3.5 — The Dynamic Benefits of Markets

ECON 306 • Microeconomic Analysis • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/microS23

microS23.classes.ryansafner.com

The Model is Not the Reality I

“All models are wrong, but some are useful.”

This course is about economic modeling and formal theory

Lots of applications beyond this course

Models help us understand reality, but they are not reality!

- Don't mistake the map for the territory itself

The Model is Not the Reality II

Our models so far have given us interesting results:

- Markets reach equilibrium

- Economic profits are zero in the long run in competitive markets

Both are fictional!

But the models still show us useful insights about how a market economy works

Some readings in today’s readings page to help you understand

The Model is Not the Reality III

Why Markets Tend to Equilibrate, Redux

The Law of One Price I

- Law of One Price: all units of the same good exchanged on the market will tend to have the same market price (the market-clearing price, p∗)

The Law of One Price II

Consider if there are multiple different prices for same good:

Arbitrage opportunities: optimizing individuals recognize profit opportunity:

- Buy at low price, resell at high price!

- There are possible gains from trade or gains from innovation to be had

Entrepreneurship: recognizing profit opportunities and entering a market as a seller to try to capture gains from trade/innovation

Arbitrage and Entrepreneurship I

Arbitrage and Entrepreneurship II

Arbitrage and Entrepreneurship III

Uncertainty vs. Risk

Uncertainty vs. Risk

“Known knowns”: perfect information

“Known unknowns”: risk

- We know the probability distribution of states that could happen

- We just don't know which state will be realized

- We can estimate probabilities, maximize expected value, minimize variance, etc.

Uncertainty vs. Risk

- “Unknown unknowns”: uncertainty

- We don’t even know the probability distribution of states that could happen

- No model to optimize in a world of uncertainty!

The Role of Entrepreneurial Judgment

Under true uncertainty, it’s not that we can’t assign probabilities to each outcome; we do not even have the knowledge necessary to list all possible outcomes!

Requires entrepreneurial judgment to both:

- estimate possible actions and

- estimate the likelihood of their success

Entrepreneur is central player, earns pure profits (a residual) for bearing uncertainty

For more, see Knight 1920 in today’s readings.

Entrepreneurial Judgment

Henry Ford

1863-1947

“If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

Entrepreneurial Judgment

“It's really hard to design products by focus groups. A lot of times, people don't know what they want until you show it to them.” - Steve Jobs

Uncertainty and Entrepreneurship

Mark Zuckerberg

1984-

"Why were we the ones to build [Facebook]? We were just students. We had way fewer resources than big companies. If they had focused on this problem, they could have done it. The only answer I can think of is: we just cared more. While some doubted that connecting the world was actually important, we were building. While others doubted that this would be sustainable, we were forming lasting connections."

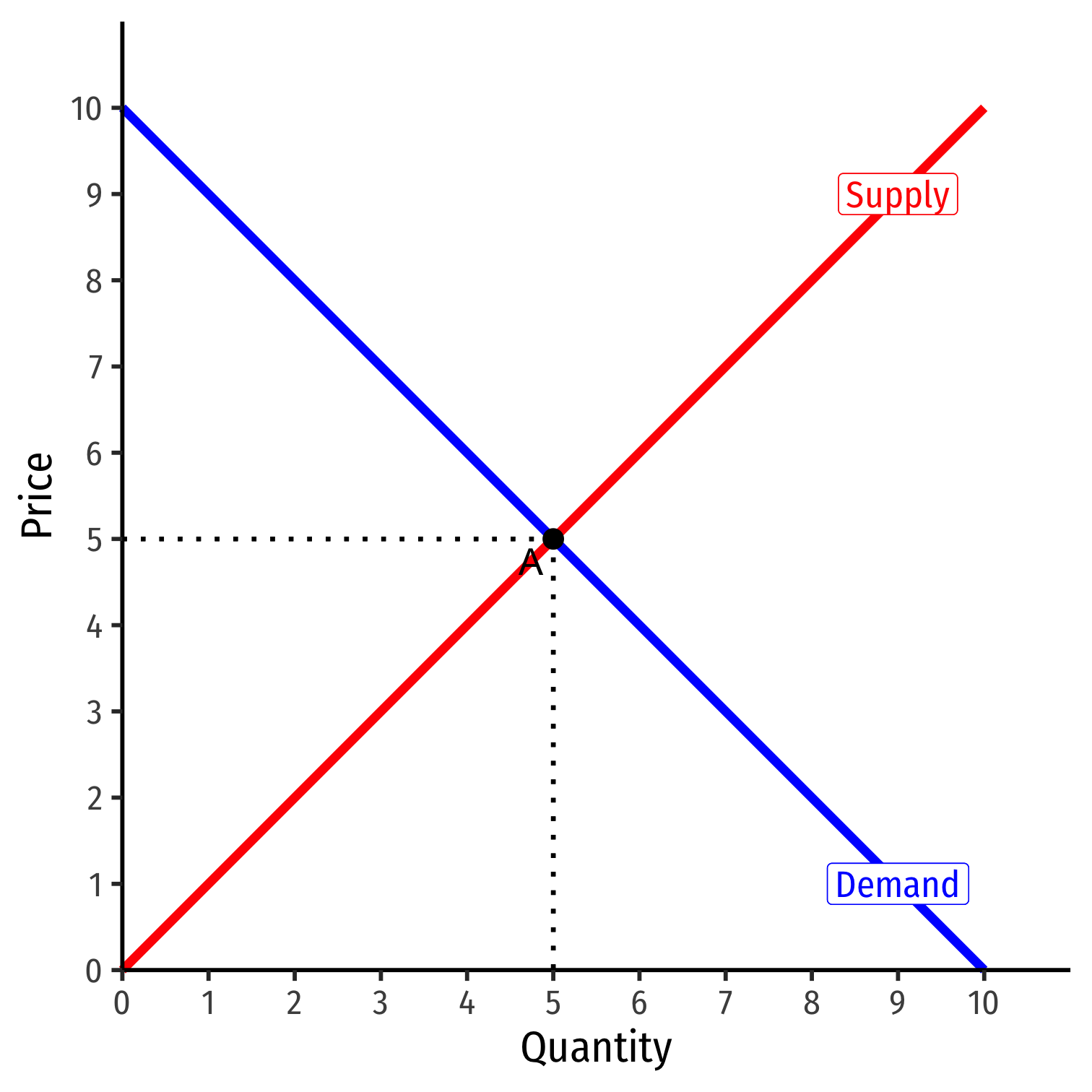

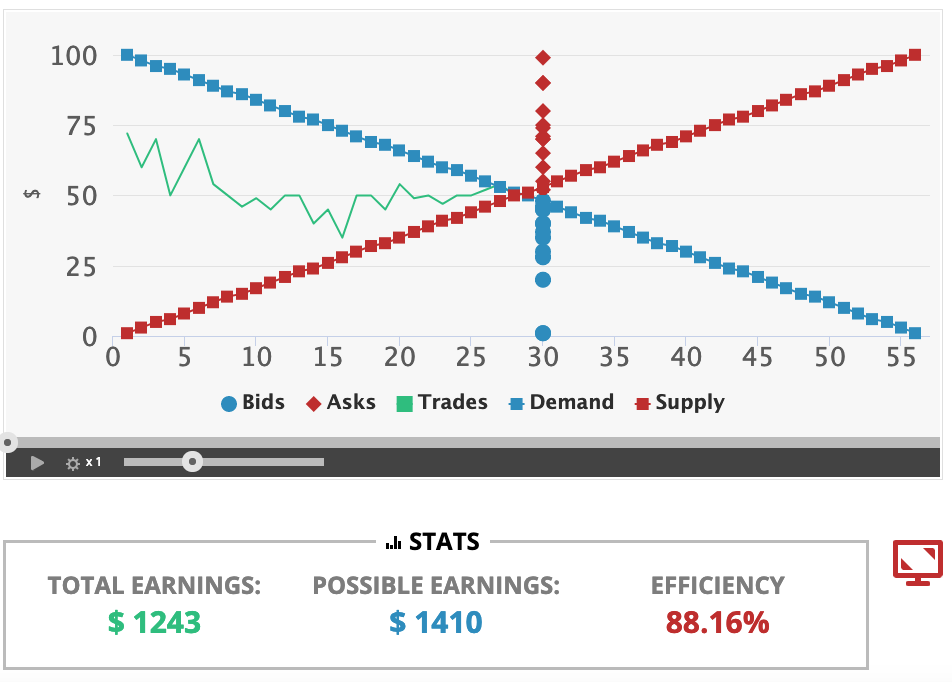

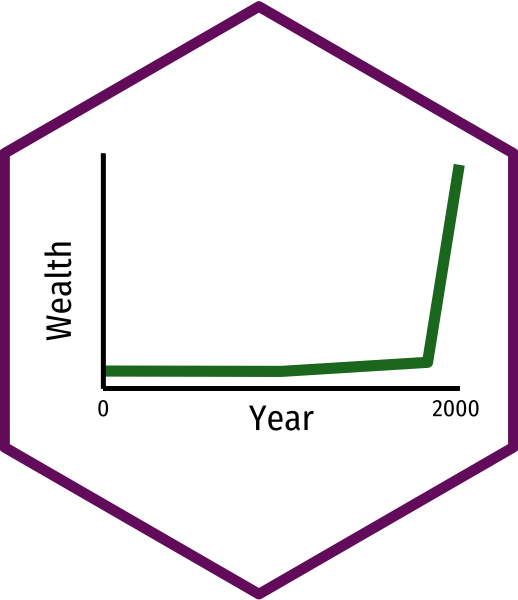

How Markets Get to Equilibrium I

Nobody knows “the right price” for things

Each buyer and seller only know their own reservation prices

Buyers and sellers adjust their bids/asks

Markets do not start competitive, but become competitive!

New entrepreneurs enter to try to capture gains from trade/innovation

As these gains are exhausted, prices converge to equilibrium

How Markets Get to Equilibrium II

For more, see Hayek 1945 in today’s readings.

- Errors and imperfect information

⟹ multiple prices

⟹ arbitrage opportunities

⟹ entrepreneurship

⟹ correcting mistakes

⟹ people update their behavior & expectations

- Markets are discovery processes that discover the right prices, the optimal uses of resources, and cheapest production methods, none of which can be known in advance!

How Markets Get to Equilibrium III

Economy as a cat-and-mouse game between:

- Mouse: preferences, technologies, alternative uses of resources

- Cat: market prices, least-cost technologies

Cat always chasing mouse

- Mouse always moving

- Any time cat hasn’t caught mouse: profit opportunities

IF mouse froze, market would rest at equilibrium

The Social Functions of Market Prices

Prices are Signals I

Prices are Signals II

Markets are social processes that generate information via prices

Prices are never “given”, prices emerge dynamically from negotiation and market decisions of entrepreneurs and consumers

Competition: is a discovery process which discovers what consumer preferences are and what technologies are lowest cost, and how to allocate resources accordingly

For more, see Hayek 1945 in today’s readings.

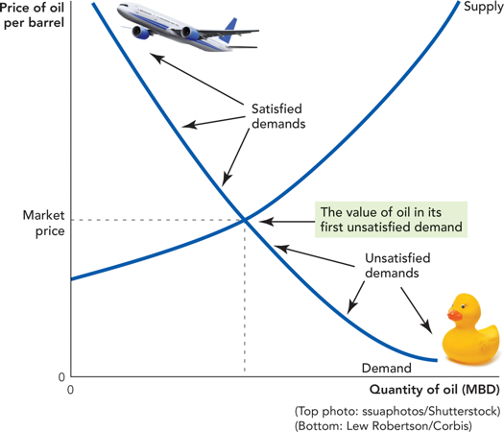

The Social Functions of Prices I

A relatively high price:

Conveys information: good is relatively scarce

Creates incentives for:

- Buyers: conserve use of this good, seek substitutes

- Sellers: produce more of this good

- Entrepreneurs: find substitutes and innovations to satisfy this unmet need

The Social Functions of Prices II

A relatively low price

Conveys information: good is relatively abundant

Creates incentives for:

- Buyers: substitute away from expensive goods towards this good

- Sellers: Produce less of this good, talents better served elsewhere

- Entrepreneurs: talents better served elsewhere: find more severe unmet needs

The Social Functions of Prices III

Prices tell us how to allocate scarce resources among competing uses

Think of diminishing marginal utility:

- allocate scarce good to highest-valued use first

- as supply becomes more plentiful (price falls), can allocate more units of the good to lower-valued uses (higher-valued uses already satisfied)

Uncertainty and Profits

Uncertainty, Tacit Information, and Profit I

Economic theory: in a perfectly competitive market, in the long run, economic profit → to zero

Real world: there are often economic profits

Our blackboard models assume perfect information

In reality we have to deal with uncertainty

Uncertainty, Tacit Information, and Profit II

Imperfect information: mispricing and multiple prices → arbitrage/profit opportunities

- Some people recognize opportunities ($20 bills) that others do not see

In a world of certainty, there would be no profit

- The model world of perfect competition is a fictional world of certainty

- The real world, because it’s uncertain, has profit opportunities!

Uncertainty, Tacit Information, and Profit III

Firms don’t actually maximize profits 😨, just a convenient assumption!

- In a world of uncertainty (unlike mere risk), there’s no way to maximize anything!

Real world is not a mere constrained maximization problem!

Better to think in evolutionary terms:

- Firms that best adapt to market circumstances will survive and earn profit...whether by skill & talent or just dumb luck!

For more, see Alchian 1950, Gigerenzer, 2012, and Smith, 2003 in today’s readings.

Uncertainty, Tacit Information, and Profit IV

Reminder: Profits and Entrepreneurship

In markets, production faces profit-test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival for sellers in markets requires firms continually create value and earn profits or die

Why We Need Prices, Profits, and Losses I

People often confuse the economic problem with a technological problem

Technological problem: how to allocate scarce resources to accomplish a particular goal

- e.g. buy the right combination of goods to maximize utility

- e.g. buy the right combination of inputs and produce output to maximize profits

- given stable prices, preferences, and technologies, a computer can solve this problem

For more, see Hayek 1945 in today’s readings.

Why We Need Prices, Profits, and Losses II

Economic calculation problem: how to determine which of the infinite technologically-feasible options are economically viable?

How to best make use of dispersed knowledge to coordinate conflicting plans of individuals for their own ends?

ONLY can be discovered through competition, prices, profits & losses

For more, see Hayek 1945 in today’s readings.

What if there Were No Prices? I

What if there Were No Prices? II

For More On The Socialist Calculation Debate

See lesson 4.2 in my History of Economic Thought Course: The Socialist Calculation Debate

And How Did The Soviet Union “Work” For So Long?

See lesson 12 in my Economics of Development Course: Russia and the Post-Communist Transition