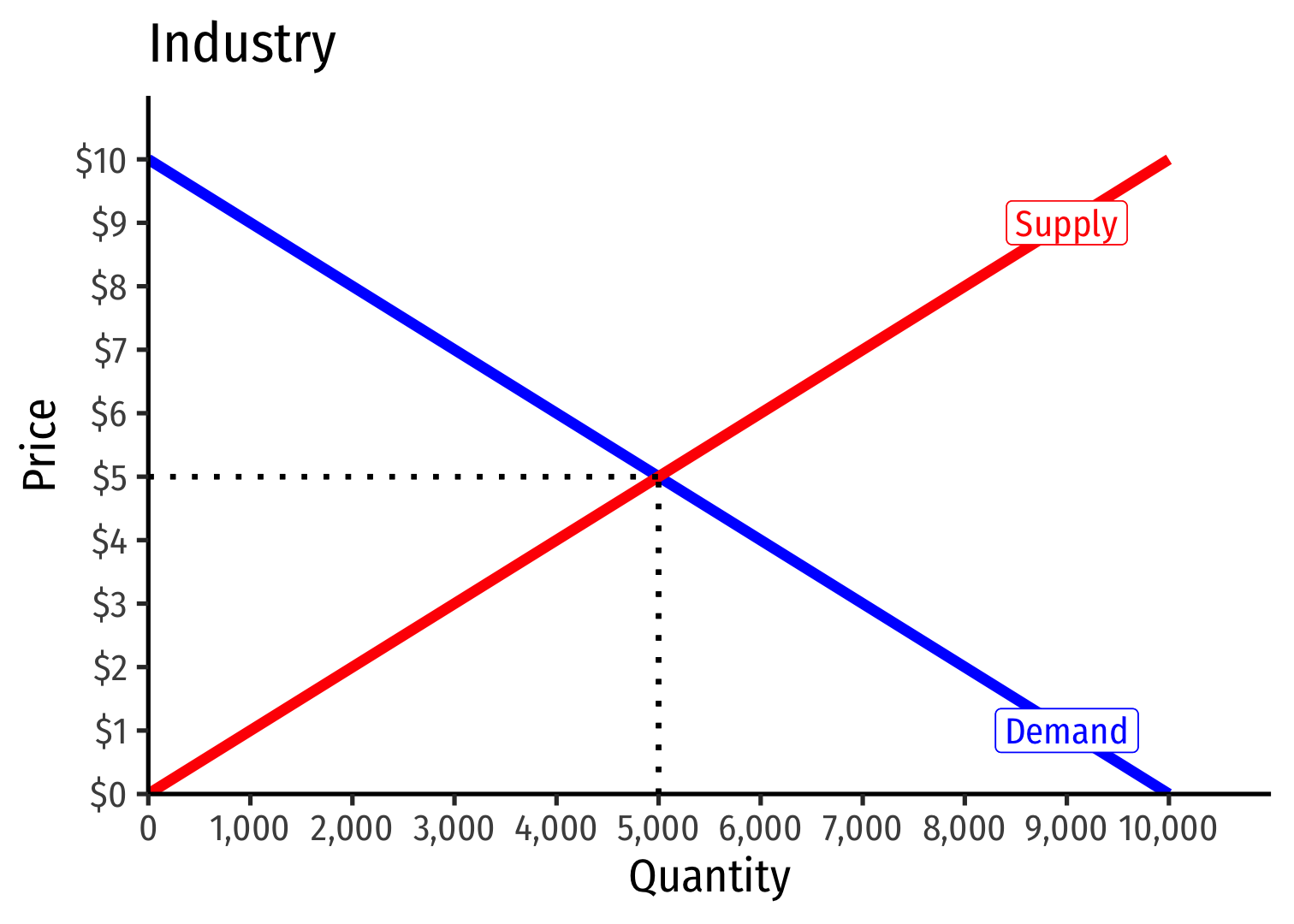

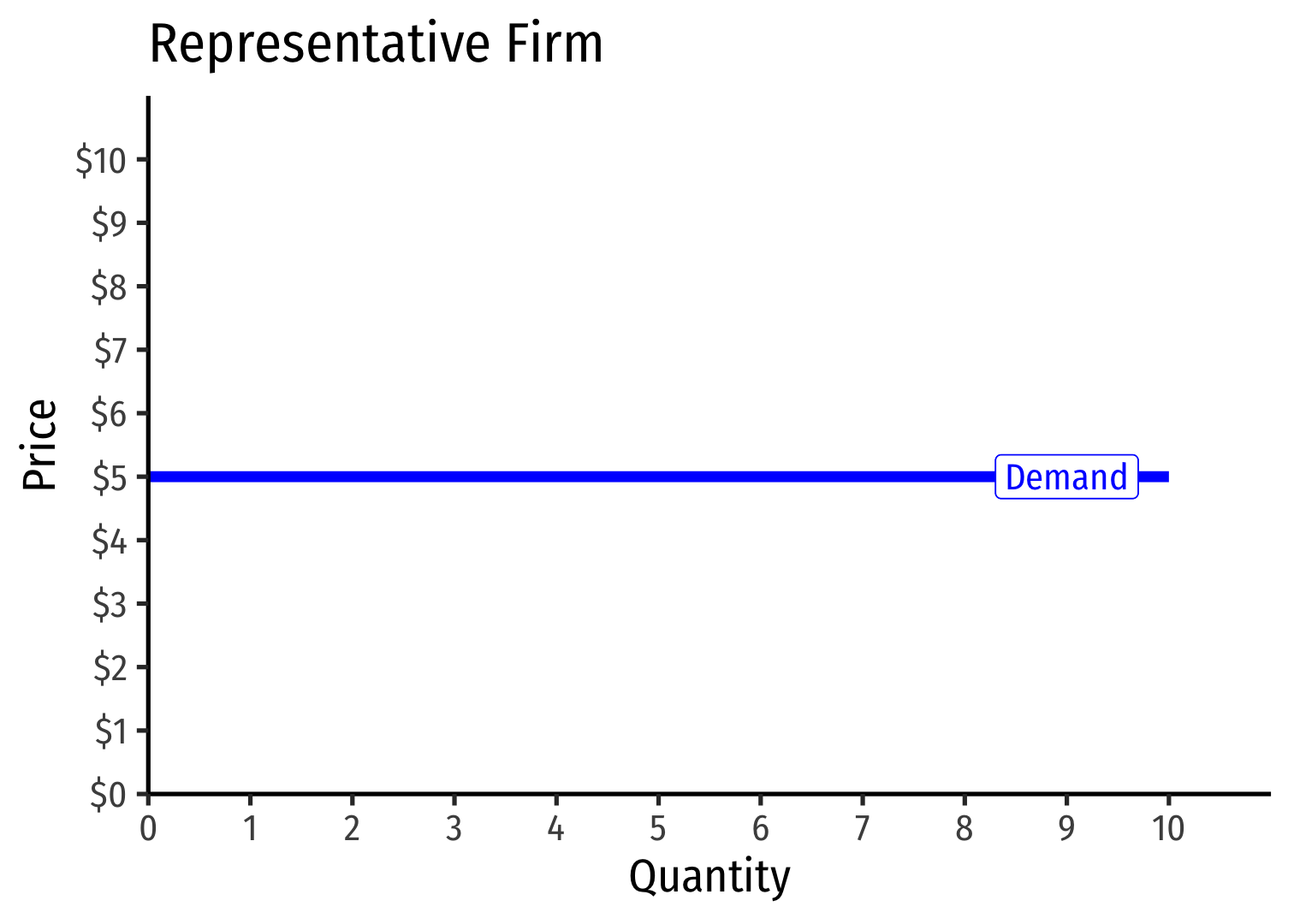

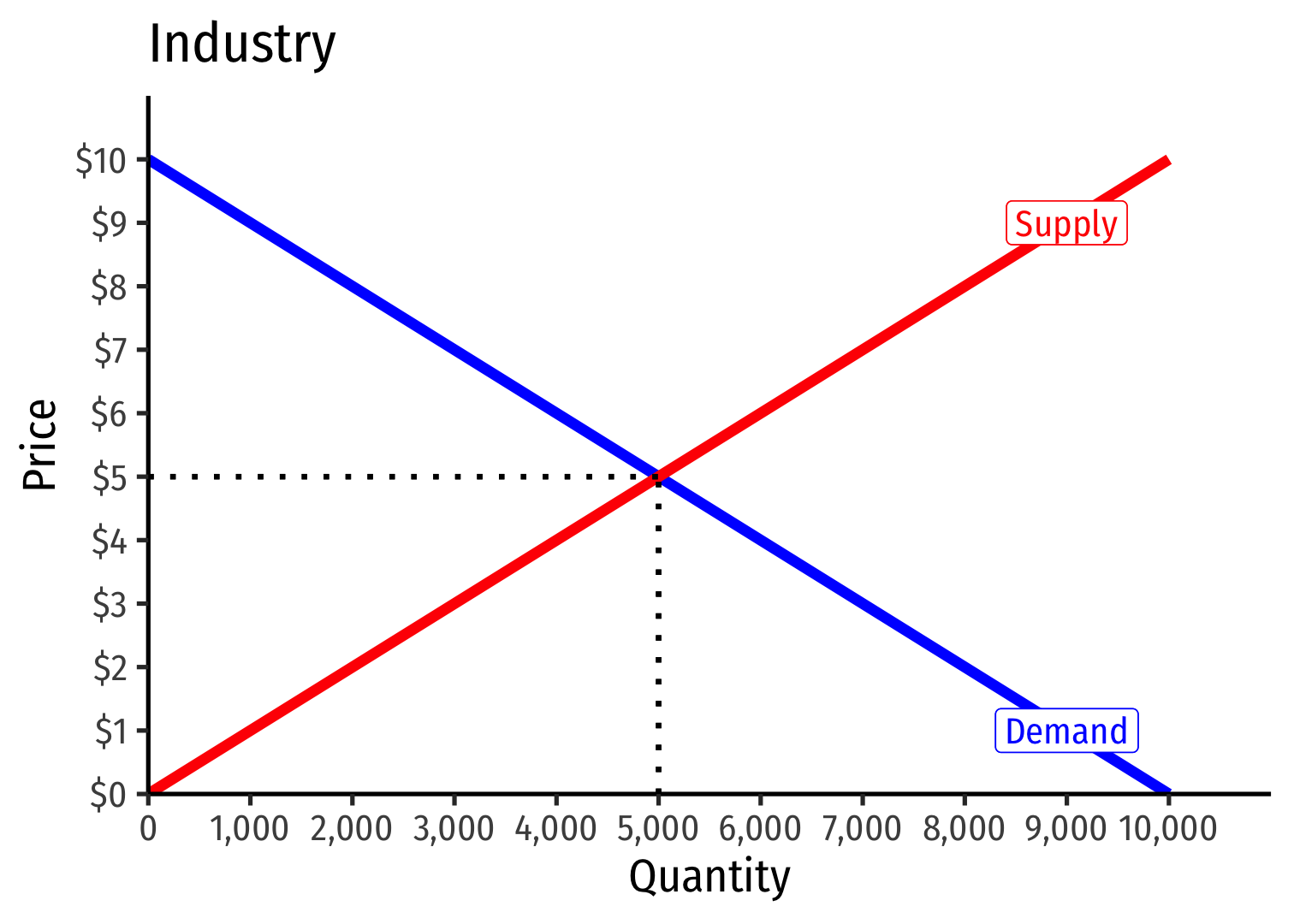

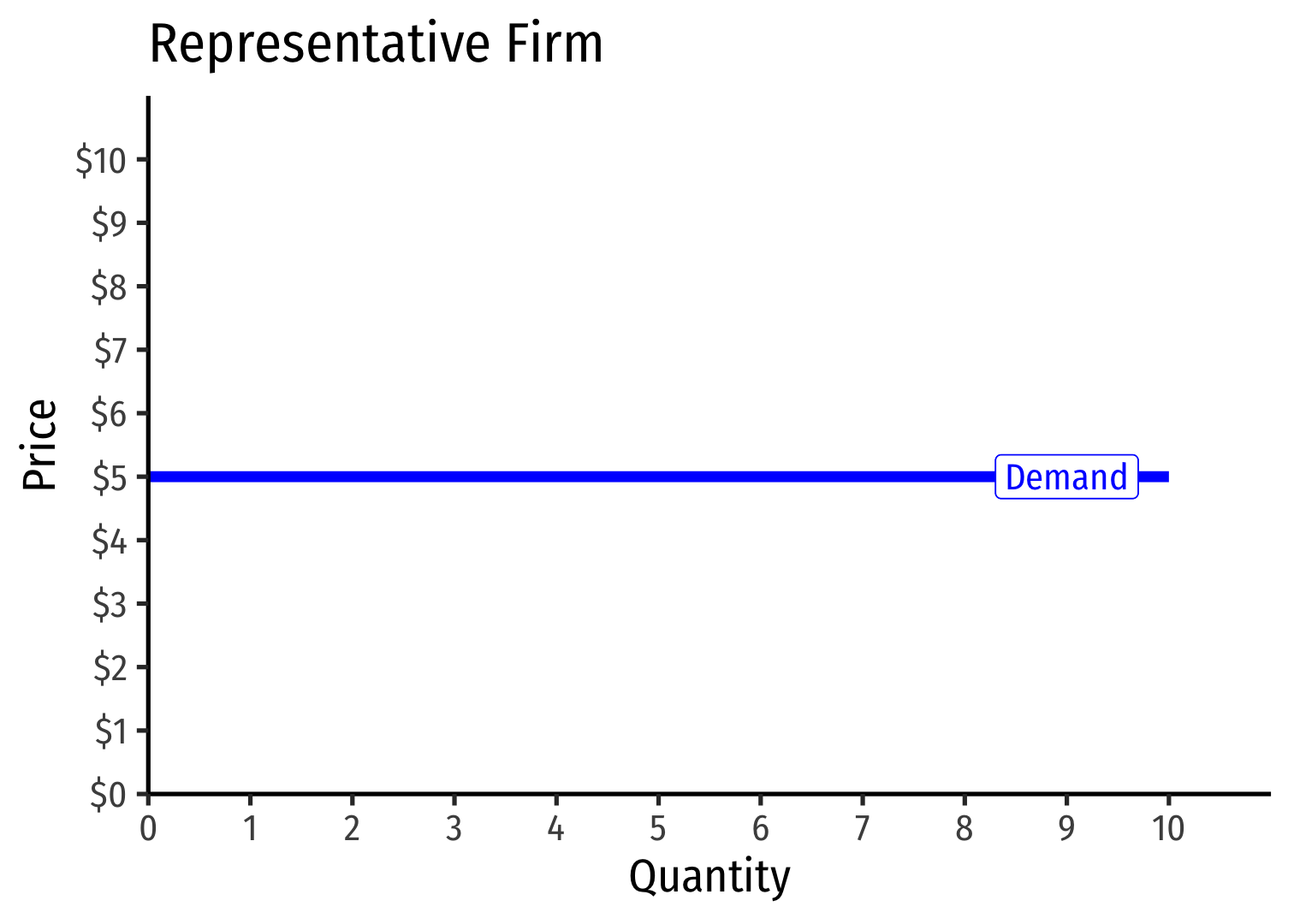

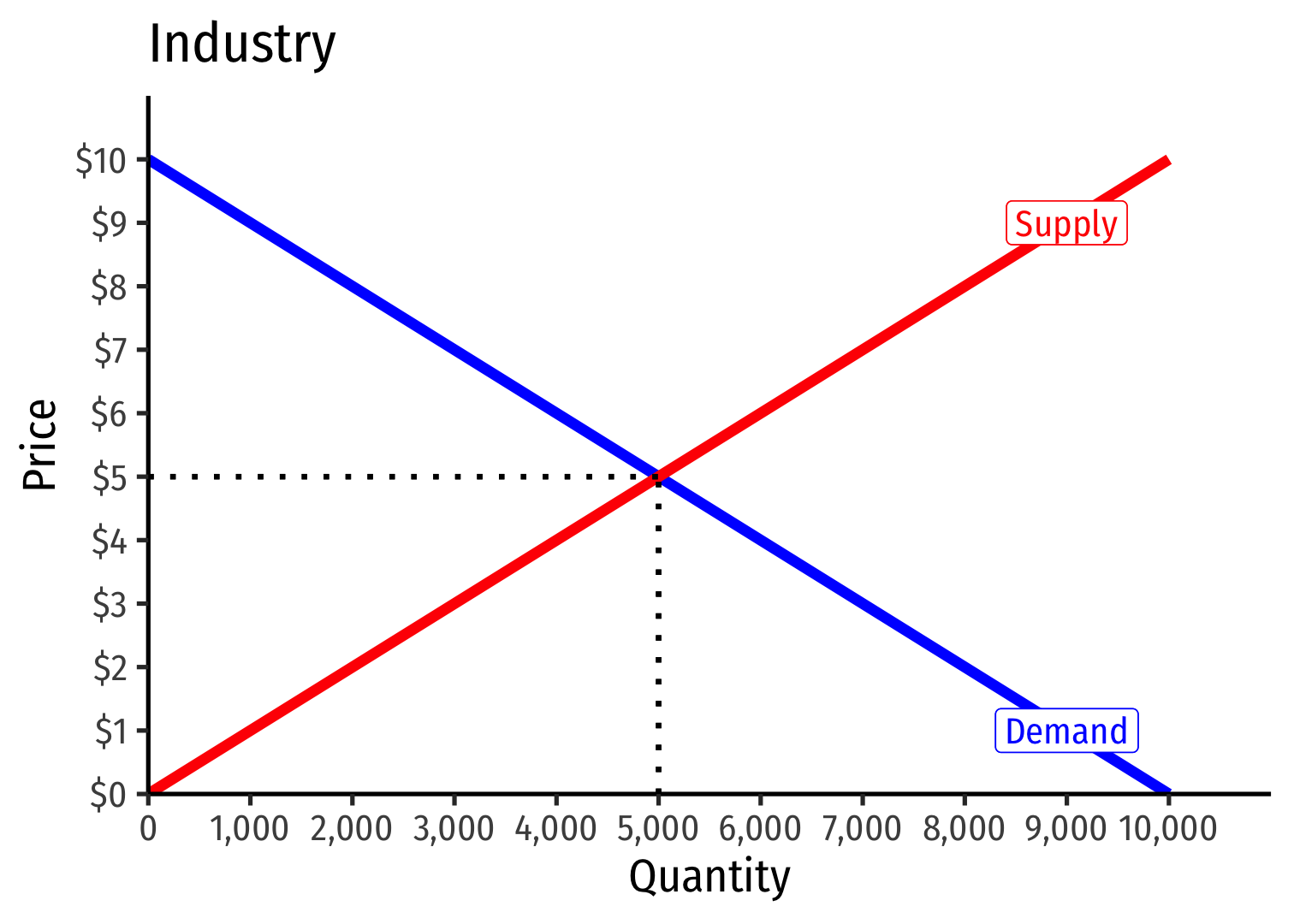

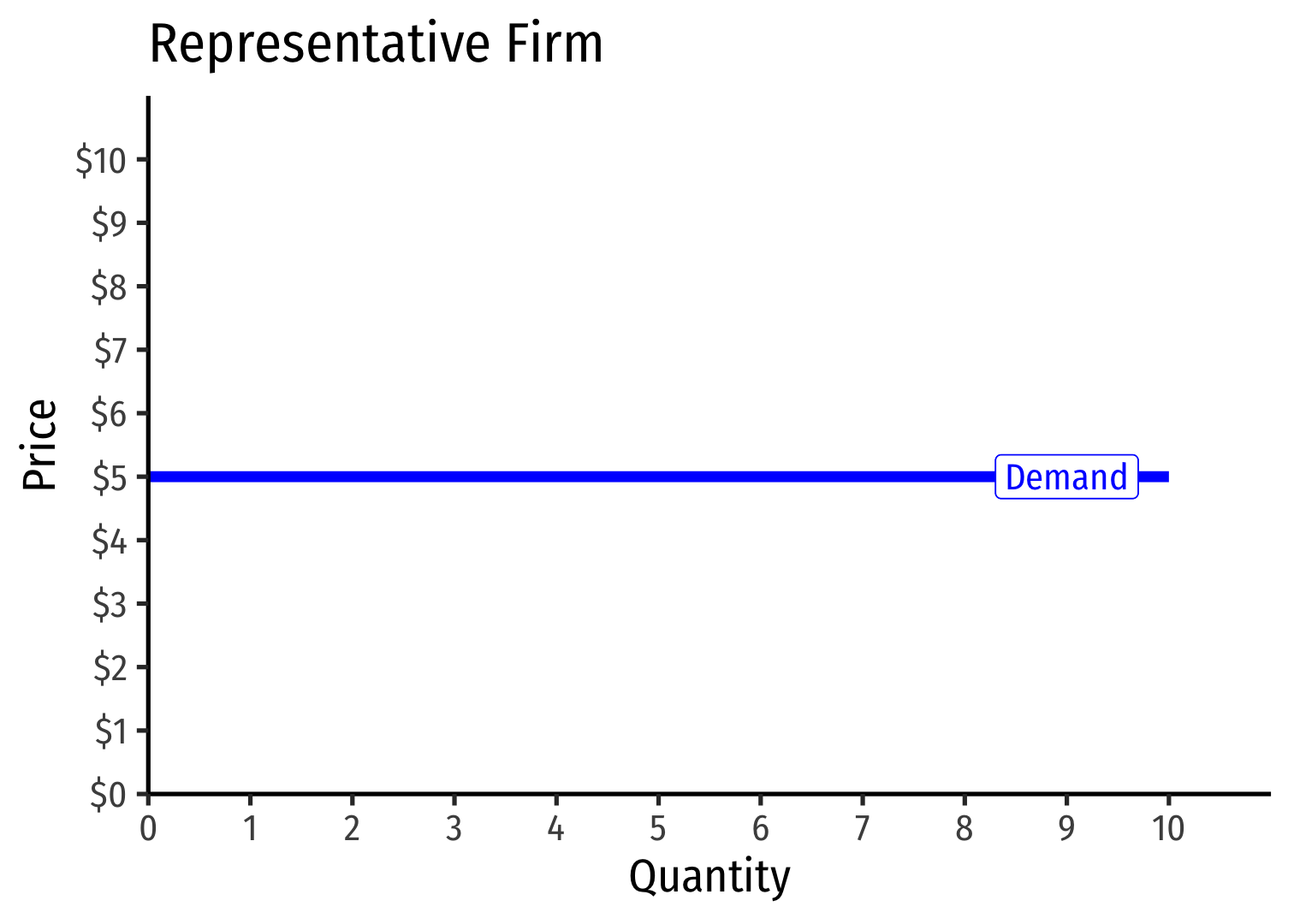

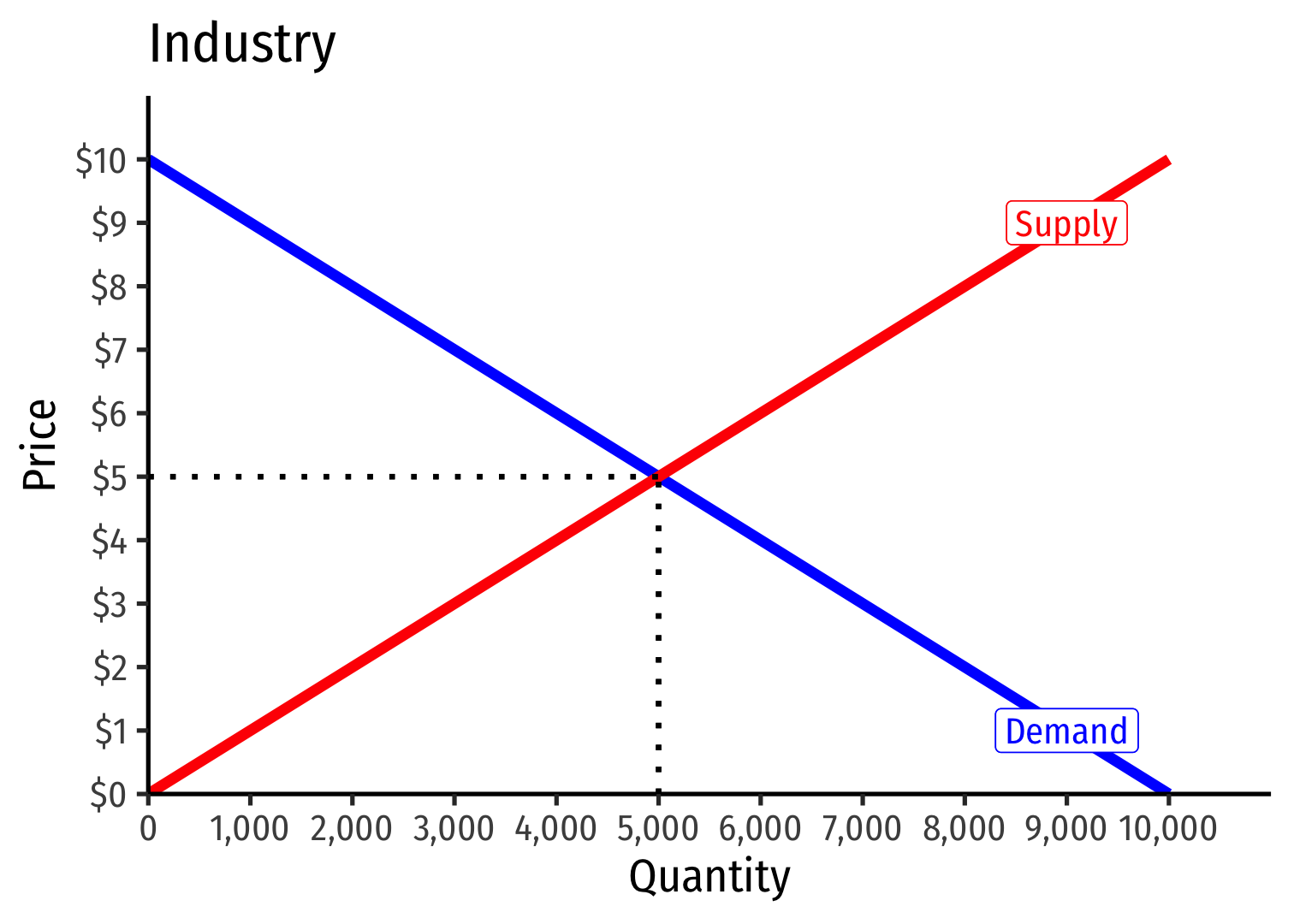

- Demand for a firm’s product is perfectly elastic at the market price

Revenues for Firms in Competitive Industries I

Demand for a firm’s product is perfectly elastic at the market price

Where did the supply curve come from? You’ll know today

Revenues for Firms in Competitive Industries II

- Total Revenue \(R(q)=pq\)

Average and Marginal Revenues

- Average Revenue: revenue per unit of output

$$AR(q)=\frac{R}{q}$$

- \(AR(q)\) is by definition equal to the price! (Why?)

Average and Marginal Revenues

Average Revenue: revenue per unit of output $$AR(q)=\frac{R}{q}$$

- \(AR(q)\) is by definition equal to the price! (Why?)

Marginal Revenue: change in revenues for each additional unit of output sold: $$\color{#e64173}{MR(q) = \frac{\Delta R(q)}{\Delta q}}$$

- Calculus: first derivative of the revenues function

- For a competitive firm (only), MR(q) = p, i.e. the price!

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

For the 1st bushel sold:

What is the total revenue?

What is the average revenue?

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

For the 1st bushel sold:

What is the total revenue?

What is the average revenue?

For the 2nd bushel sold:

What is the total revenue?

What is the average revenue?

What is the marginal revenue?

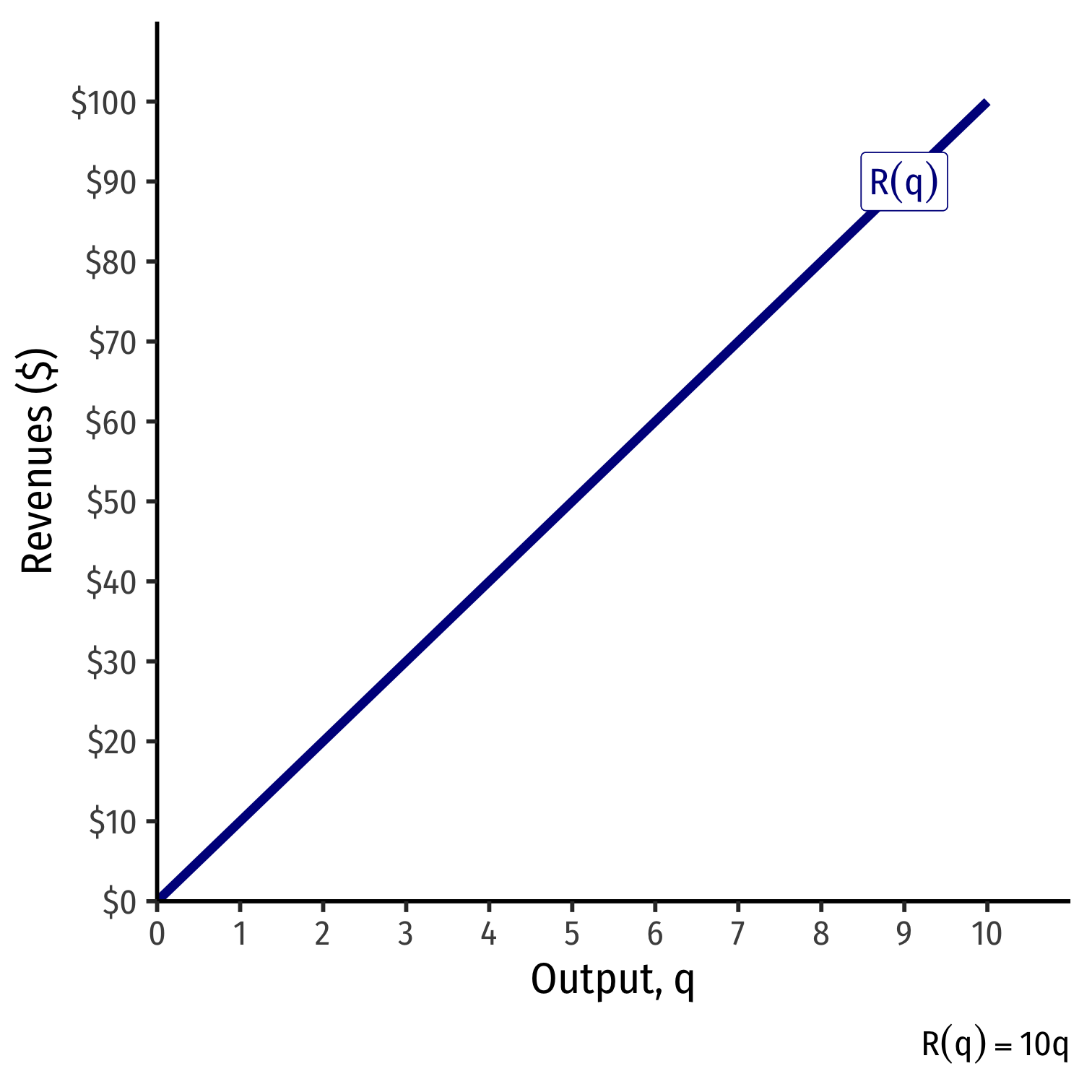

Total Revenue, Example: Visualized

| \(q\) | \(R(q)\) |

|---|---|

| \(0\) | \(0\) |

| \(1\) | \(10\) |

| \(2\) | \(20\) |

| \(3\) | \(30\) |

| \(4\) | \(40\) |

| \(5\) | \(50\) |

| \(6\) | \(60\) |

| \(7\) | \(70\) |

| \(8\) | \(80\) |

| \(9\) | \(90\) |

| \(10\) | \(100\) |

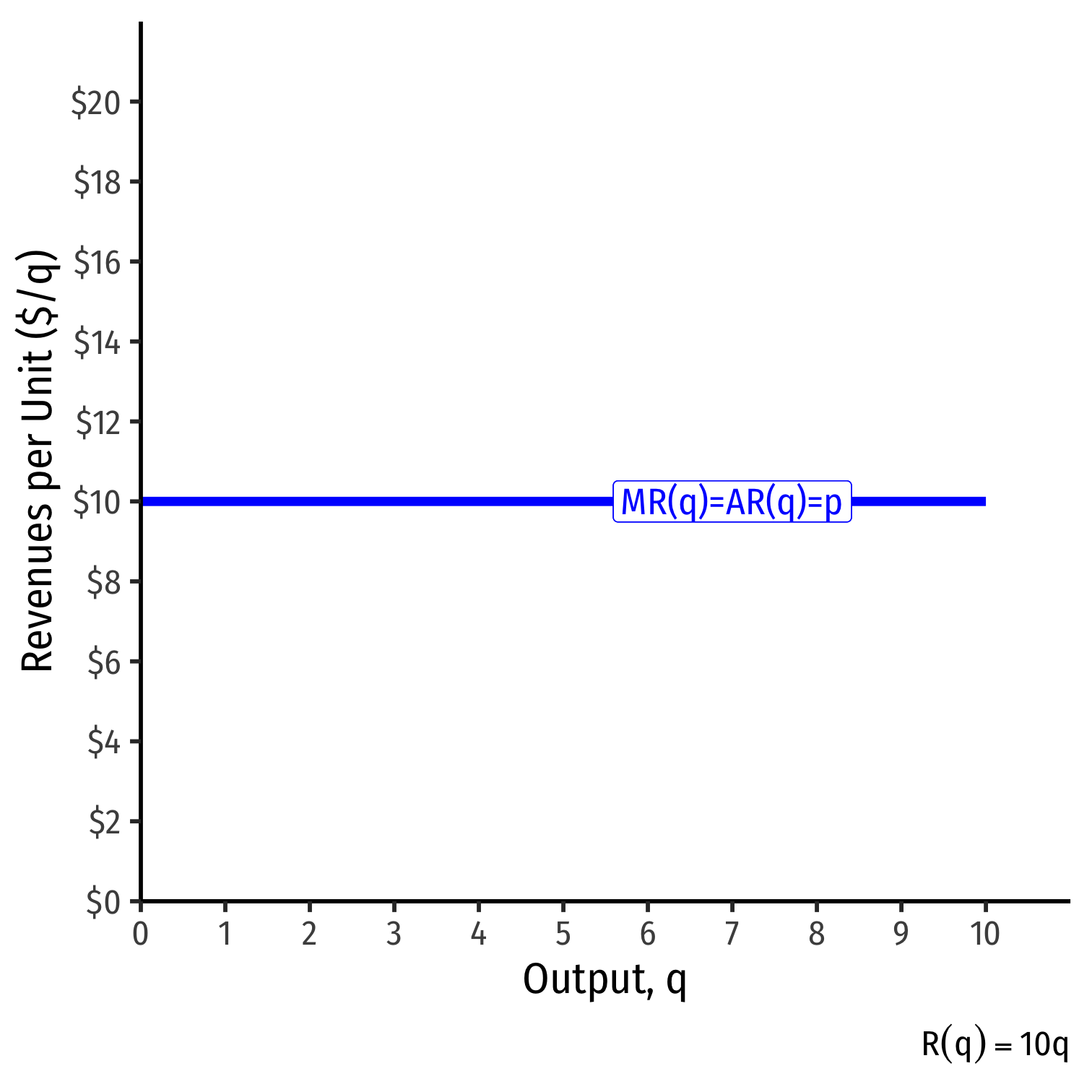

Average and Marginal Revenue, Example: Visualized

| \(q\) | \(R(q)\) | \(AR(q)\) | \(MR(q)\) |

|---|---|---|---|

| \(0\) | \(0\) | \(-\) | \(-\) |

| \(1\) | \(10\) | \(10\) | \(10\) |

| \(2\) | \(20\) | \(10\) | \(10\) |

| \(3\) | \(30\) | \(10\) | \(10\) |

| \(4\) | \(40\) | \(10\) | \(10\) |

| \(5\) | \(50\) | \(10\) | \(10\) |

| \(6\) | \(60\) | \(10\) | \(10\) |

| \(7\) | \(70\) | \(10\) | \(10\) |

| \(8\) | \(80\) | \(10\) | \(10\) |

| \(9\) | \(90\) | \(10\) | \(10\) |

| \(10\) | \(100\) | \(10\) | \(10\) |

Profits

Recall: The Firm's Two Problems

1st Stage: firm's profit maximization problem:

Choose: < output >

In order to maximize: < profits >

2nd Stage: firm's cost minimization problem:

Choose: < inputs >

In order to minimize: < cost >

Subject to: < producing the optimal output >

- Minimizing costs \(\iff\) maximizing profits

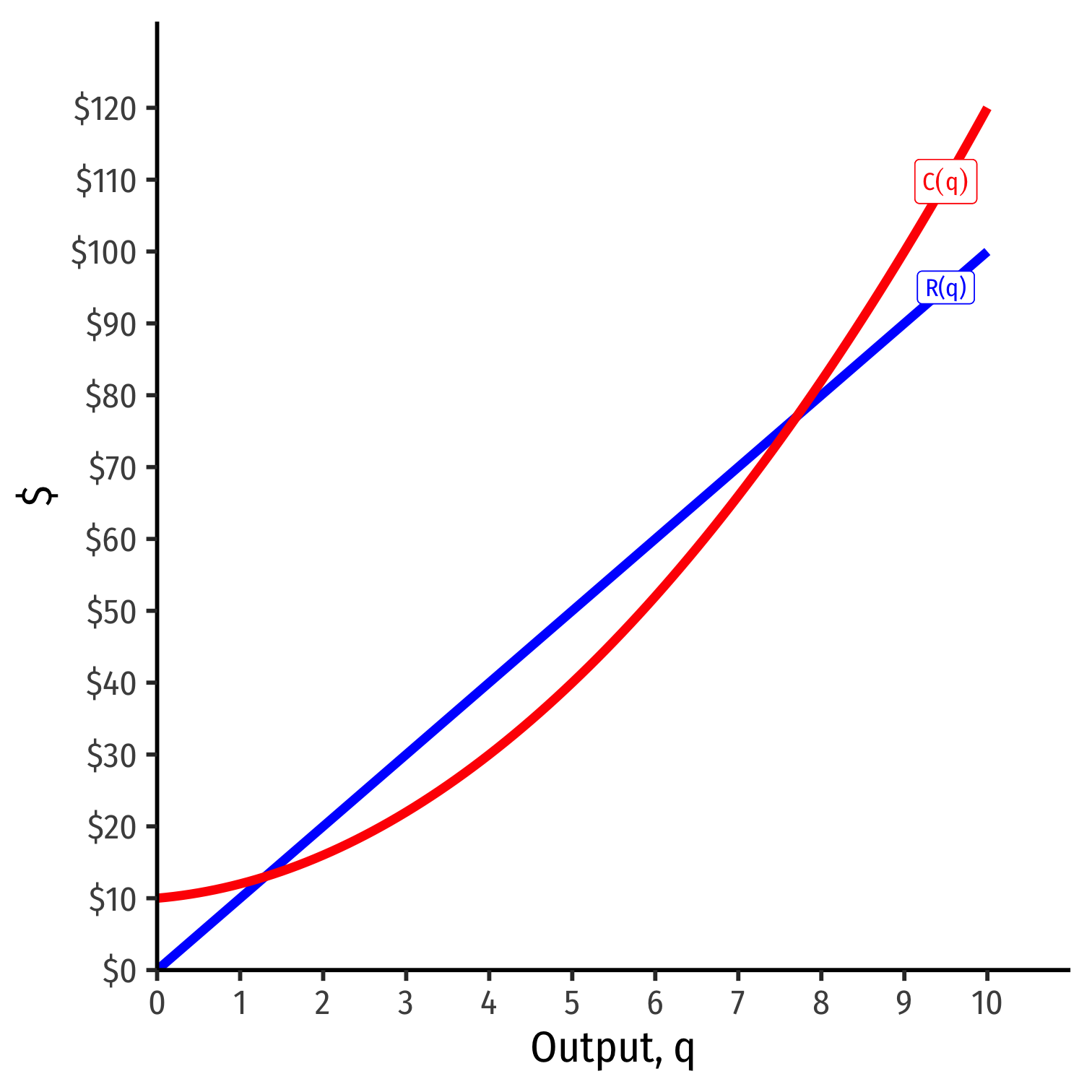

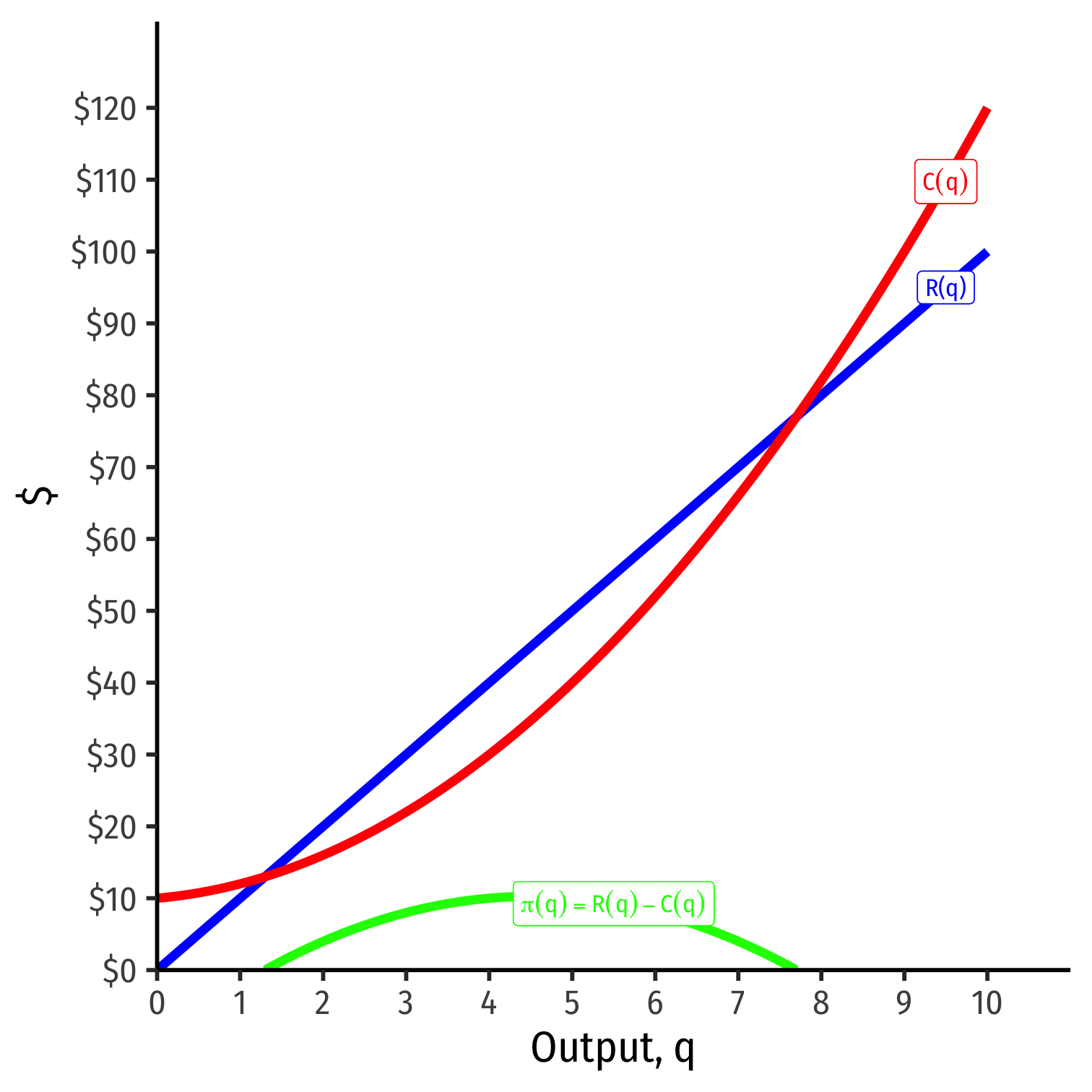

Visualizing Total Profit As \(R(q)-C(q)\)

- \(\color{green}{\pi(q)}=\color{blue}{R(q)}-\color{red}{C(q)}\)

Visualizing Total Profit As \(R(q)-C(q)\)

- \(\color{green}{\pi(q)}=\color{blue}{R(q)}-\color{red}{C(q)}\)

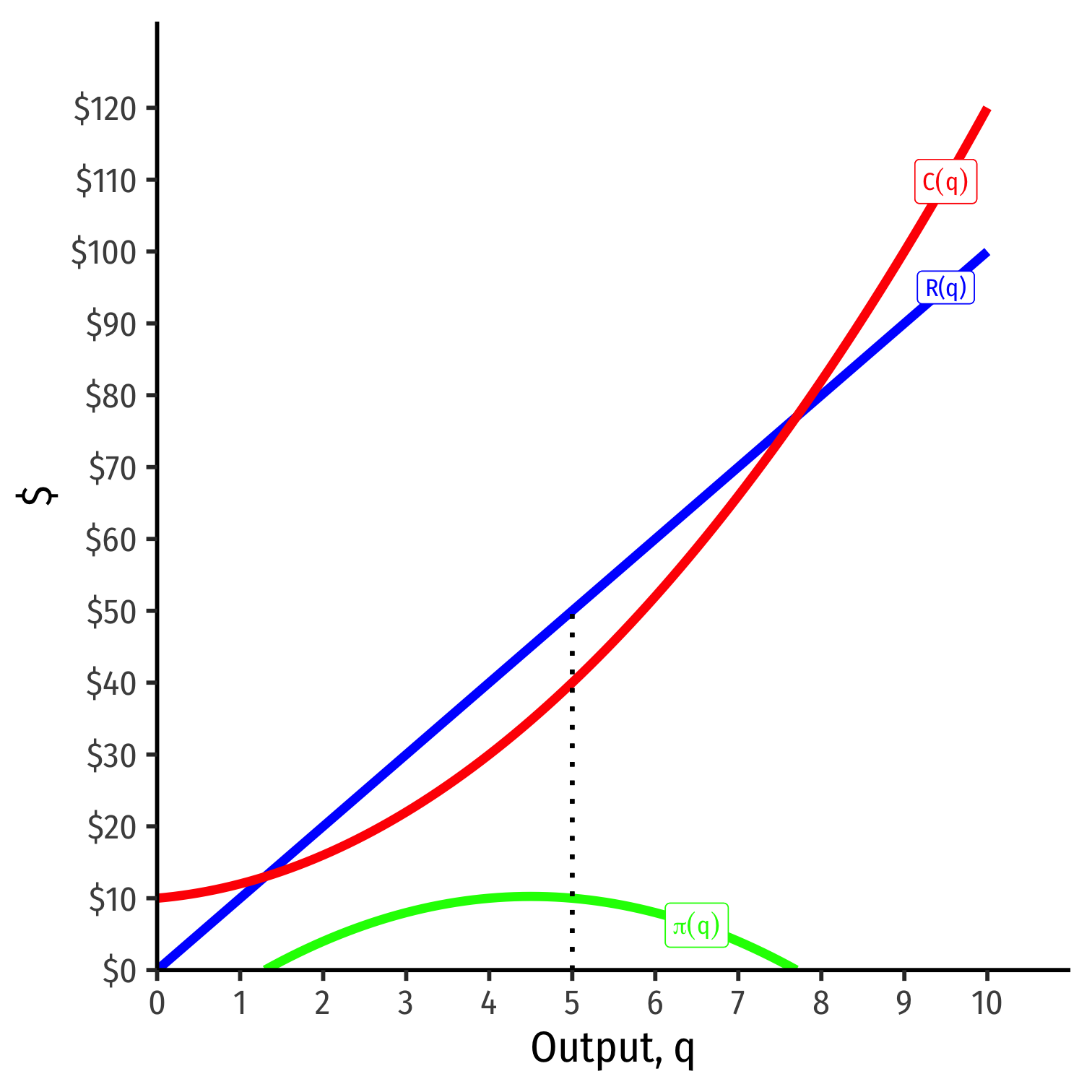

Visualizing Total Profit As \(R(q)-C(q)\)

\(\color{green}{\pi(q)}=\color{blue}{R(q)}-\color{red}{C(q)}\)

Graph: find \(q^*\) to max \(\pi \implies q^*\) where max distance between \(R(q)\) and \(C(q)\)

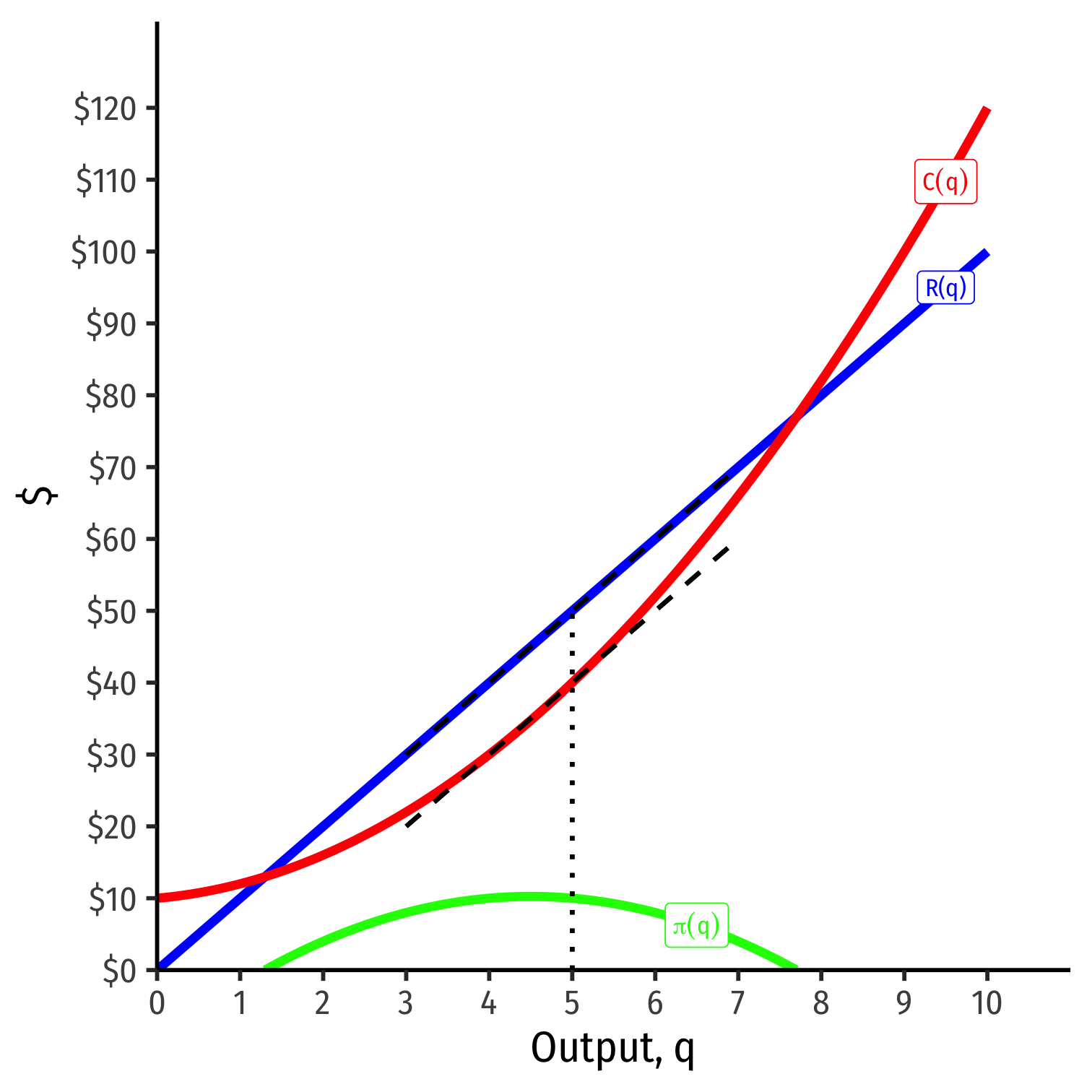

Visualizing Total Profit As \(R(q)-C(q)\)

\(\color{green}{\pi(q)}=\color{blue}{R(q)}-\color{red}{C(q)}\)

Graph: find \(q^*\) to max \(\pi \implies q^*\) where max distance between \(R(q)\) and \(C(q)\)

Slopes must be equal: $$\color{blue}{MR(q)}=\color{red}{MC(q)}$$

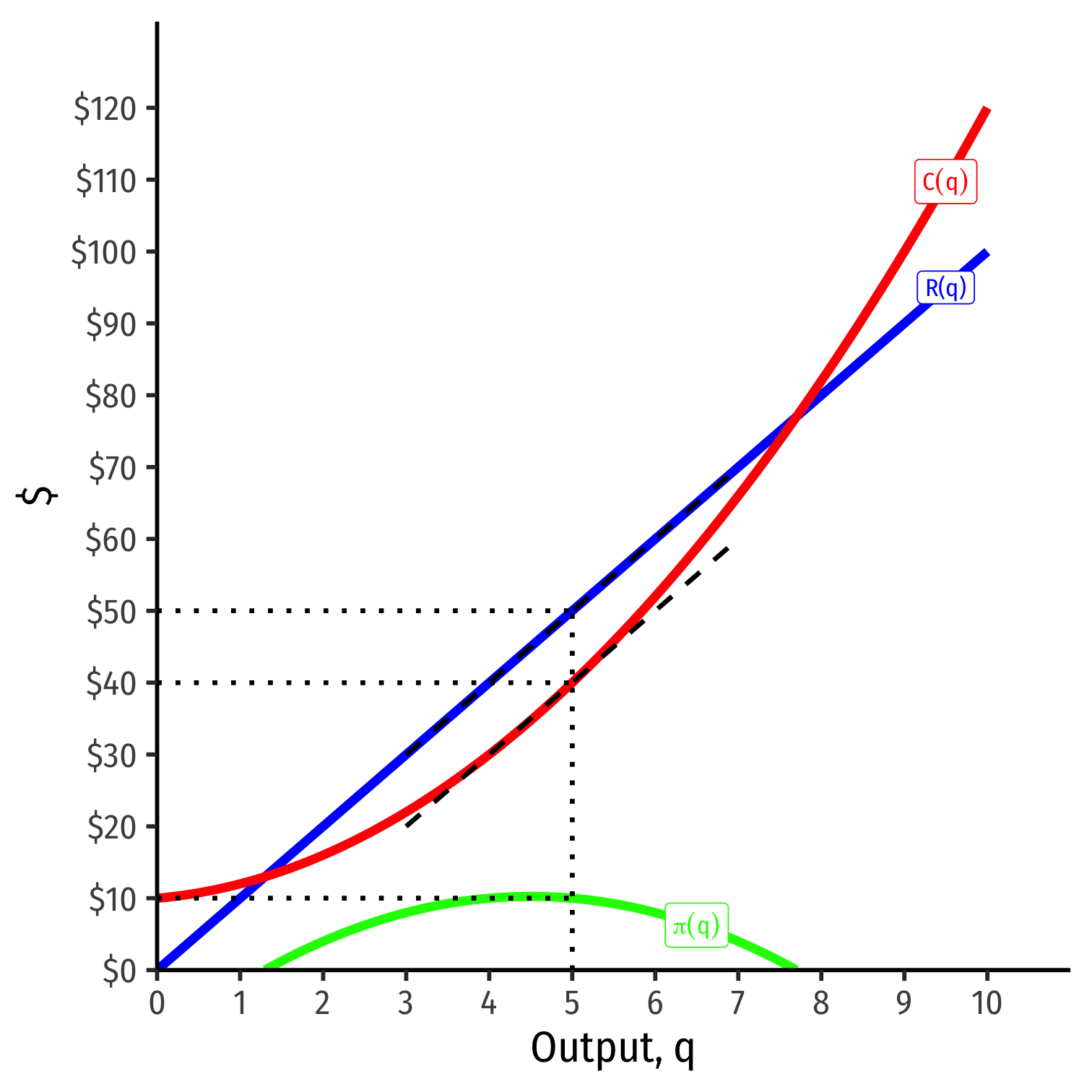

Visualizing Total Profit As \(R(q)-C(q)\)

\(\color{green}{\pi(q)}=\color{blue}{R(q)}-\color{red}{C(q)}\)

Graph: find \(q^*\) to max \(\pi \implies q^*\) where max distance between \(R(q)\) and \(C(q)\)

Slopes must be equal: $$\color{blue}{MR(q)}=\color{red}{MC(q)}$$

- At \(q^*=5\):

- \(\color{blue}{R(q)=50}\)

- \(\color{red}{C(q)=40}\)

- \(\color{green}{\pi(q)=10}\)

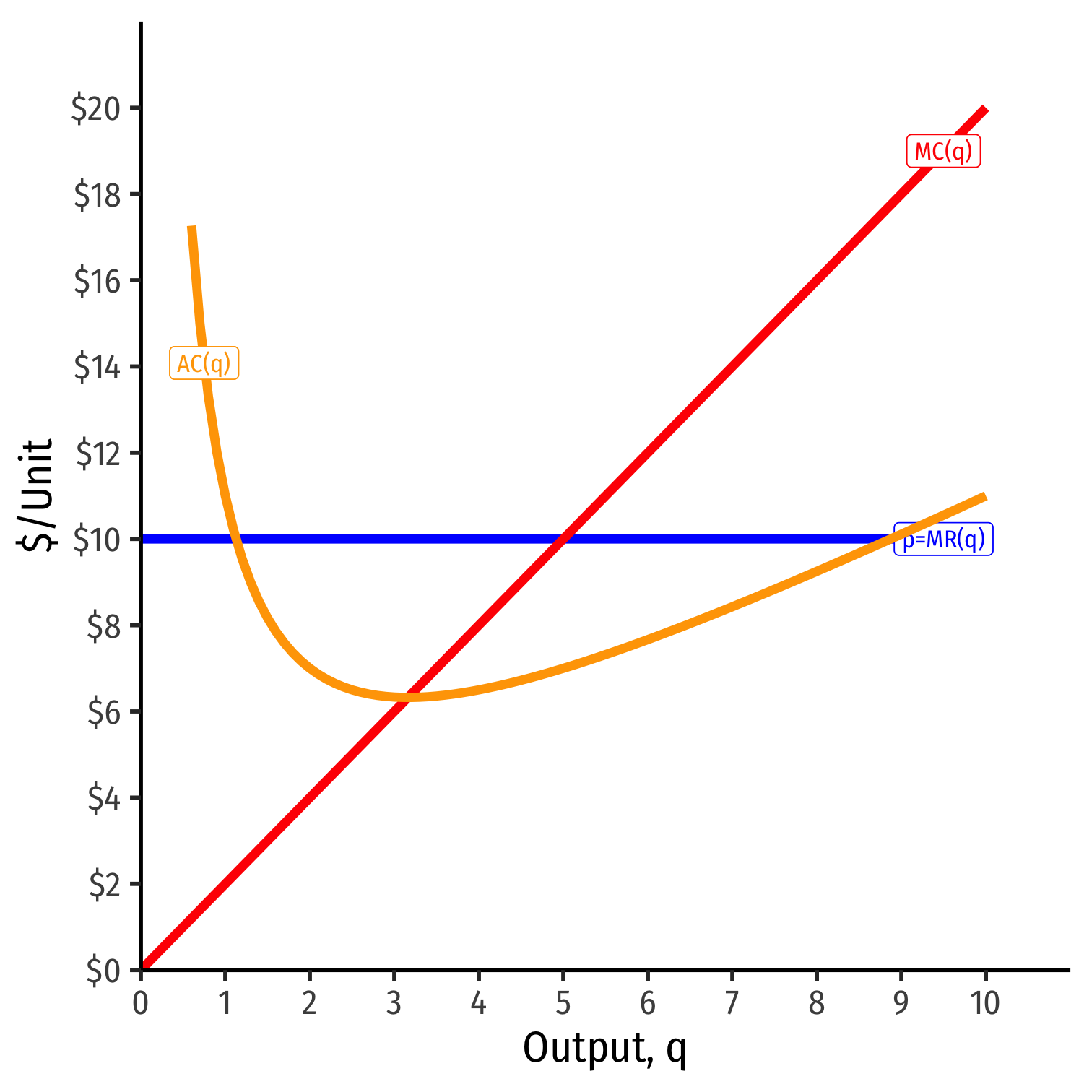

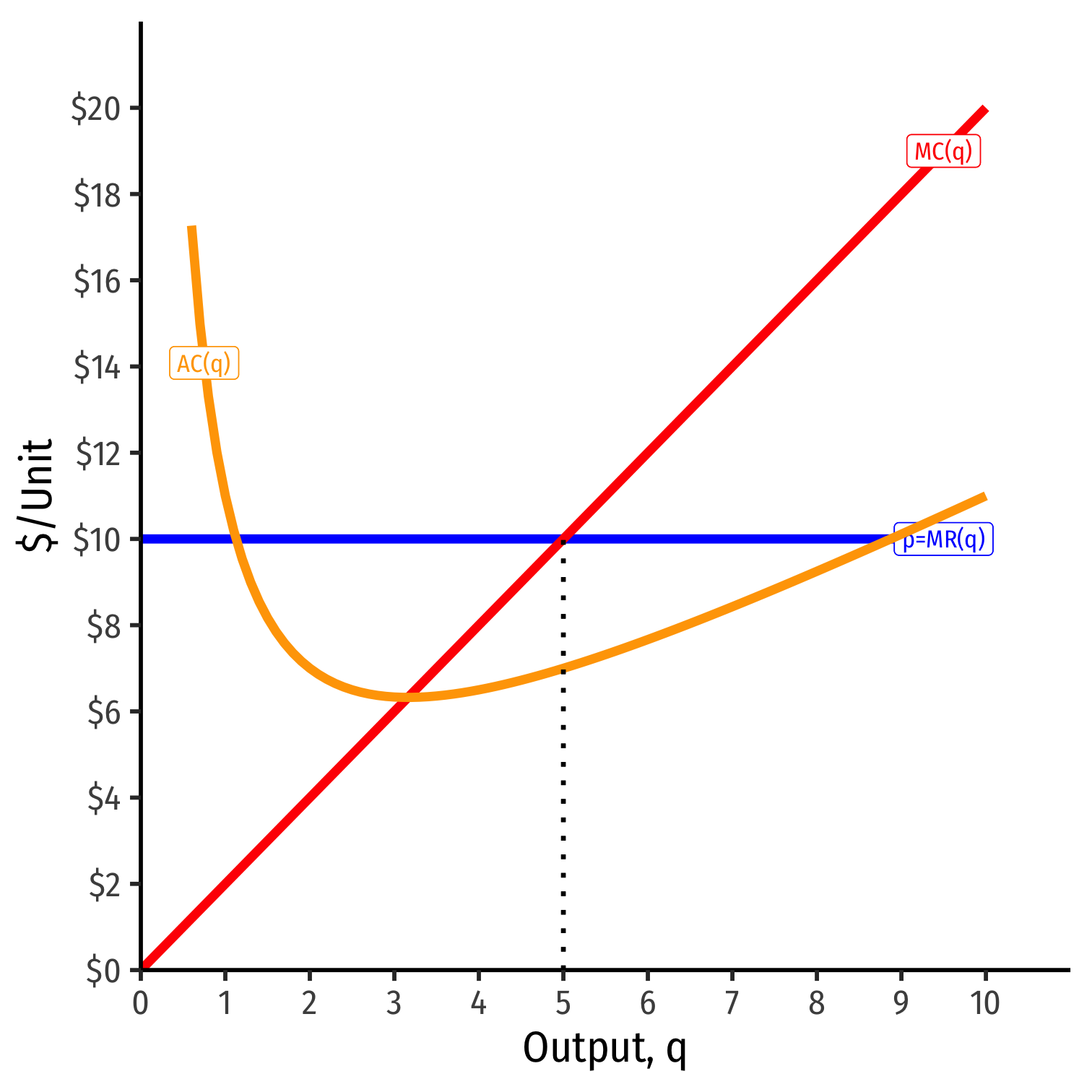

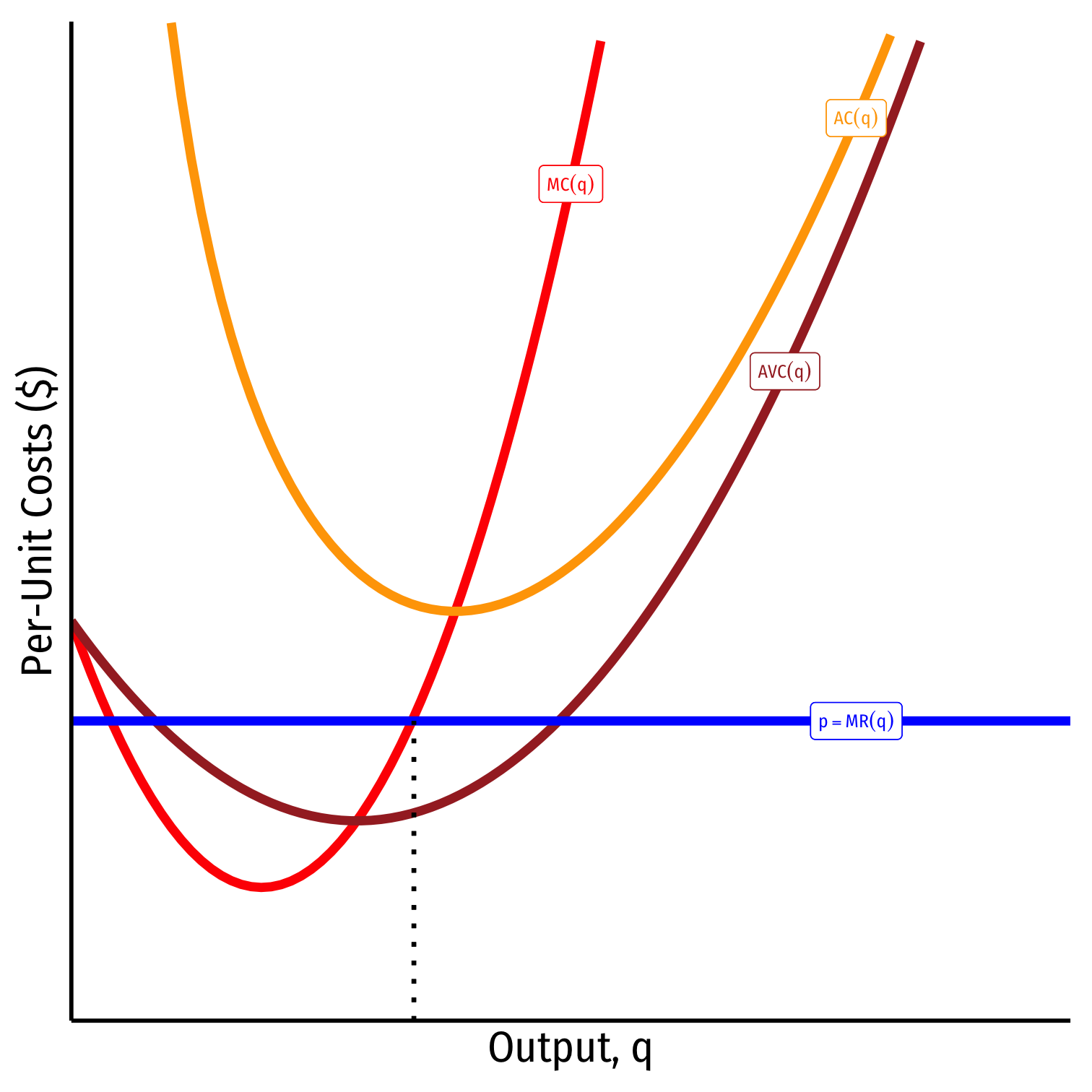

Visualizing Profit Per Unit As \(MR(q)\) and \(MC(q)\)

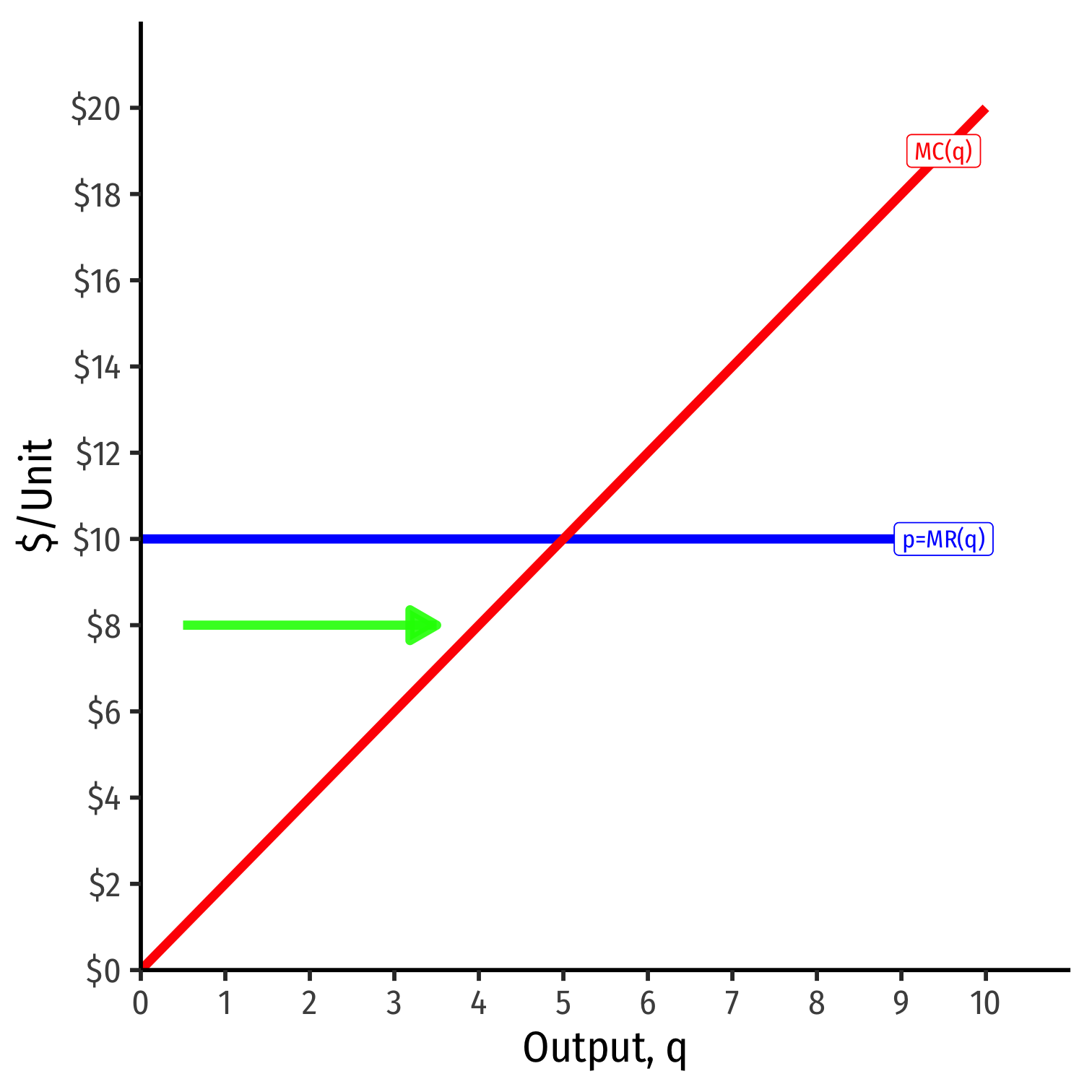

- At low output \(q<q^*\), can increase \(\pi\) by producing more: \(\color{blue}{MR(q)}>\color{red}{MC(q)}\)

Visualizing Profit Per Unit As \(MR(q)\) and \(MC(q)\)

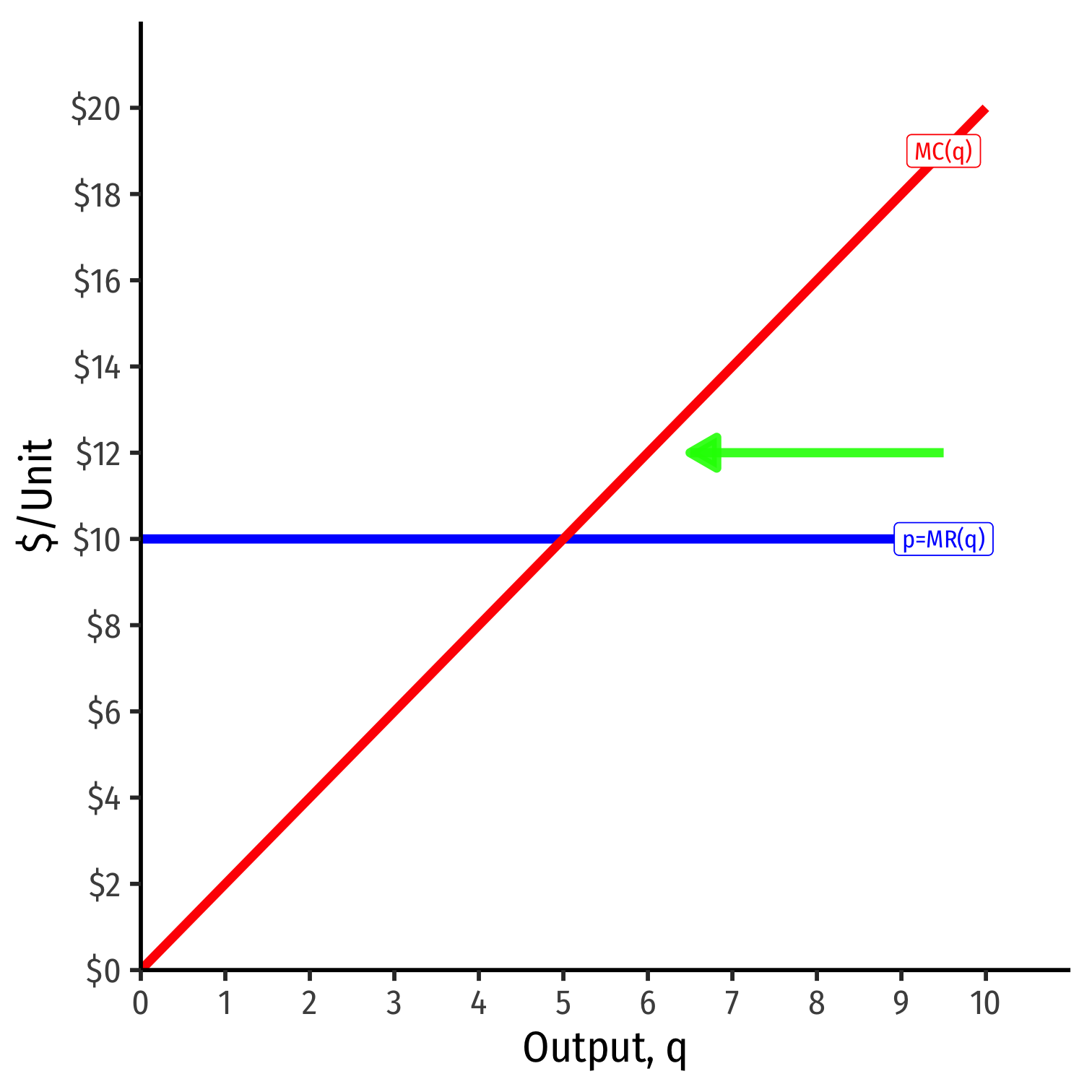

- At high output \(q>q^*\), can increase \(\pi\) by producing less: \(\color{blue}{MR(q)}<\color{red}{MC(q)}\)

Visualizing Profit Per Unit As \(MR(q)\) and \(MC(q)\)

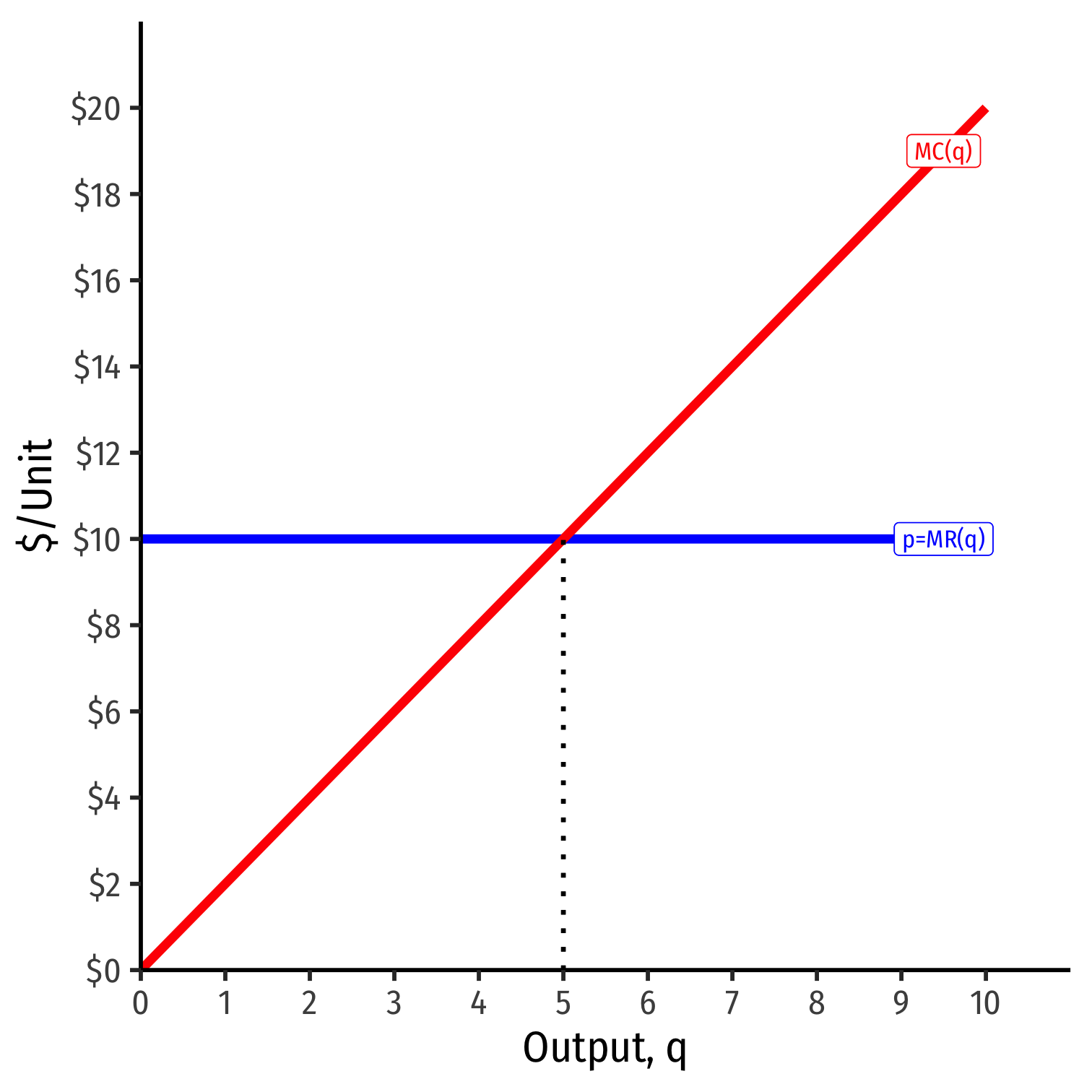

- \(\pi\) is maximized where \(\color{blue}{MR(q)}=\color{red}{MC(q)}\)

Comparative Statics

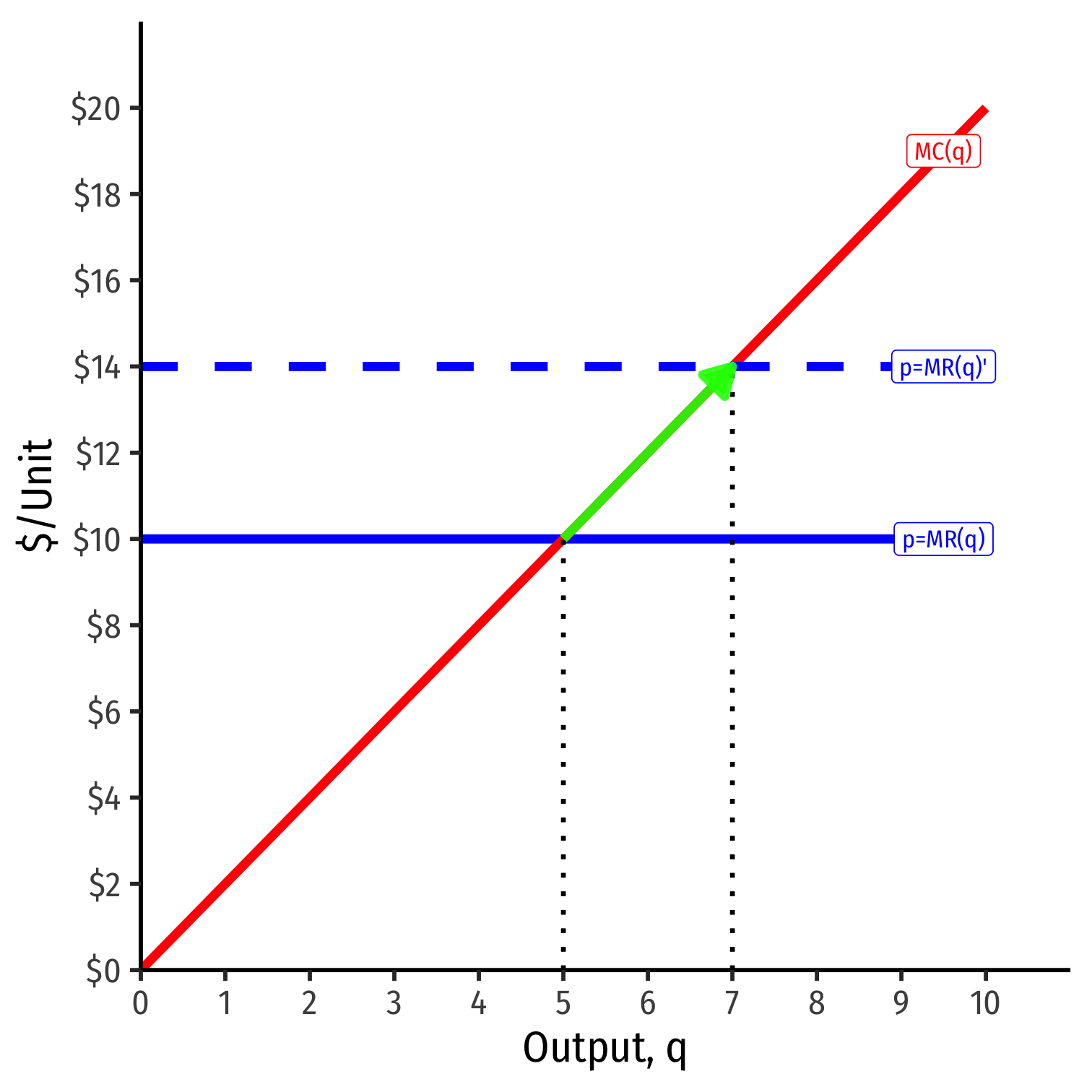

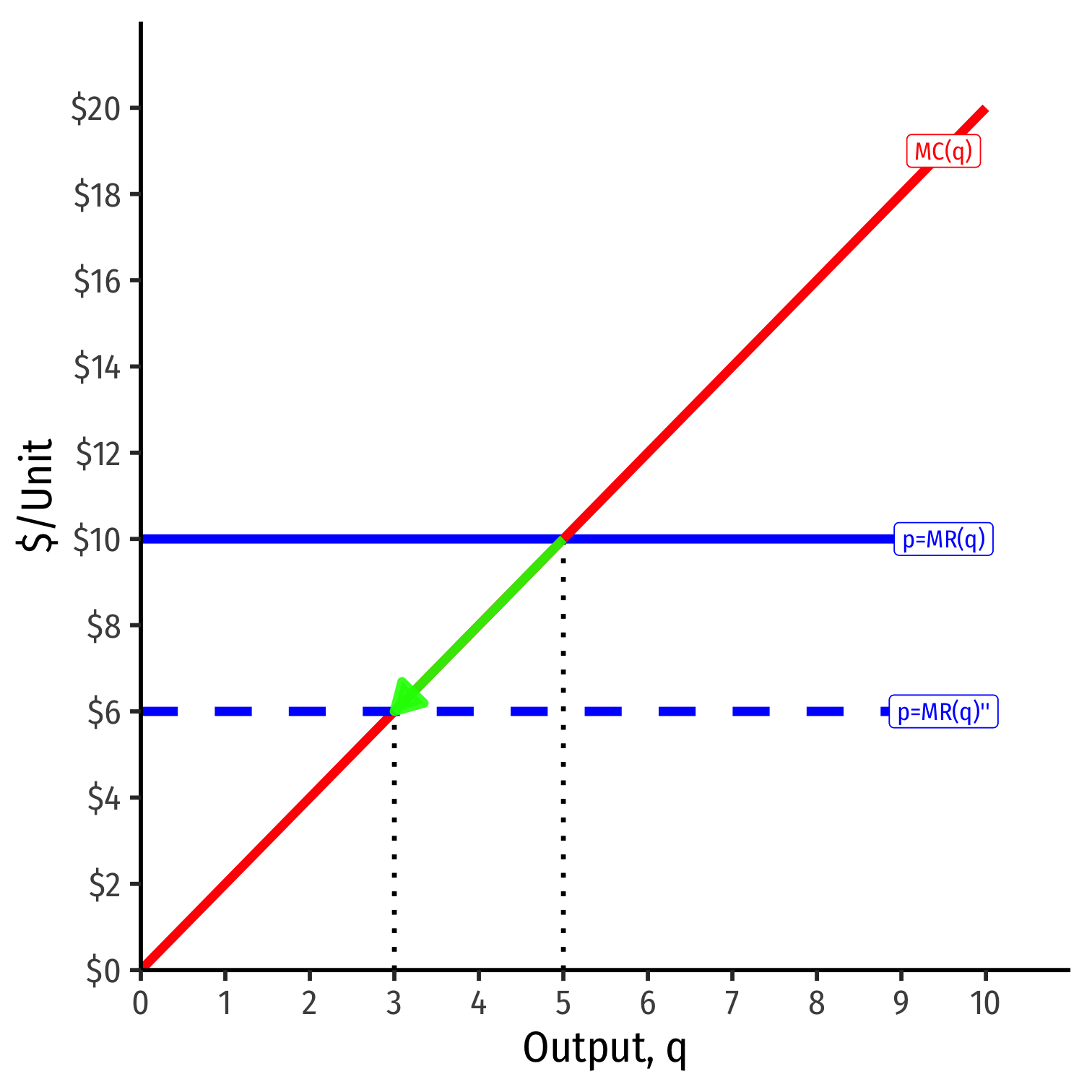

If Market Price Changes I

Suppose the market price increases

Firm (always setting MR=MC) will respond by producing more

If Market Price Changes II

Suppose the market price decreases

Firm (always setting MR=MC) will respond by producing less

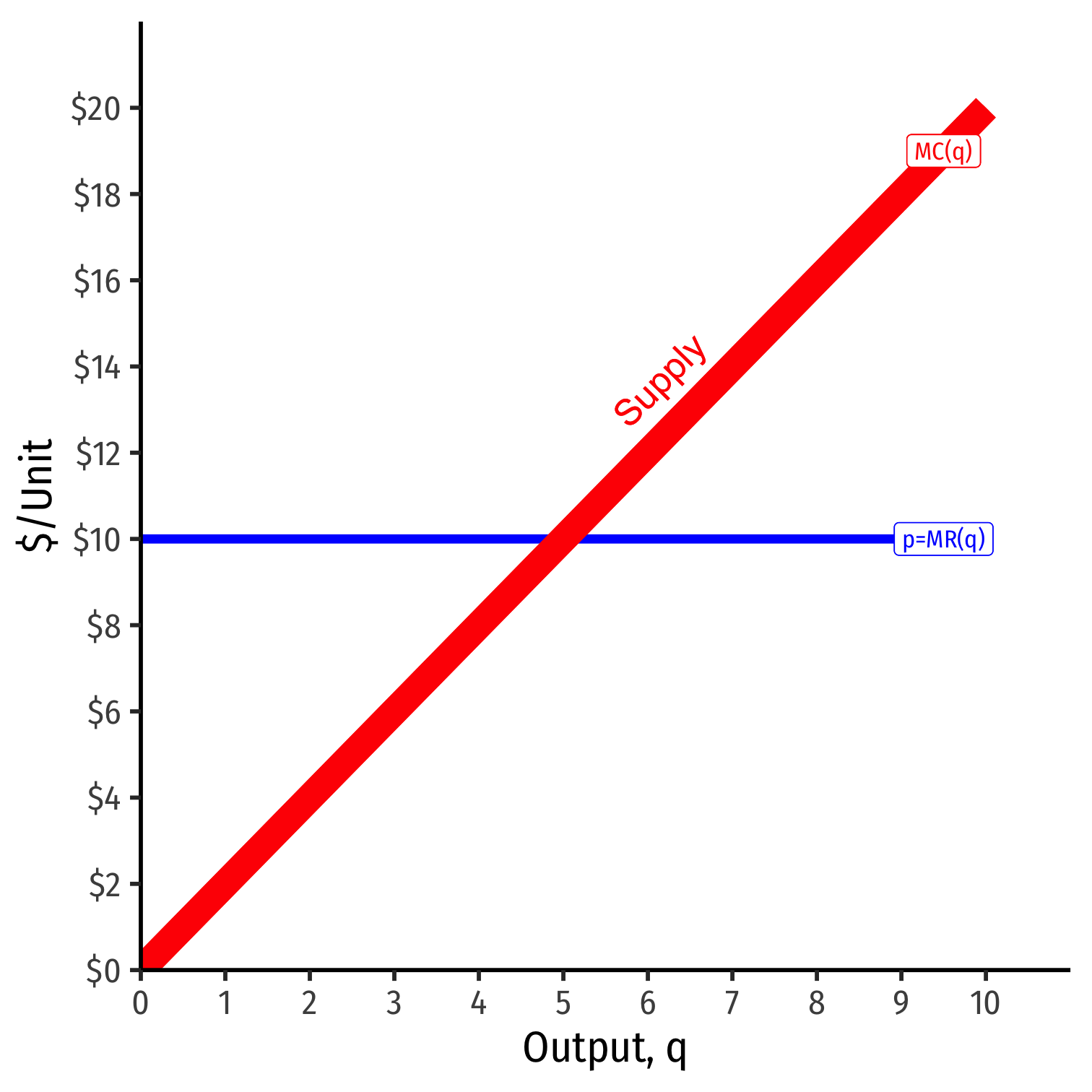

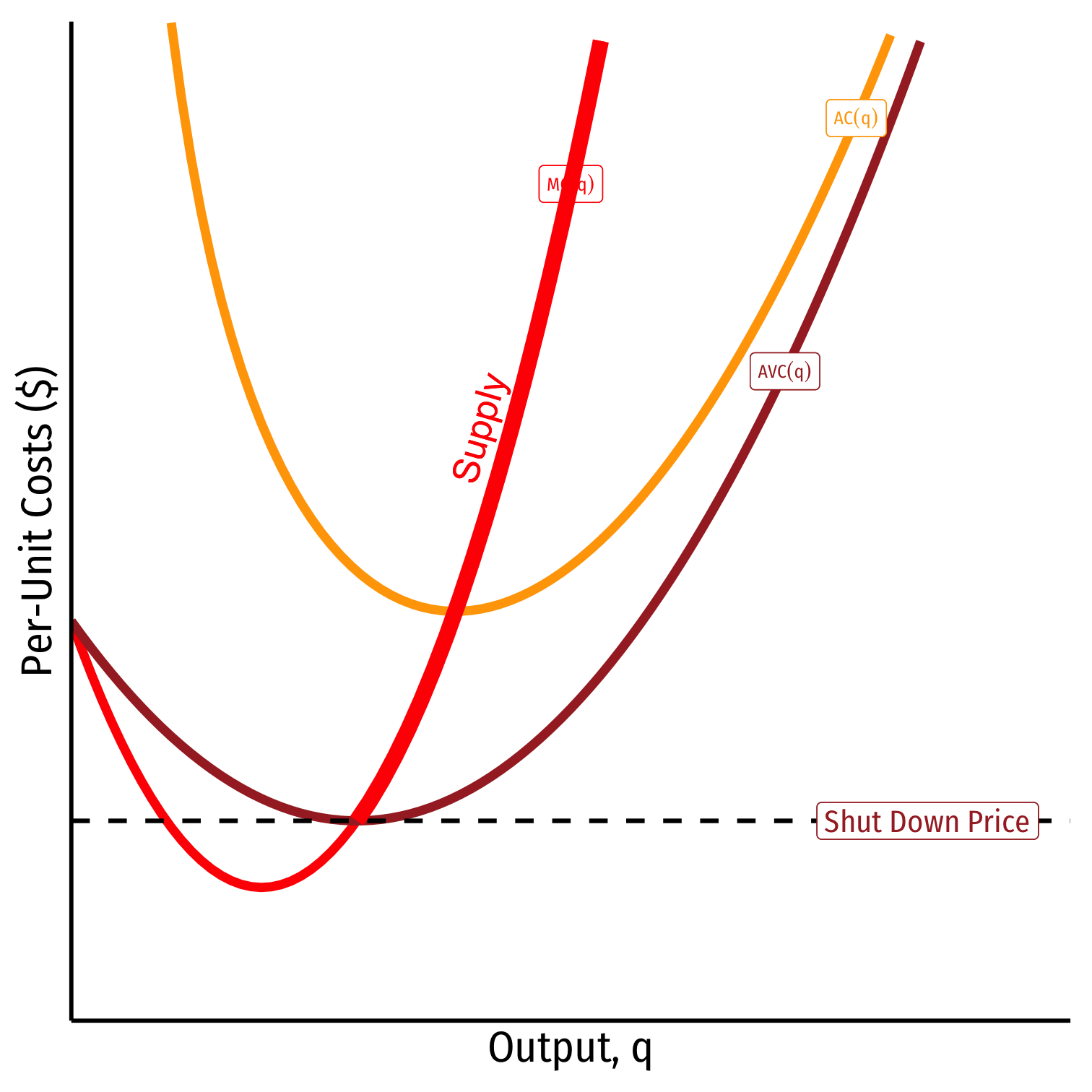

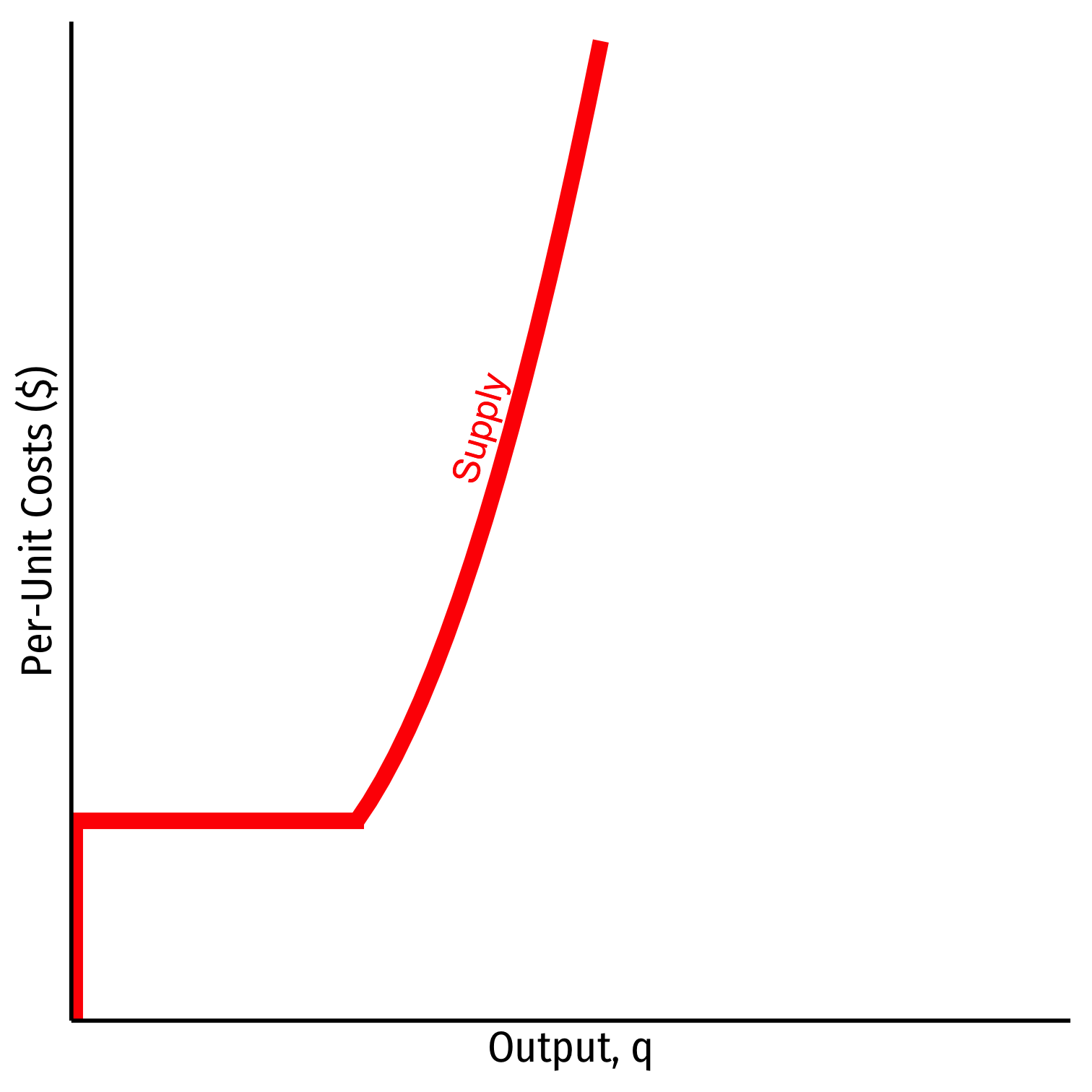

The Firm’s Supply Curve

- The firm’s marginal cost curve is its supply curve‡

$$\color{red}{p=MC(q)}$$

- How it will supply the optimal amount of output in response to the market price

- Firm always sets its price equal to its marginal cost

‡ Mostly...there is an important exception we will see shortly!

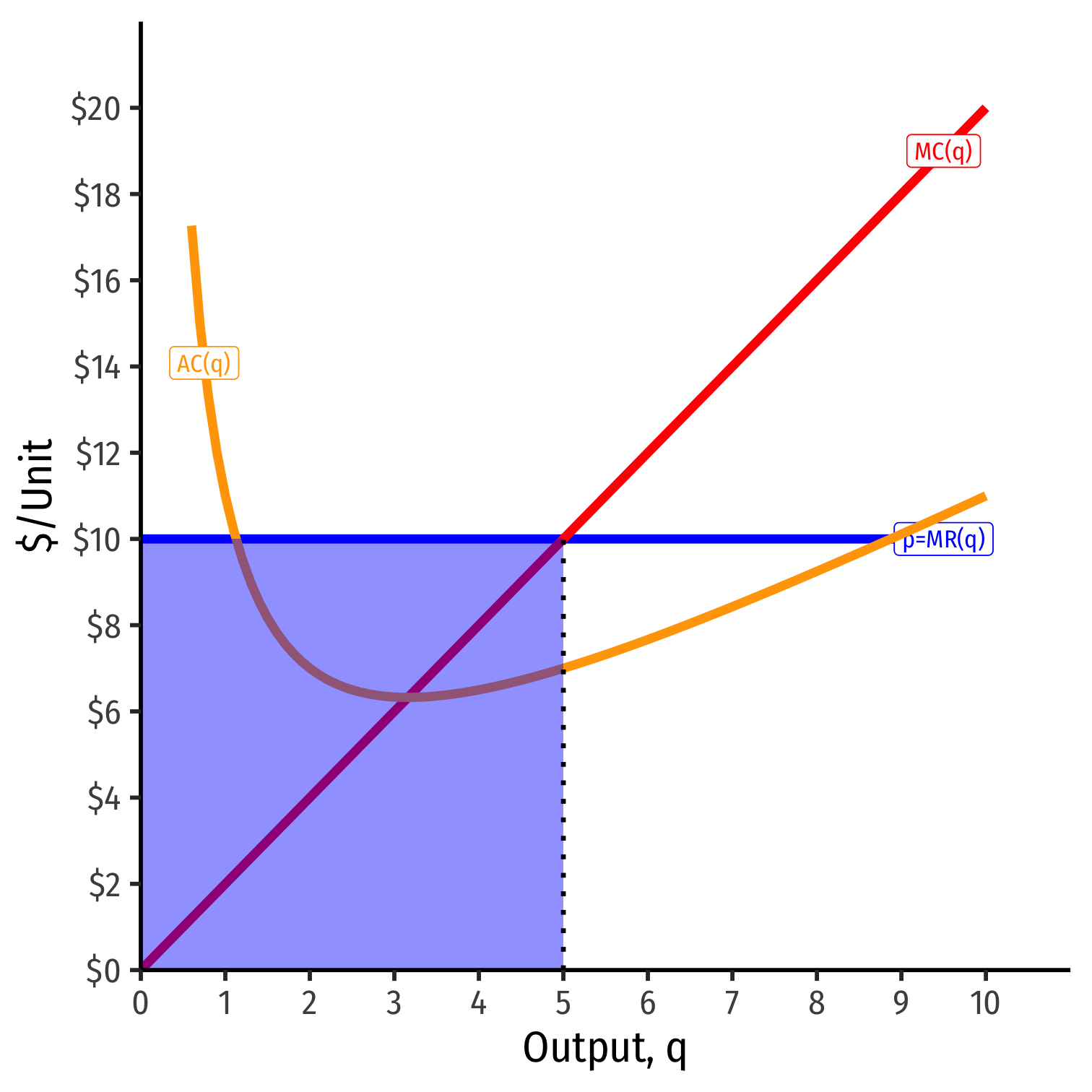

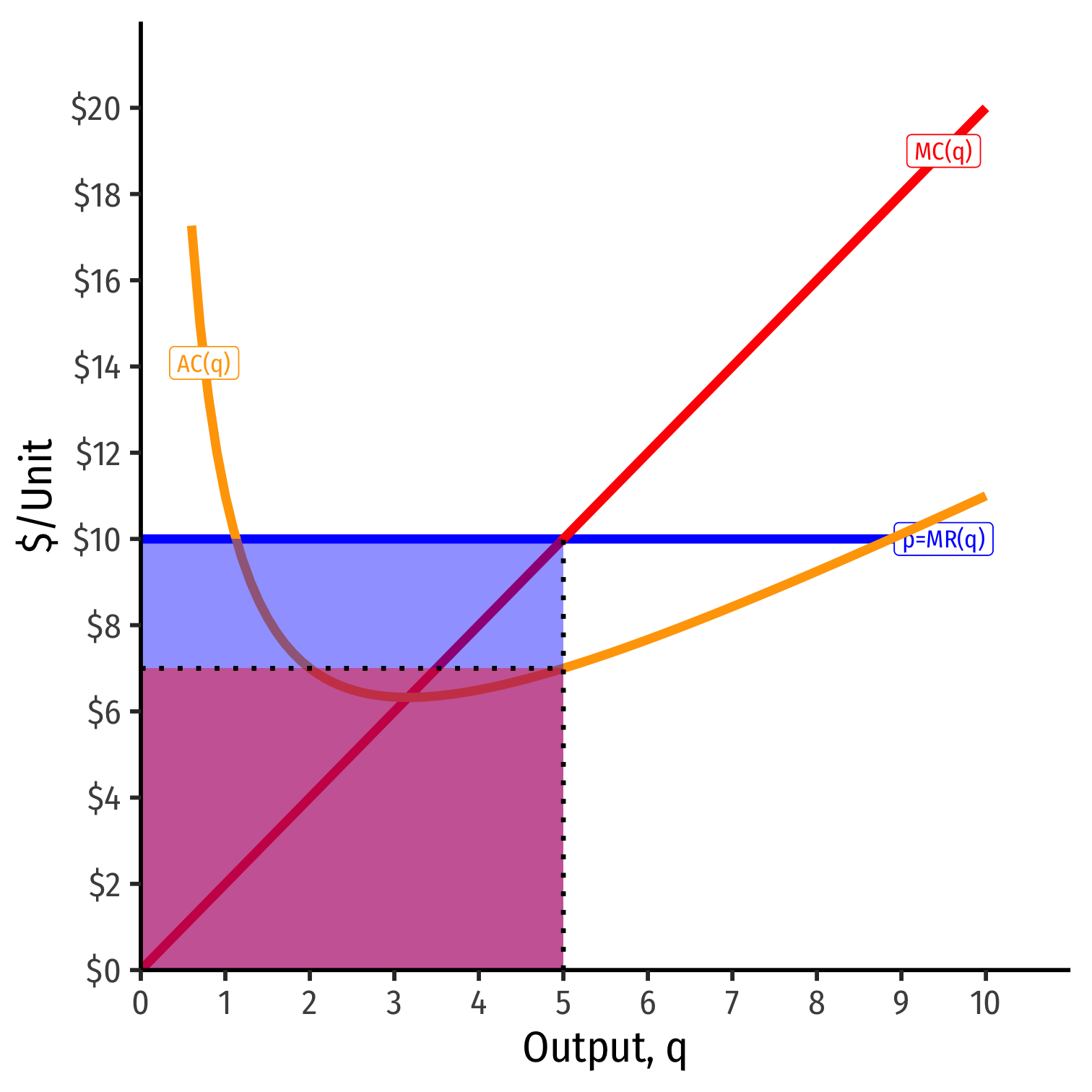

Calculating Profit

Calculating (Average) Profit as AR(q)-AC(q)

- Profit is $$\pi(q)=R(q)-C(q)$$

Calculating (Average) Profit as AR(q)-AC(q)

Profit is $$\pi(q)=R(q)-C(q)$$

Profit per unit can be calculated as: $$\begin{align*} \frac{\pi(q)}{q}&=\color{blue}{AR(q)}-\color{orange}{AC(q)}\\ &=\color{blue}{p}-\color{orange}{AC(q)}\\ \end{align*}$$

Calculating (Average) Profit as AR(q)-AC(q)

Profit is $$\pi(q)=R(q)-C(q)$$

Profit per unit can be calculated as: $$\begin{align*} \frac{\pi(q)}{q}&=\color{blue}{AR(q)}-\color{orange}{AC(q)}\\ &=\color{blue}{p}-\color{orange}{AC(q)}\\ \end{align*}$$

Multiply by \(q\) to get total profit: $$\pi(q)=q\left[\color{blue}{p}-\color{orange}{AC(q)} \right]$$

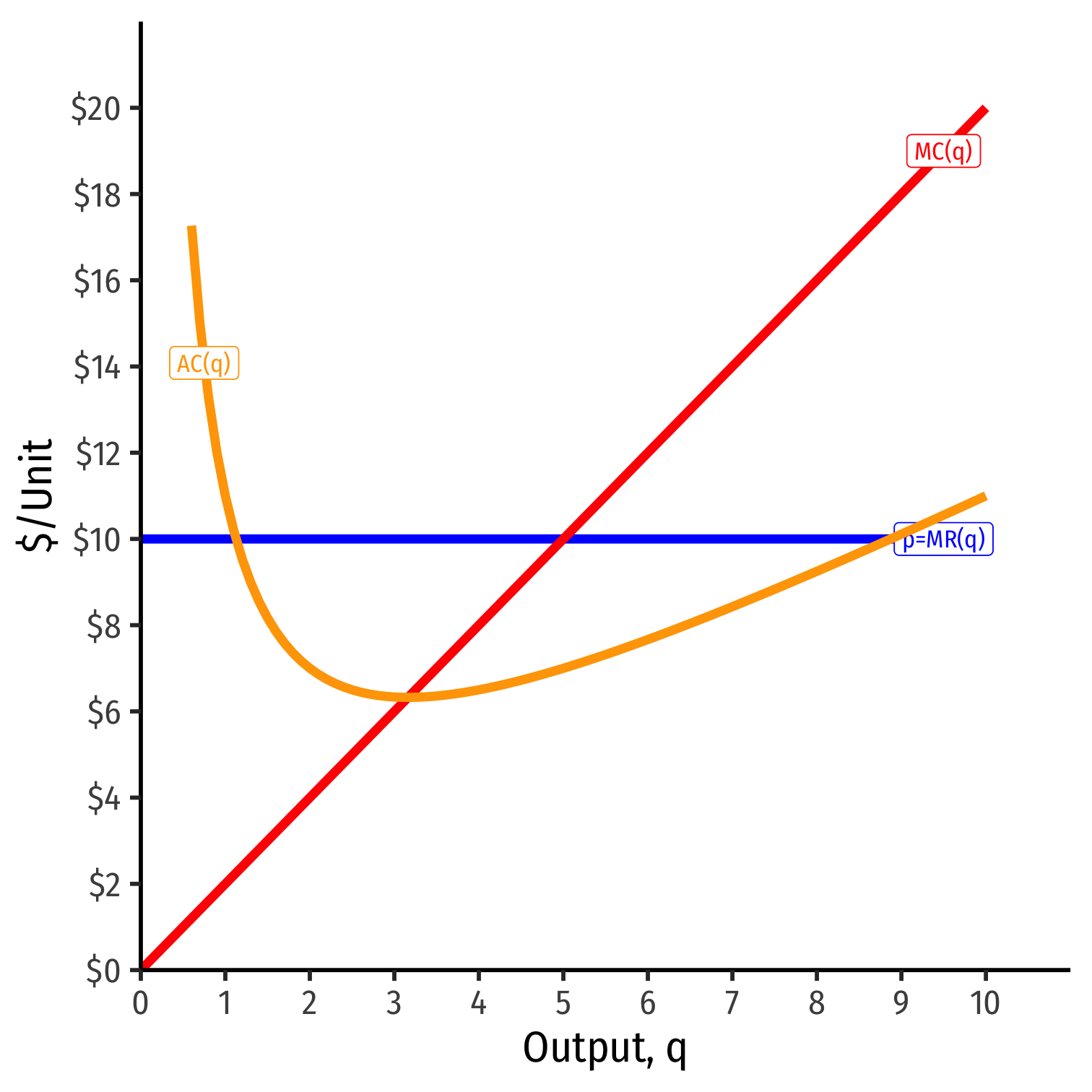

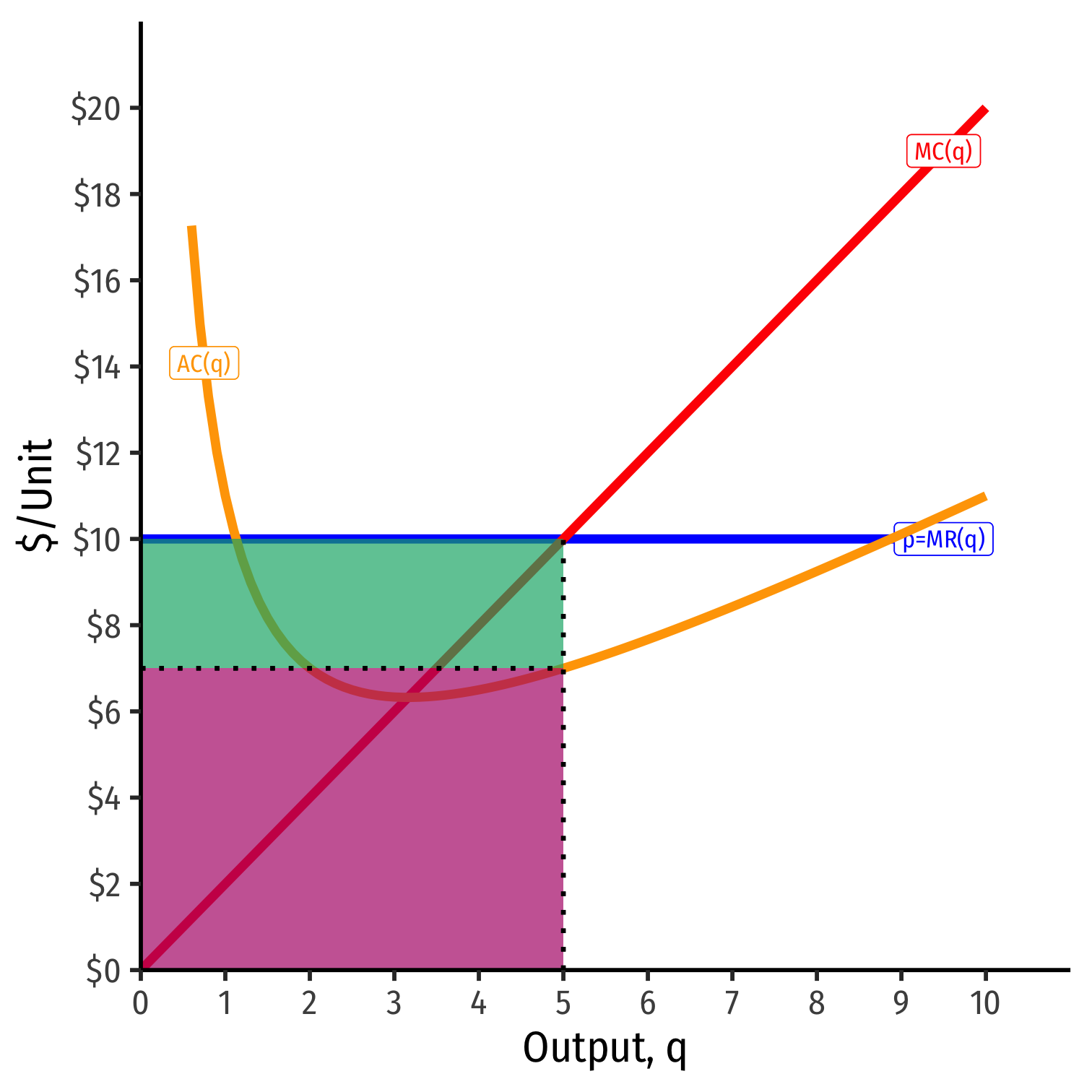

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

At q* = 5 (totals):

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

At q* = 5 (totals):

- R(5) = $50

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

- A\(\pi\)(5) = $3/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

- \(\pi\) = $15

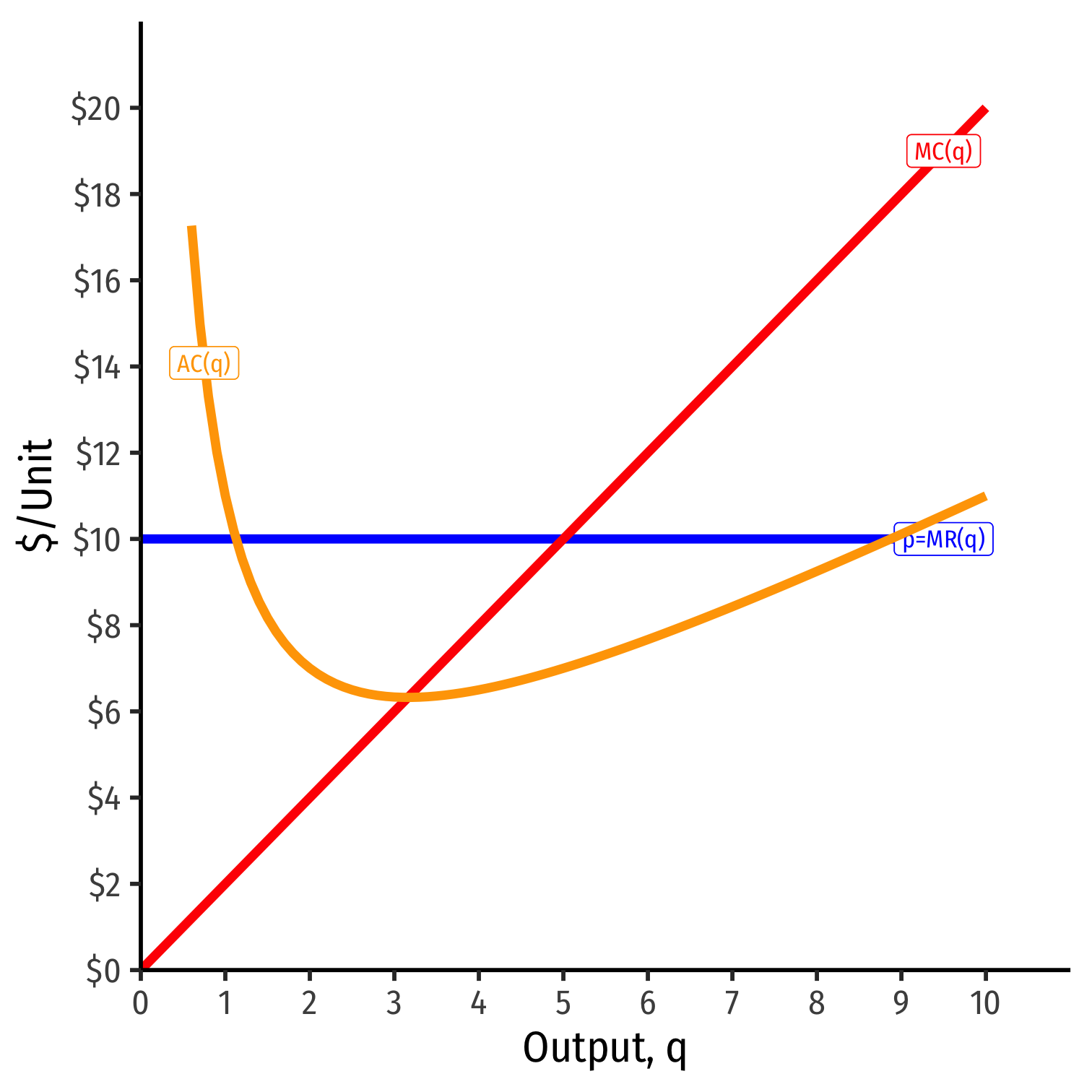

Calculating (Average) Profit as AR(q)-AC(q)

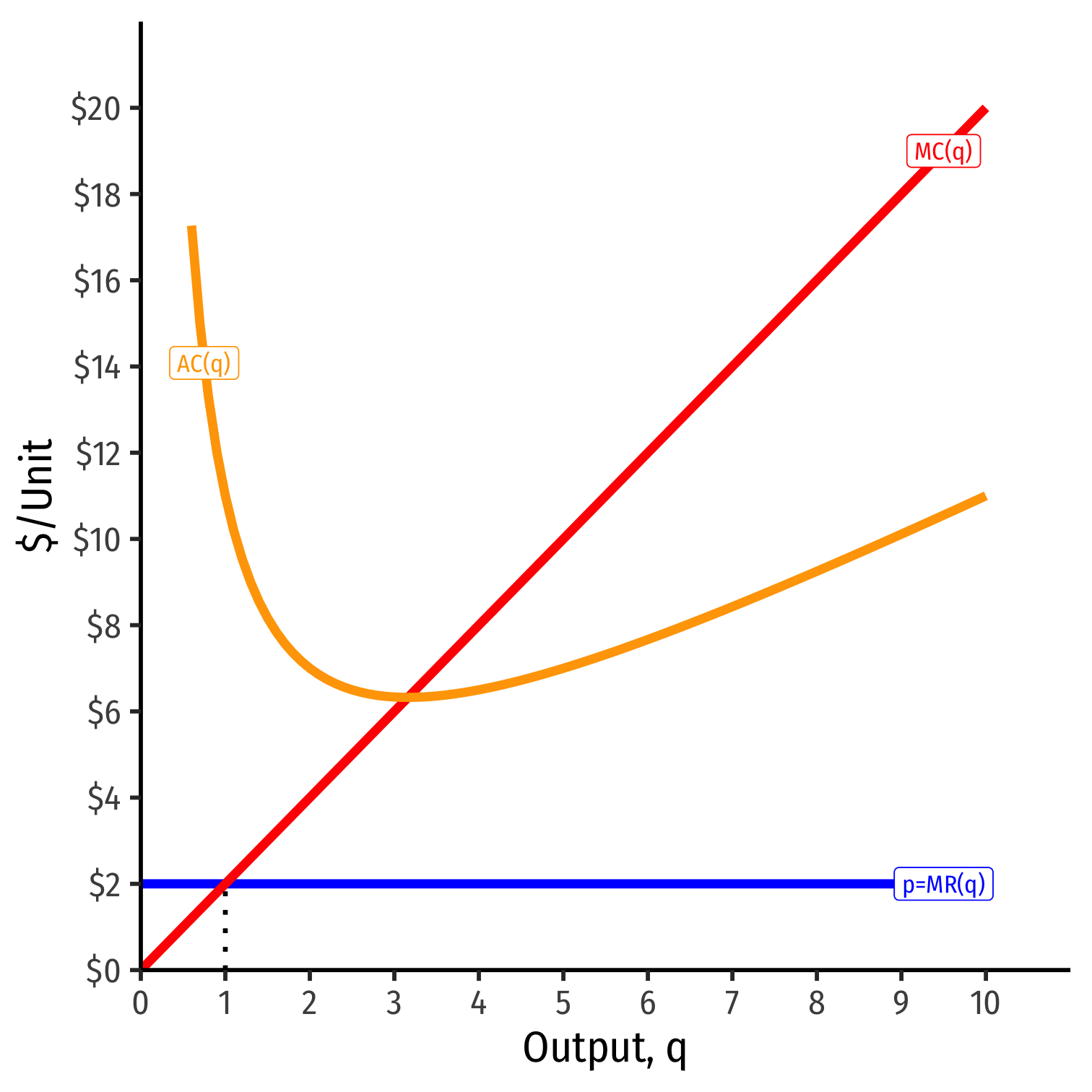

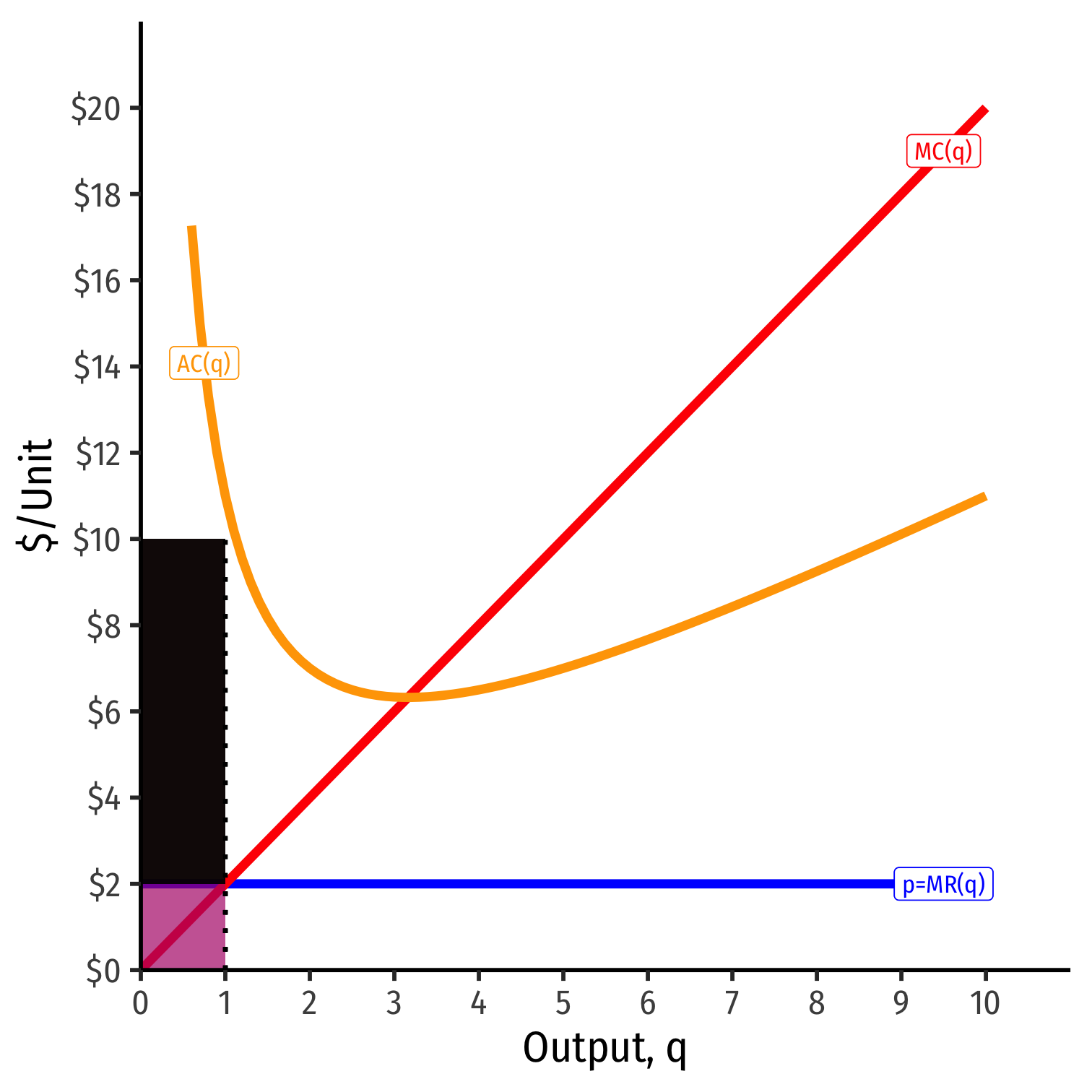

At market price of p* = $2

At q* = 1 (per unit):

At q* = 1 (totals):

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

At q* = 1 (totals):

- R(1) = $2

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

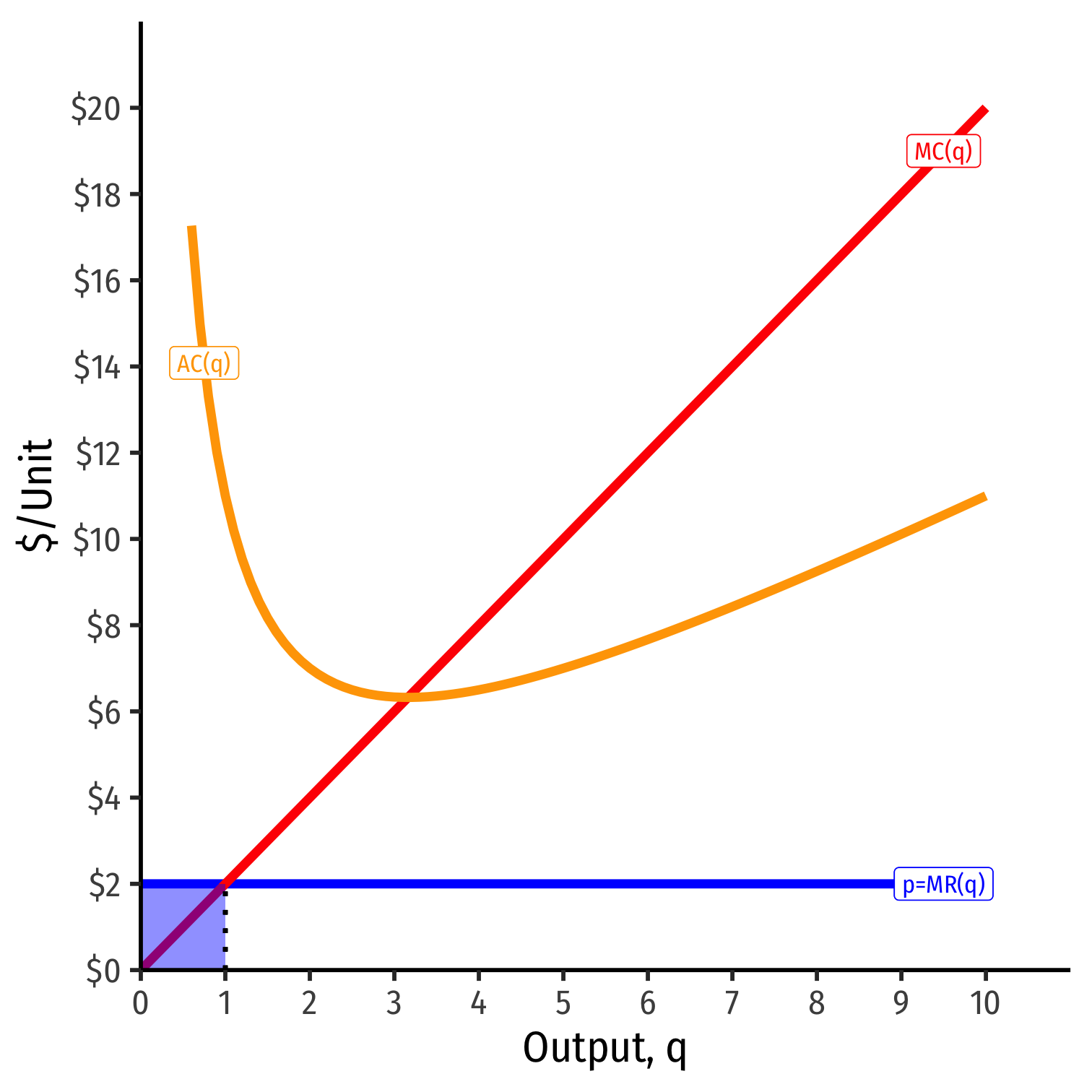

Calculating (Average) Profit as AR(q)-AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

- A\(\pi\)(1) = -$8/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

- \(\pi\)(1) = -$8

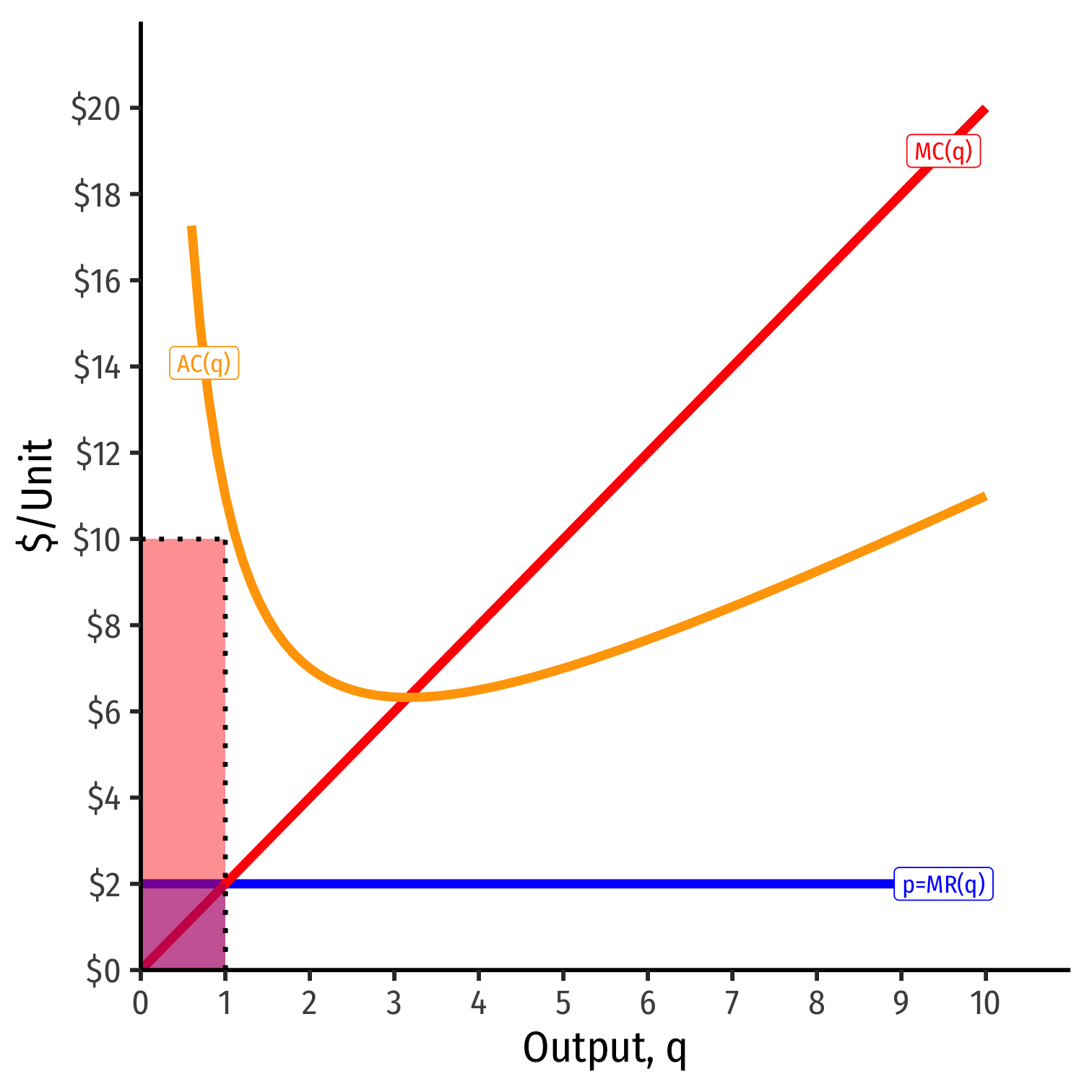

Short-Run Shut-Down Decisions

Short-Run Shut-Down Decisions

What if a firm's profits at \(q^*\) are negative (i.e. it earns losses)?

Should it produce at all?

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing \((q=0)\):

If it has fixed costs \((f>0)\), its profits are:

$$\begin{align*} \pi(q)&=pq-C(q)\\ \end{align*}$$

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing \((q=0)\):

If it has fixed costs \((f>0)\), its profits are:

$$\begin{align*} \pi(q)&=pq-\color{red}{C(q)}\\ \pi(q)&=pq-\color{red}{f-VC(q)}\\ \end{align*}$$

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing \((q=0)\):

If it has fixed costs \((f>0)\), its profits are:

$$\begin{align*} \pi(q)&=pq-C(q)\\ \pi(q)&=pq-f-VC(q)\\ \pi(0)&=-f\\ \end{align*}$$

i.e. it (still) pays its fixed costs

Short-Run Shut-Down Decisions

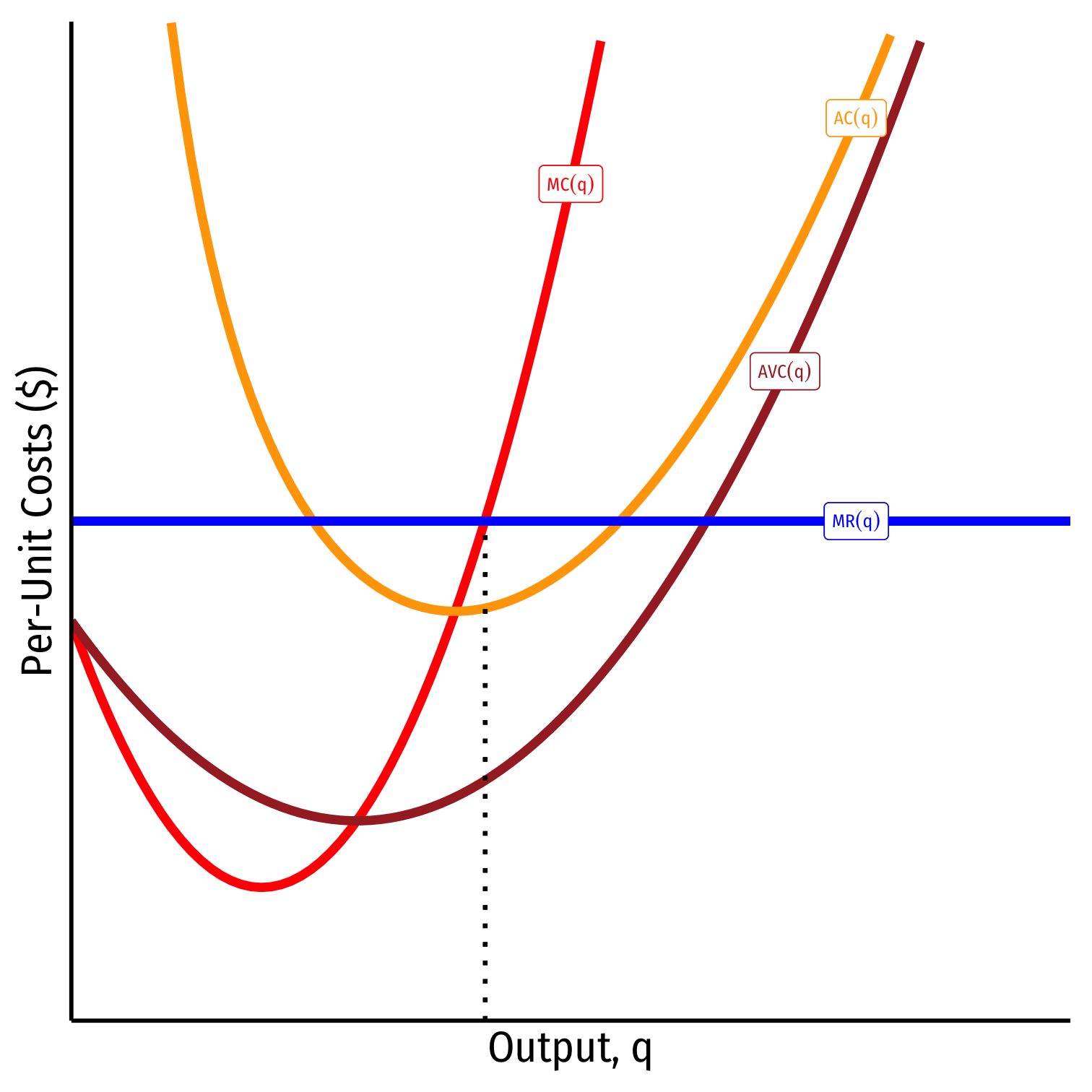

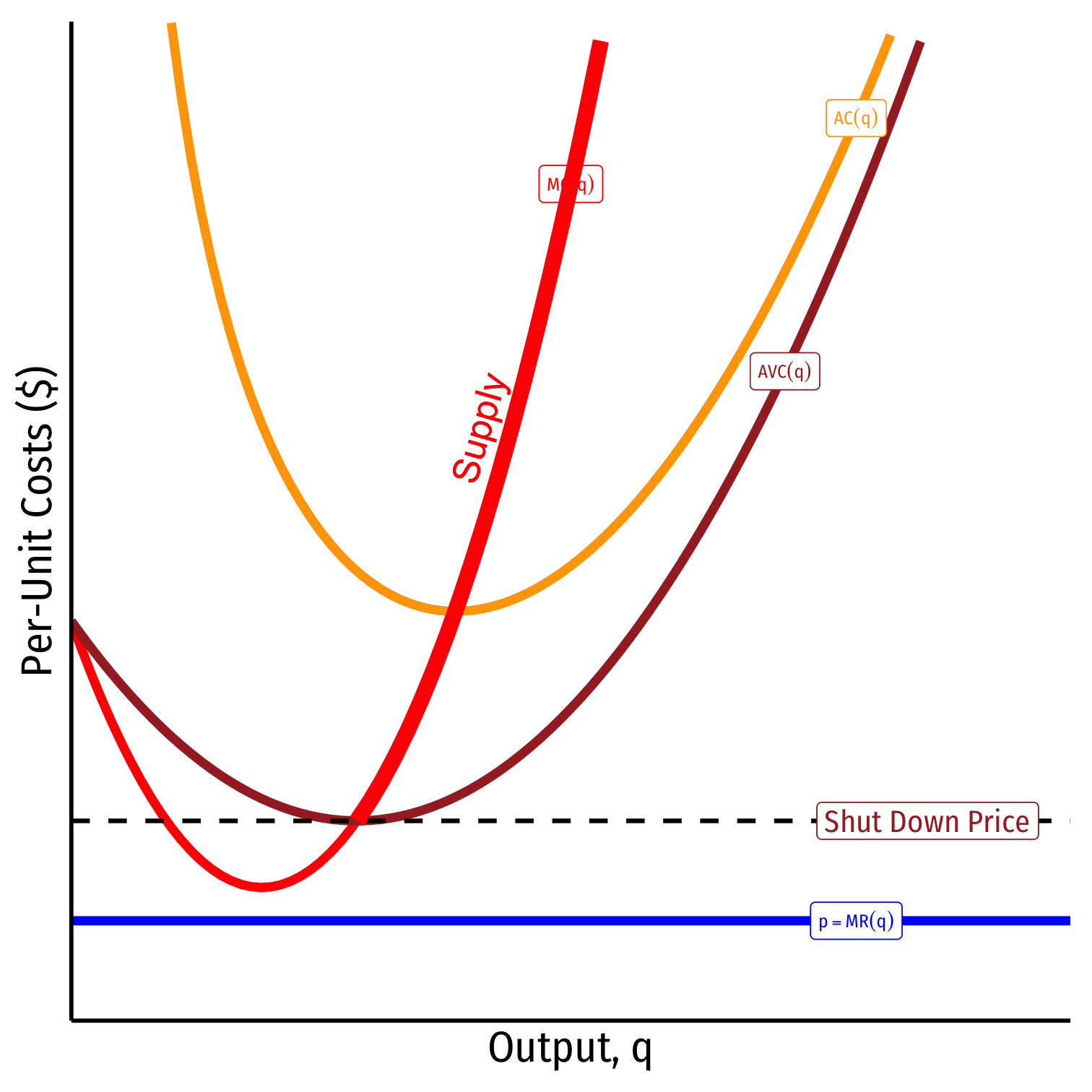

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \end{align*}$$

Short-Run Shut-Down Decisions

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \pi(q) &< -f \\ \end{align*}$$

Short-Run Shut-Down Decisions

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \pi(q) &< -f \\ pq-VC(q)-f &<-f\\ \end{align*}$$

Short-Run Shut-Down Decisions

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \pi(q) &< -f \\ pq-VC(q)-f &<-f\\ pq-VC(q) &< 0\\ \end{align*}$$

Short-Run Shut-Down Decisions

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \pi(q) &< -f \\ pq-VC(q)-f &<-f\\ pq-VC(q) &< 0\\ pq &< VC(q)\\ \end{align*}$$

Short-Run Shut-Down Decisions

- A firm should choose to produce no output \((q=0)\) only when:

$$\begin{align*} \pi \text{ from producing} &< \pi \text{ from not producing}\\ \pi(q) &< -f \\ pq-VC(q)-f &<-f\\ pq-VC(q) &< 0\\ pq &< VC(q)\\ \color{red}{p} & \color{red}{<} \color{red}{AVC(q)}\\ \end{align*}$$

- Shut down price: firm will shut down production in the short run when \(p<AVC(q)\)

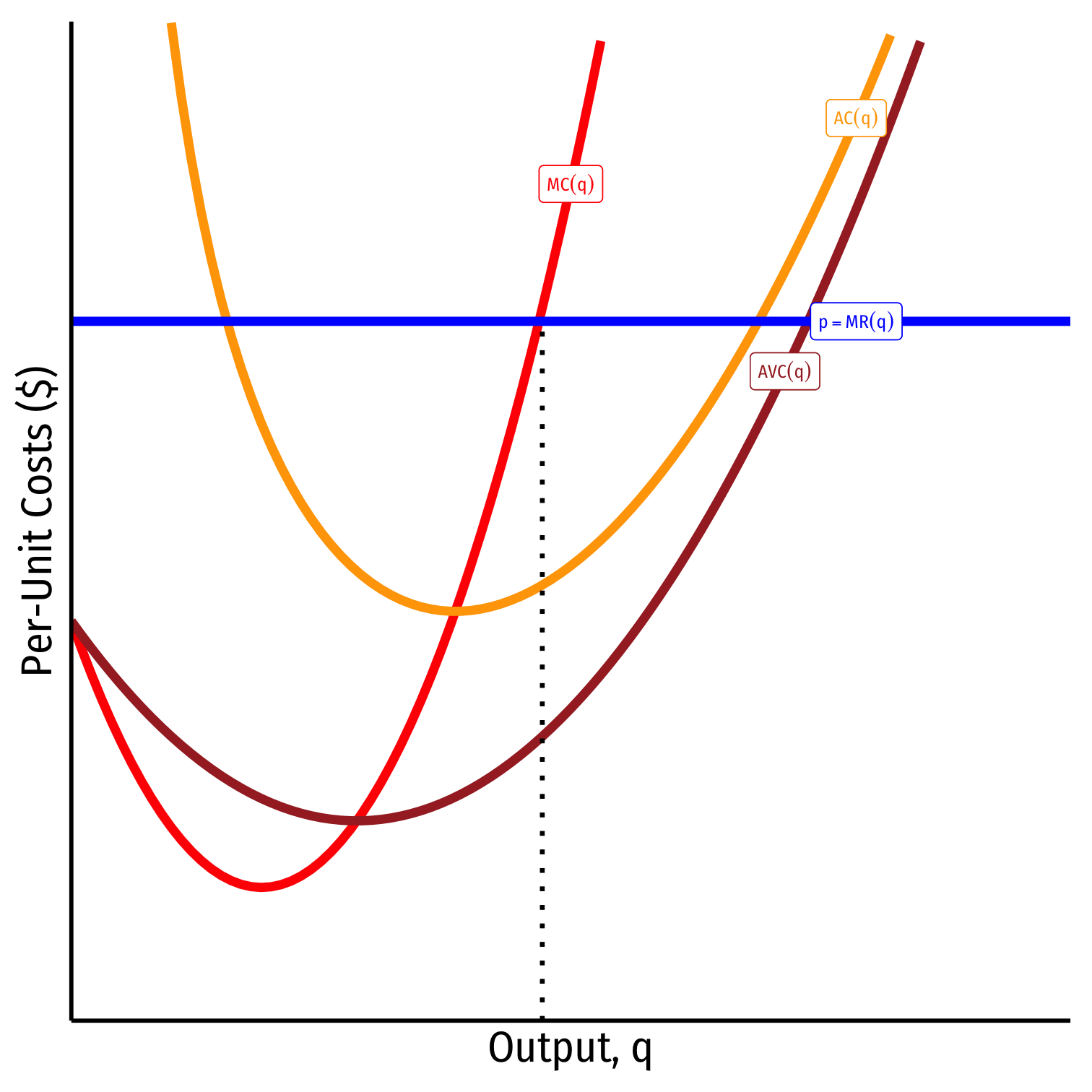

The Firm’s Short Run Supply Decision

The Firm’s Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

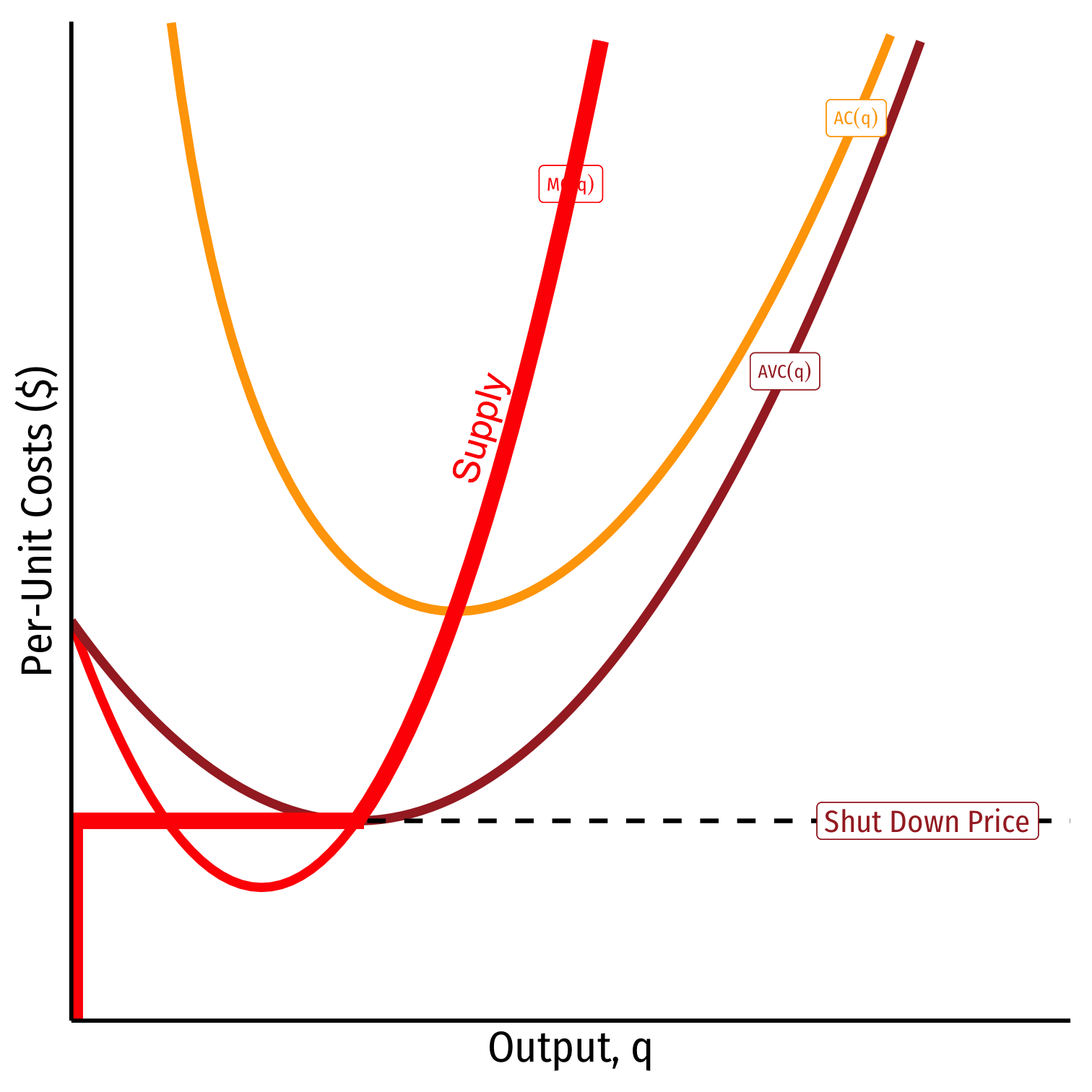

Firm’s short run supply curve:

The Firm's Short Run Supply Decision

Firm’s short run supply curve:

Summary:

1. Choose \(q^*\) such that \(MR(q)=MC(q)\)

Summary:

1. Choose \(q^*\) such that \(MR(q)=MC(q)\)

2. Profit \(\pi=q[p-AC(q)]\)

Summary:

1. Choose \(q^*\) such that \(MR(q)=MC(q)\)

2. Profit \(\pi=q[p-AC(q)]\)

3. Shut down if \(p<AVC(q)\)

Summary:

1. Choose \(q^*\) such that \(MR(q)=MC(q)\)

2. Profit \(\pi=q[p-AC(q)]\)

3. Shut down if \(p<AVC(q)\)

Firm's short run (inverse) supply:

$$\begin{cases} p=MC(q) & \text{if } p \geq AVC\\ q=0 & \text{If } p < AVC\\ \end{cases}$$

Choosing the Profit-Maximizing Output \(q^*\): Example

Example: Bob’s barbershop gives haircuts in a very competitive market, where barbers cannot differentiate their haircuts. The current market price of a haircut is $15. Bob’s daily short run costs are given by:

$$\begin{align*} C(q) &= 0.5q^2+30\\ MC(q) &=q\\ \end{align*}$$

How many haircuts per day would maximize Bob’s profits?

How much profit will Bob earn per day?

At what price would Bob break even?

At what price should the Bob shut down in the short run?

Write equations for Bob’s short-run supply curve and long-run supply curve.