4.3 — Pricing Strategies

ECON 306 • Microeconomic Analysis • Spring 2023

Ryan Safner

Associate Professor of Economics

safner@hood.edu

ryansafner/microS23

microS23.classes.ryansafner.com

Profit-Seeking Firms

Any firm with market power seeks to maximize profits

Wants to (1st) create a surplus

Profit-Seeking Firms and Appropriability

Any firm with market power seeks to maximize profits

Wants to (1st) create a surplus and then appropriate some of it as profit

- i.e. convert CS →→ ππ

Consumers are still better off than without the firm because it creates value (consumer surplus)

- Just not as best-off as under perfect competition

Most Firms Create More Value than They Can Capture!

William Nordhaus

(1941-)

Economics Nobel 2018

“We conclude that [about 2.2%] of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers rather than captured by producers,” (p.1)

Nordhaus, William, 2004, "Schumpeterian Profits in the American Economy: Theory and Measurement," NBER Working Paper 10433

Price Discrimination

The most obvious way to capture more surplus is to raise prices

- But Law of Demand ⟹⟹ this would turn many customers away!

Also, we saw that if a firm wants to sell more units, it has to lower the price on all units!

Price Discrimination

Instead, if firm could charge different customers with different WTP different prices for the same goods, firm could convert more consumer surplus into profit

“Price discrimination” or “Variable pricing”

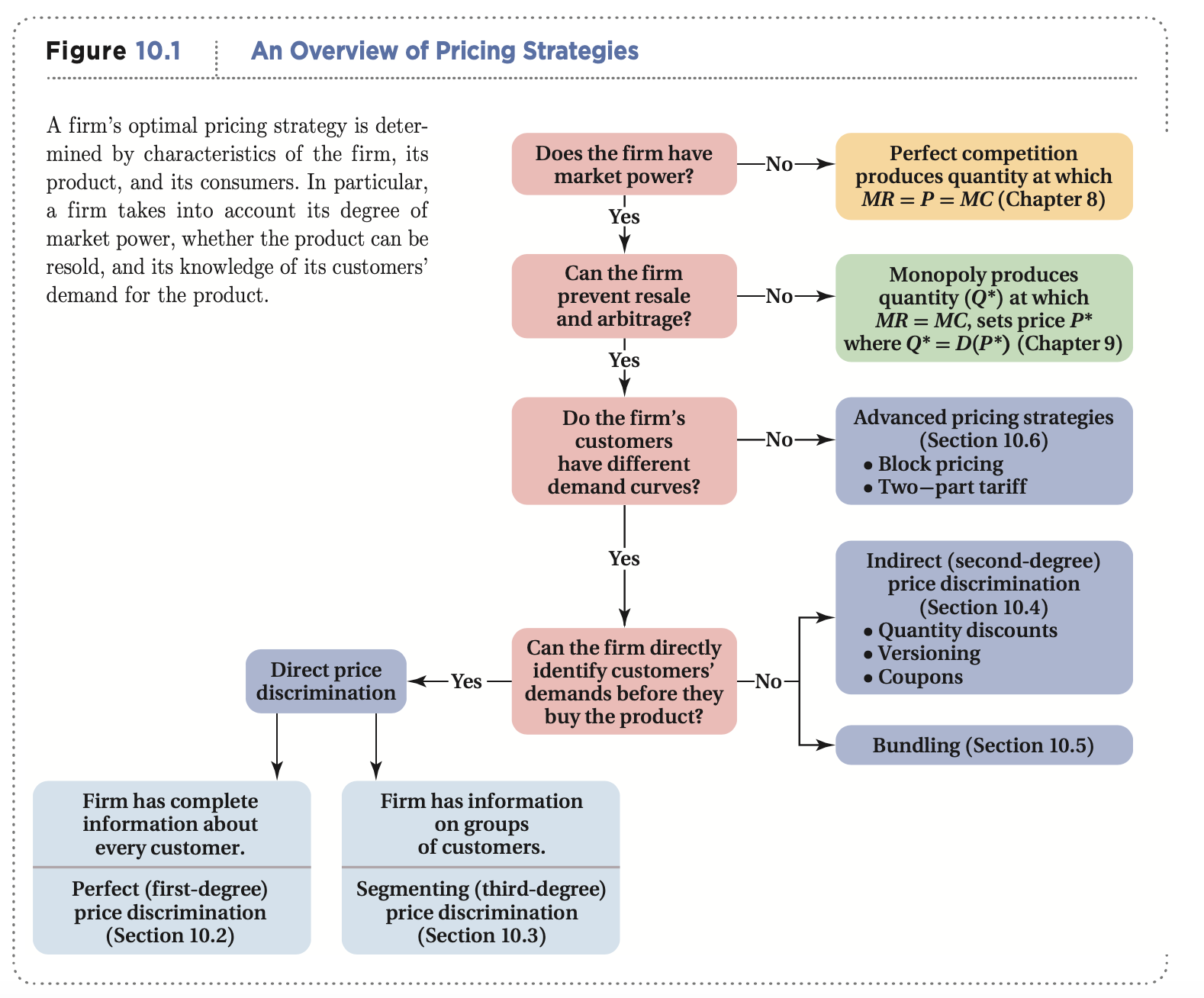

The Economics of Pricing Strategy I

- Two conditions are required for a firm to engage in variable pricing:

1) Firm must have market power

- A competitive firm must charge the market price

The Economics of Pricing Strategy I

- Two conditions are required for a firm to engage in variable pricing:

1) Firm must have market power

- A competitive firm must charge the market price

2) Firms must be able to prevent resale or arbitrage

- Clever customers buy in your lower-price market to resell it in your higher-price market

The Economics of Pricing Strategy II

Firm must acquire information about the variations in its customers' demands

Can the firm identify consumers' demands before they buy the product?

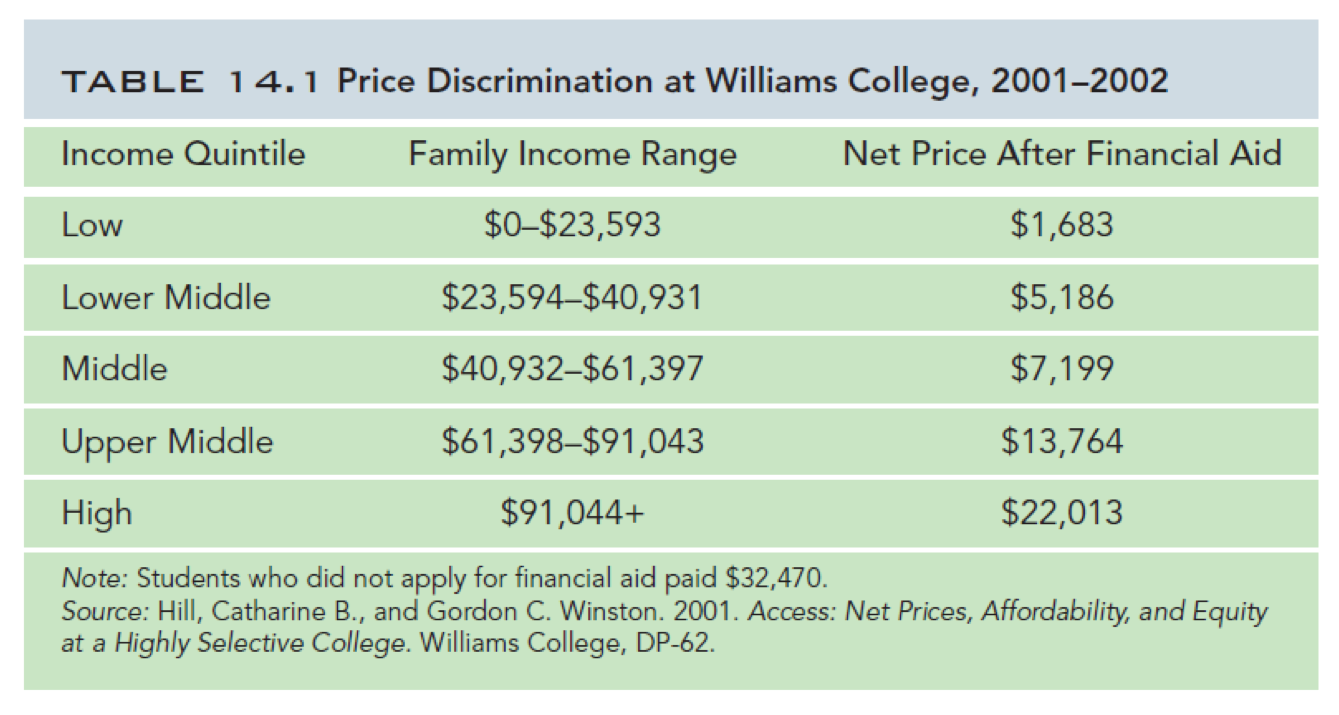

The Economics of Pricing Strategy III

(Goolsbee et al., 2013: 397)

The Economics of Pricing Strategy IV

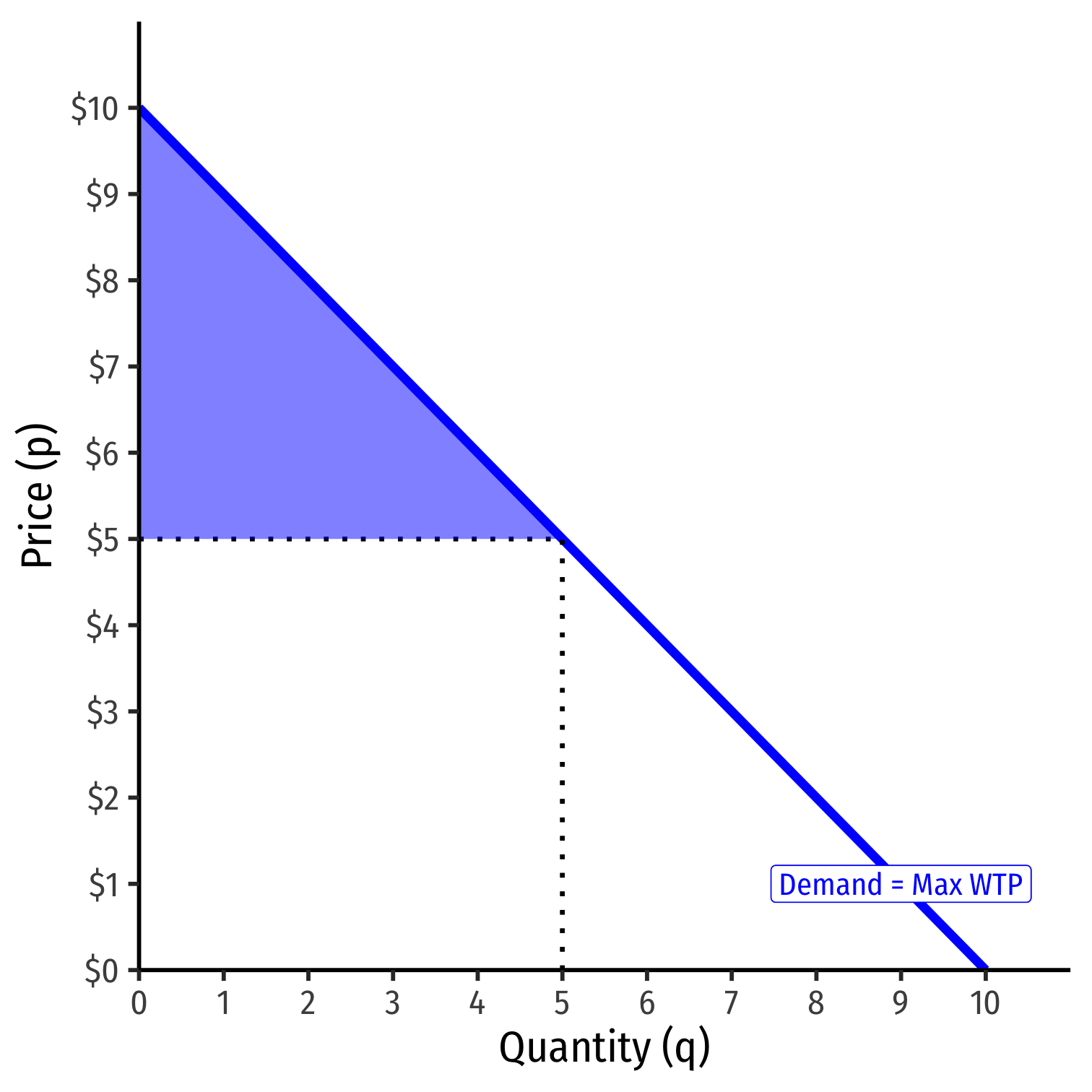

With perfect information ⟹⟹ Perfect or 1st-degree price discrimination

Charge a different price to each customer (their max WTP)

The Economics of Pricing Strategy V

With imperfect information ⟹⟹ 3rd-degree price discrimination

Separate customers into groups (by demand differences) and charge each group a different price

The Economics of Pricing Strategy VI

- 2nd-degree price discrimination: More indirect forms of pricing: tying, bundling, quantity-discounts

- Firm does not have enough information to categorize customers into groups

- Consumers self-select into their own group

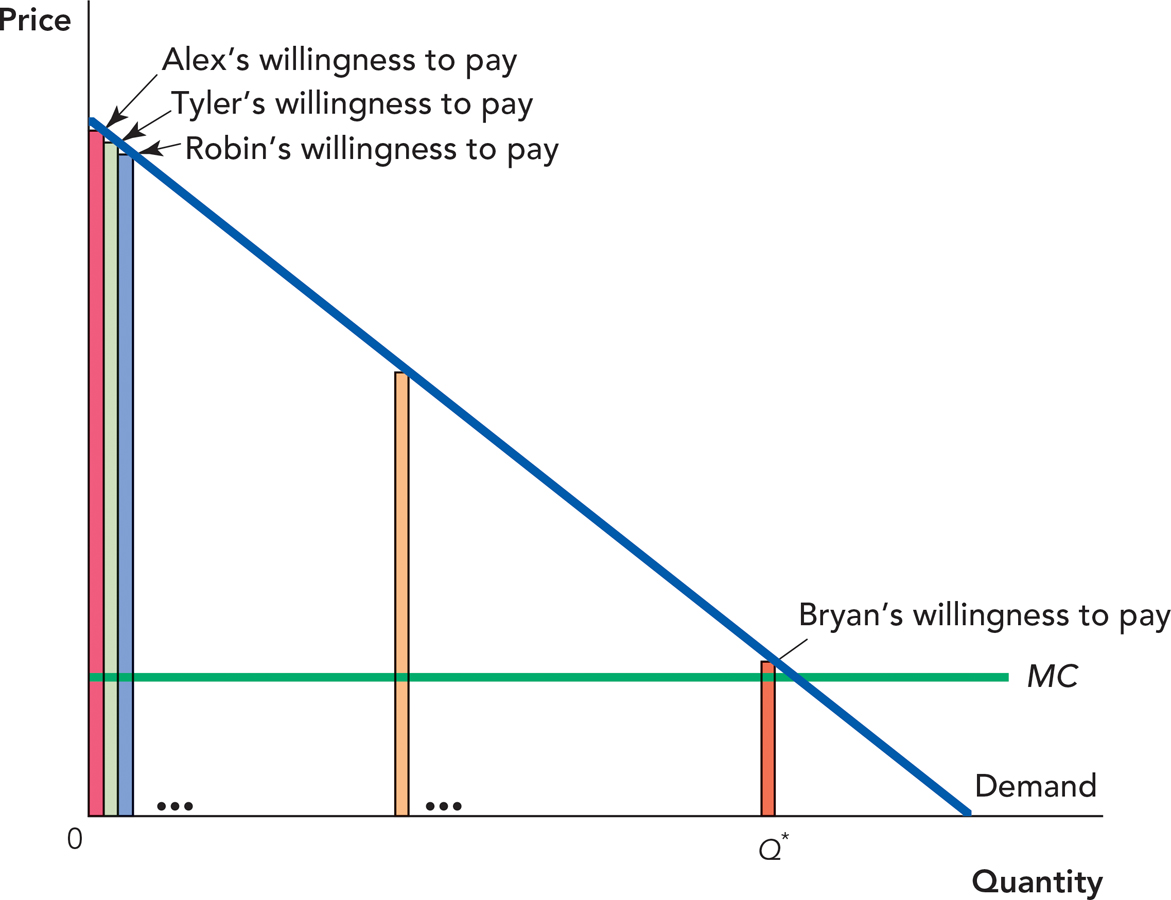

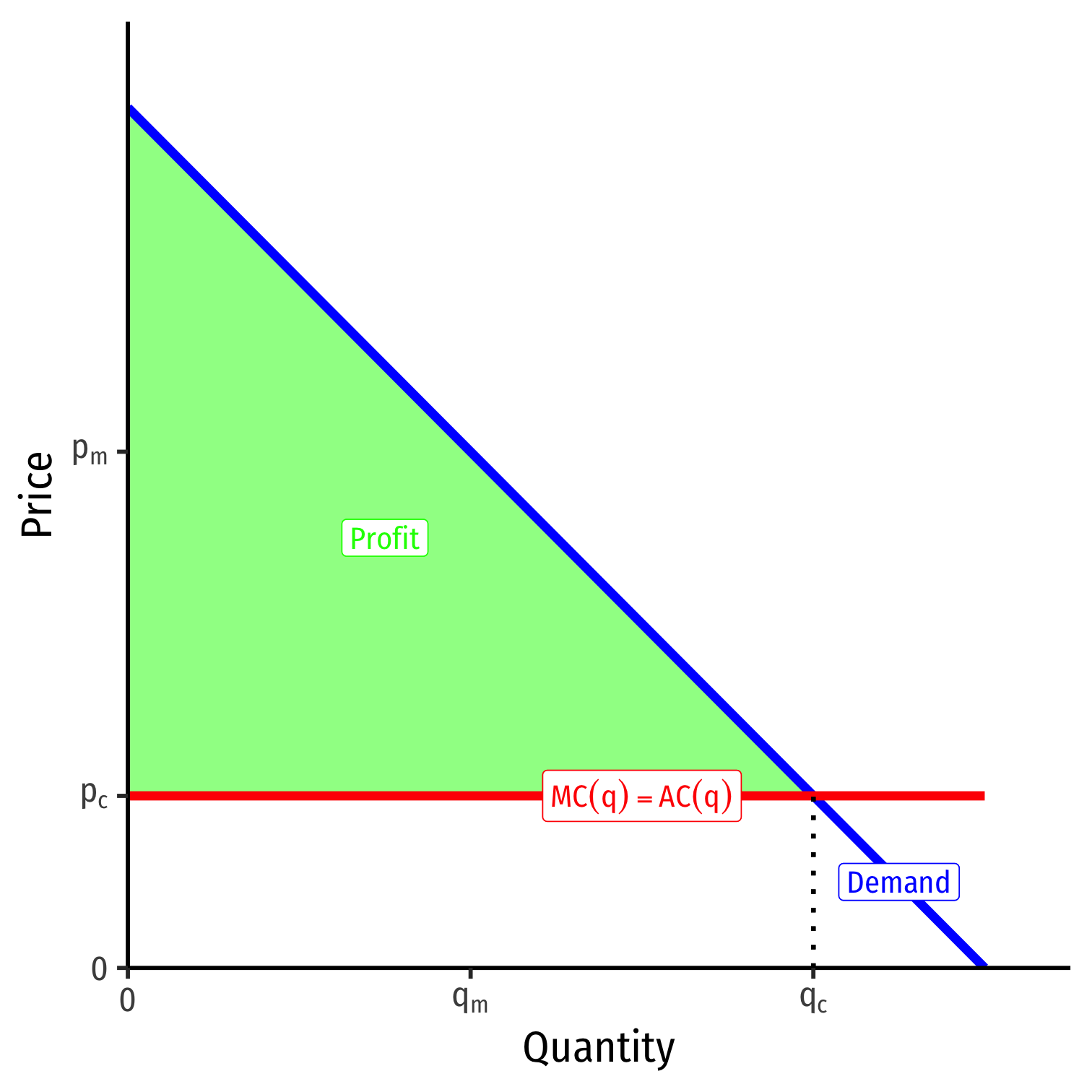

1st-Degree Price Discrimination

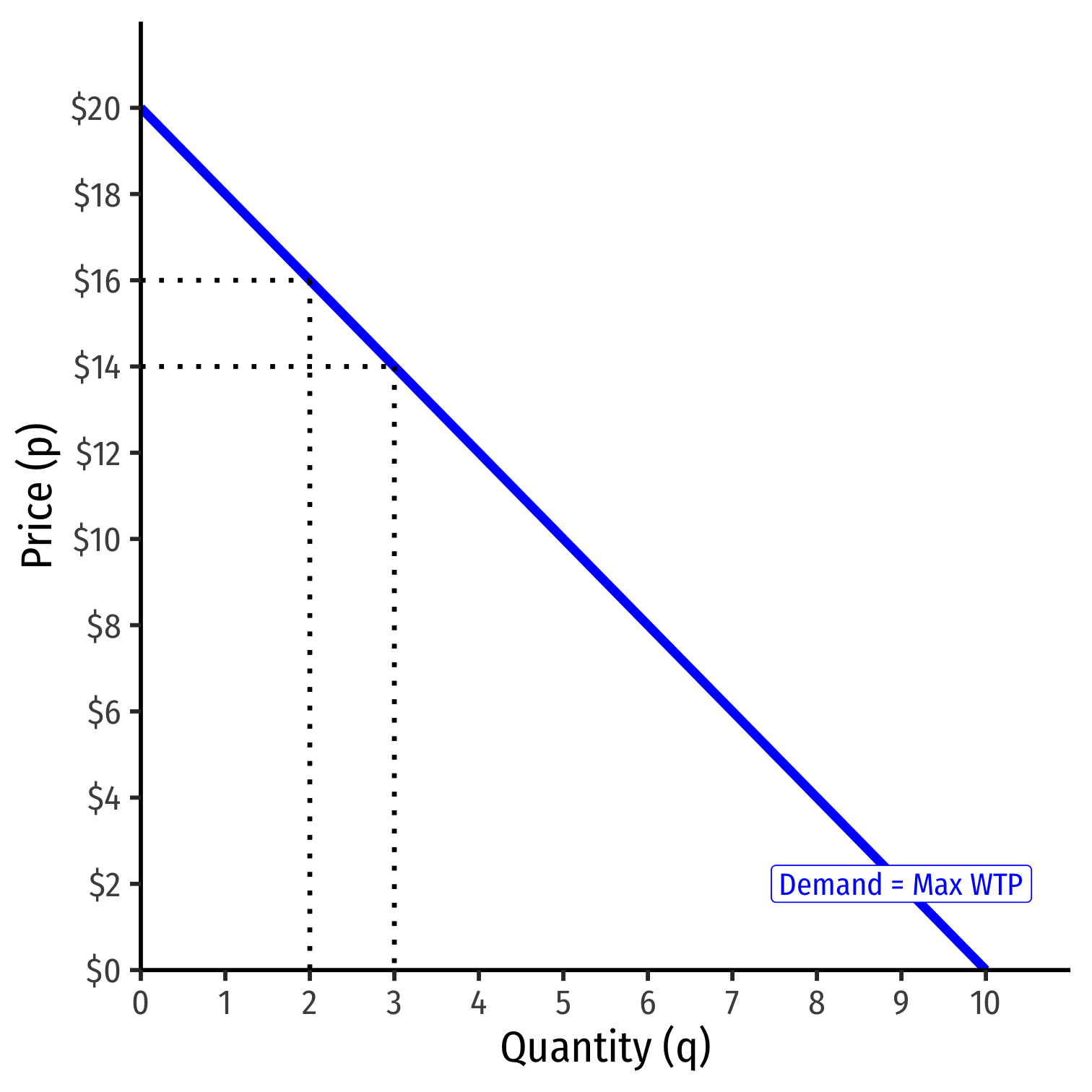

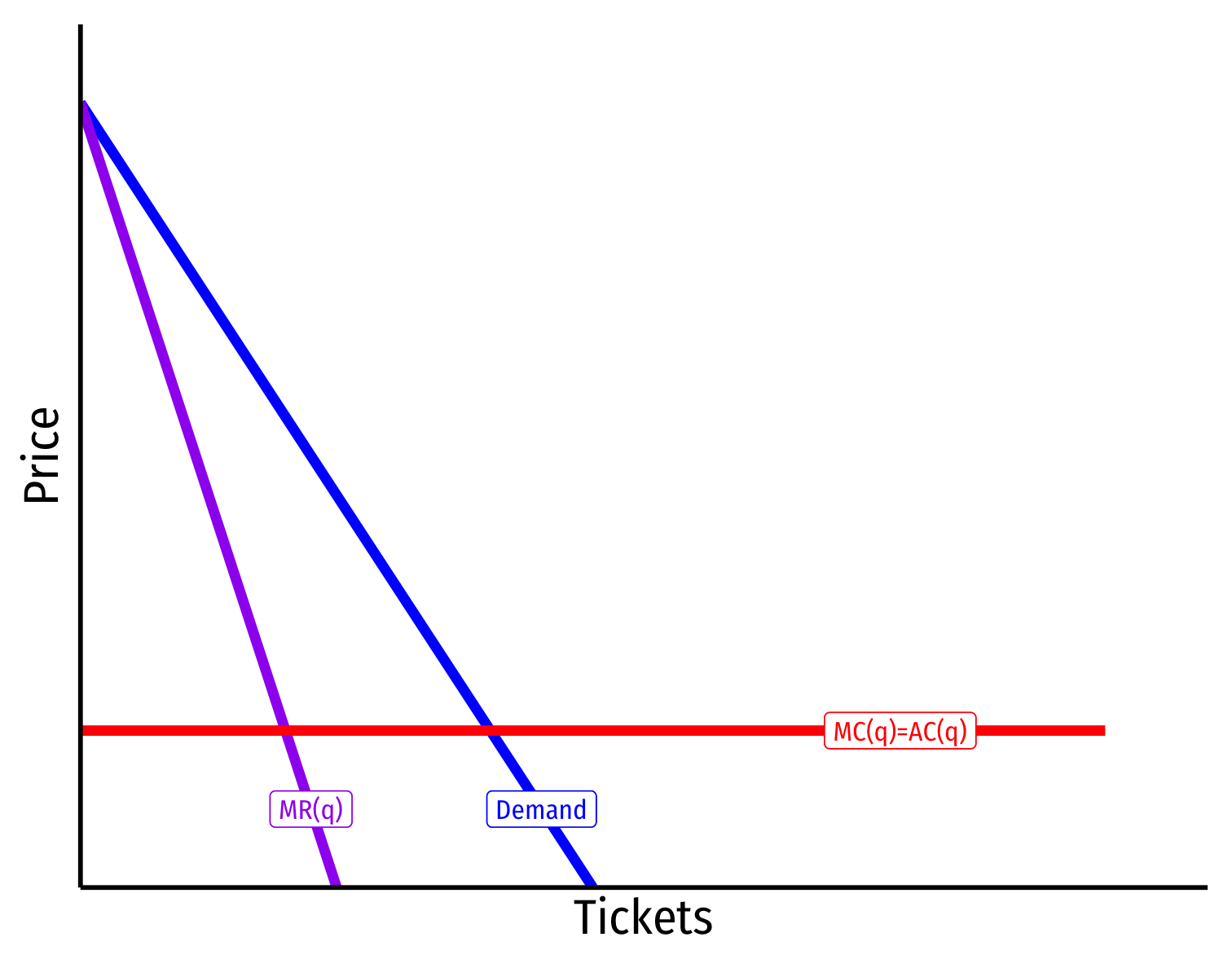

1st-Degree Price Discrimination I

If firm has perfect information about every customer's demand before purchase:

Perfect or 1st-degree price discrimination: firm charges each customer their maximum willingness to pay

- “walks” down the market demand curve customer by customer

1st-Degree Price Discrimination II

Firm converts all consumer surplus into profit!

Produces the competitive amount (qc)(qc)!

1st-Degree Price Discrimination: Example

Big Data and Perfect Price Discrimination

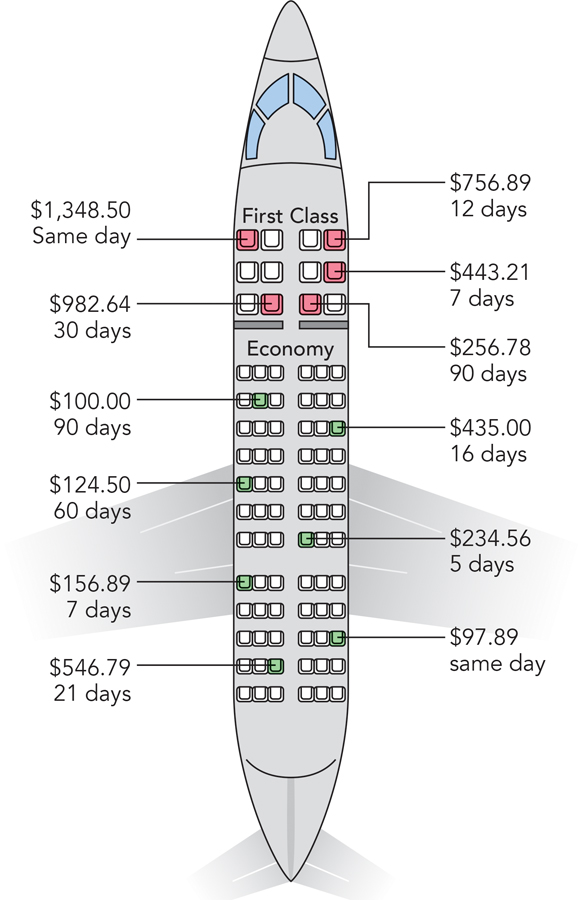

3rd-Degree Price Discrimination

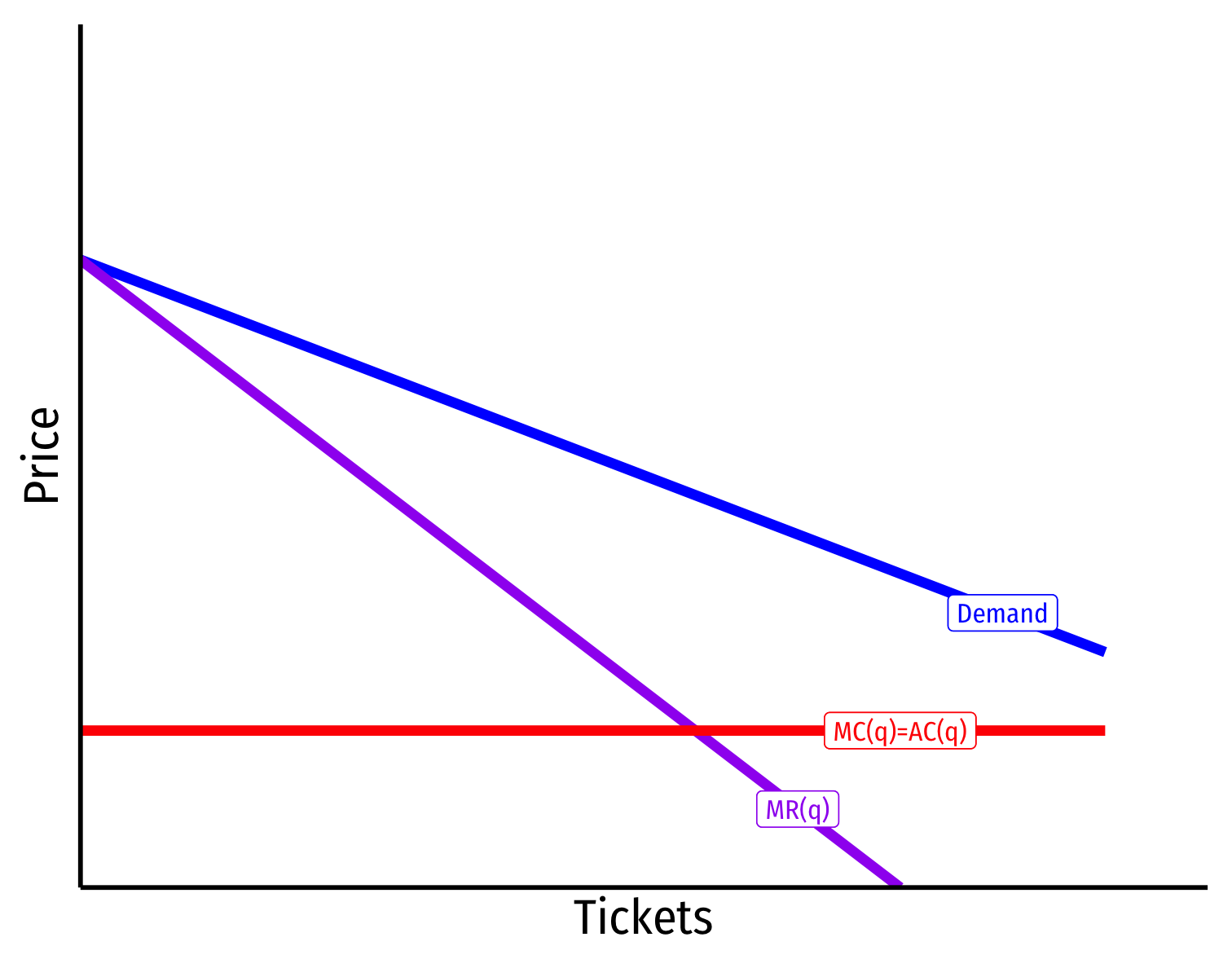

3rd-Degree Price Discrimination I

Firms almost never have perfect information about their customers

But they can often separate customers by observable characteristics into different groups with similar demands before purchasing

3rd-Degree Price Discrimination I

Firms segment the market or engage in 3rd-degree price discrimination by charging different prices to different groups of customers

By far the most common type of price-discrimination

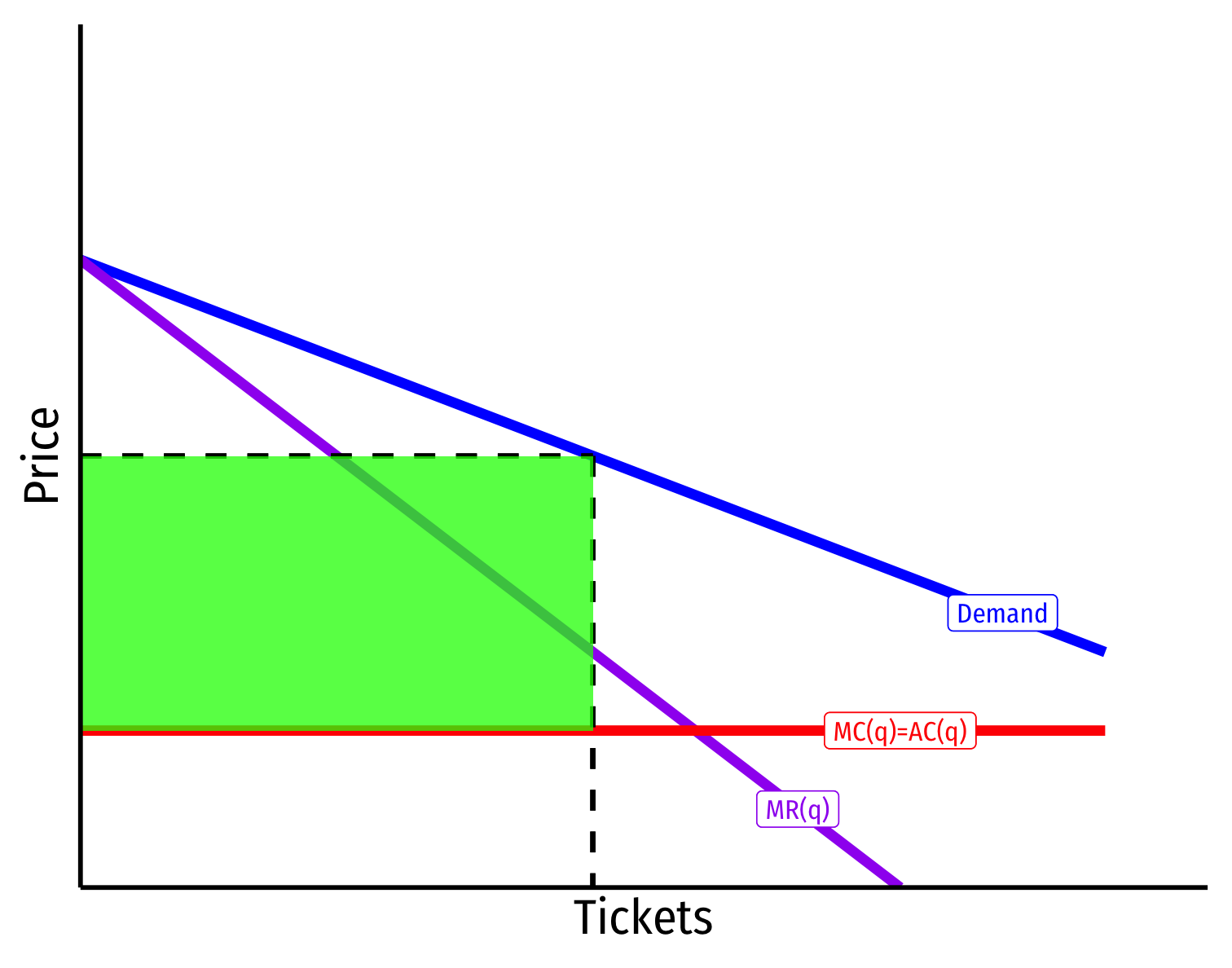

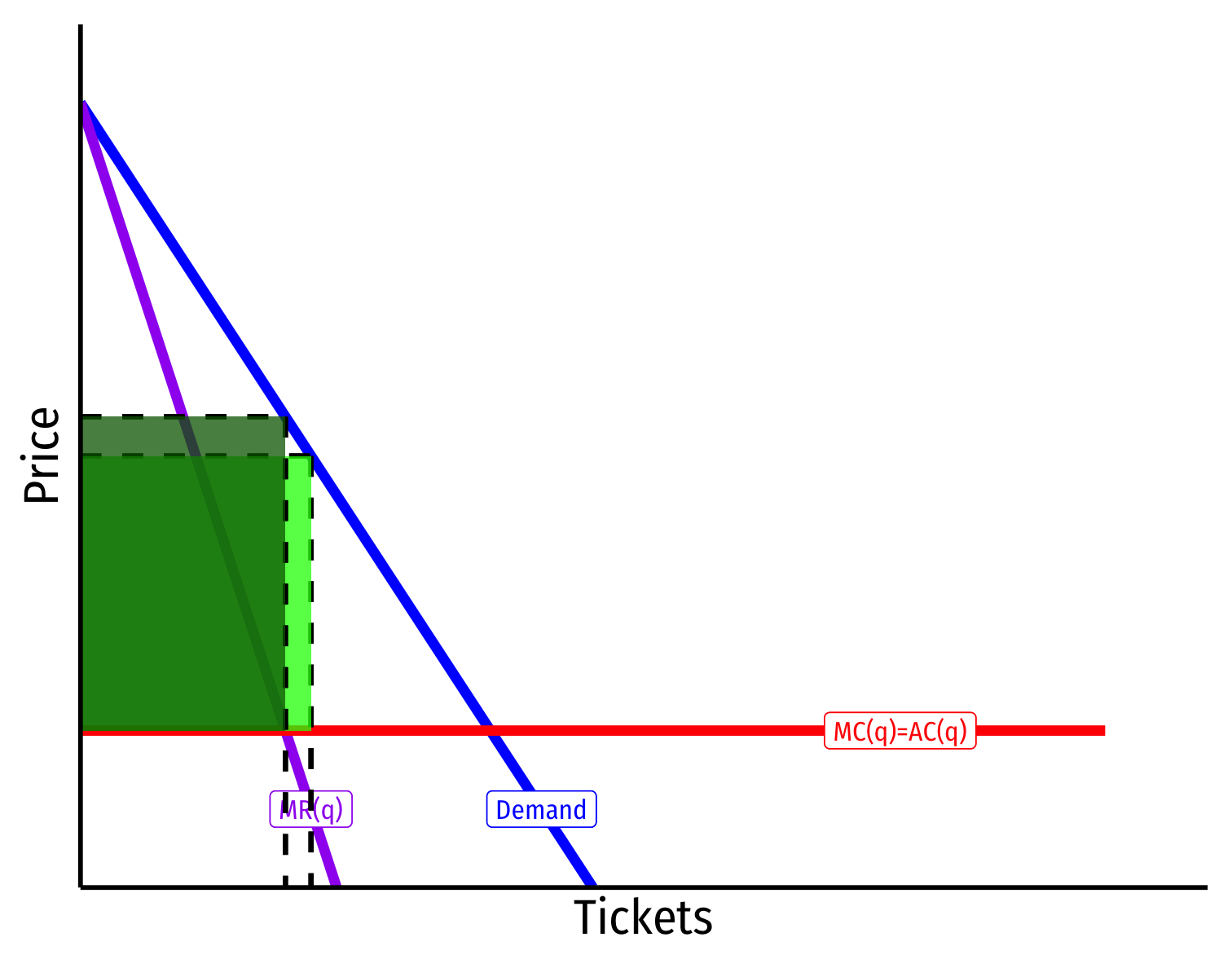

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

Consider airlines: different groups of travelers have different demands & price elasticities

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

The firm could charge a single price to all travelers and earn some profit

3rd-Degree Price Discrimination II

Business Travelers (Less Elastic)

Vacationers (More Elastic)

With different prices: raise price on inelastic travelers, lower price on elastic travelers, earn more profit!

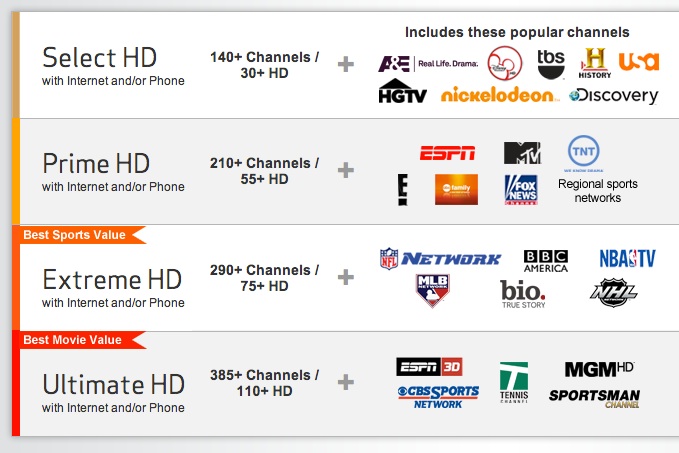

3rd-Degree Price Discrimination: Examples I

3rd-Degree Price Discrimination: Examples II

3rd-Degree Price Discrimination: Examples II

3rd-Degree Price Discrimination: Examples III

3rd-Degree Price Discrimination: Examples IV

3rd-Degree Price Discrimination: Examples IV

Sales

Price-inelastic buyers will buy something (a necessity?) now regardless of whether or not it is “on sale”

Price-elastic buyers will be attracted to buying something when price is lower

Stores lower prices on rare occasions to attract price-sensitive shoppers (will lose profits on price-insensitive shoppers who buy during the sale!)

- Black Friday: many price-insensitive shoppers stay away to avoid crowds! Better for the stores!

Coupons

Coupons also are designed to bring in more price-elastic shoppers

- Often lower income, very sensitive to price, worth the hassle of collecting & using coupons

Store sells at higher price (to capture profit from price-insensitive shoppers who can’t be bothered with coupons) and brings in profits from price-sensitive shoppers who use coupons to pay lower price

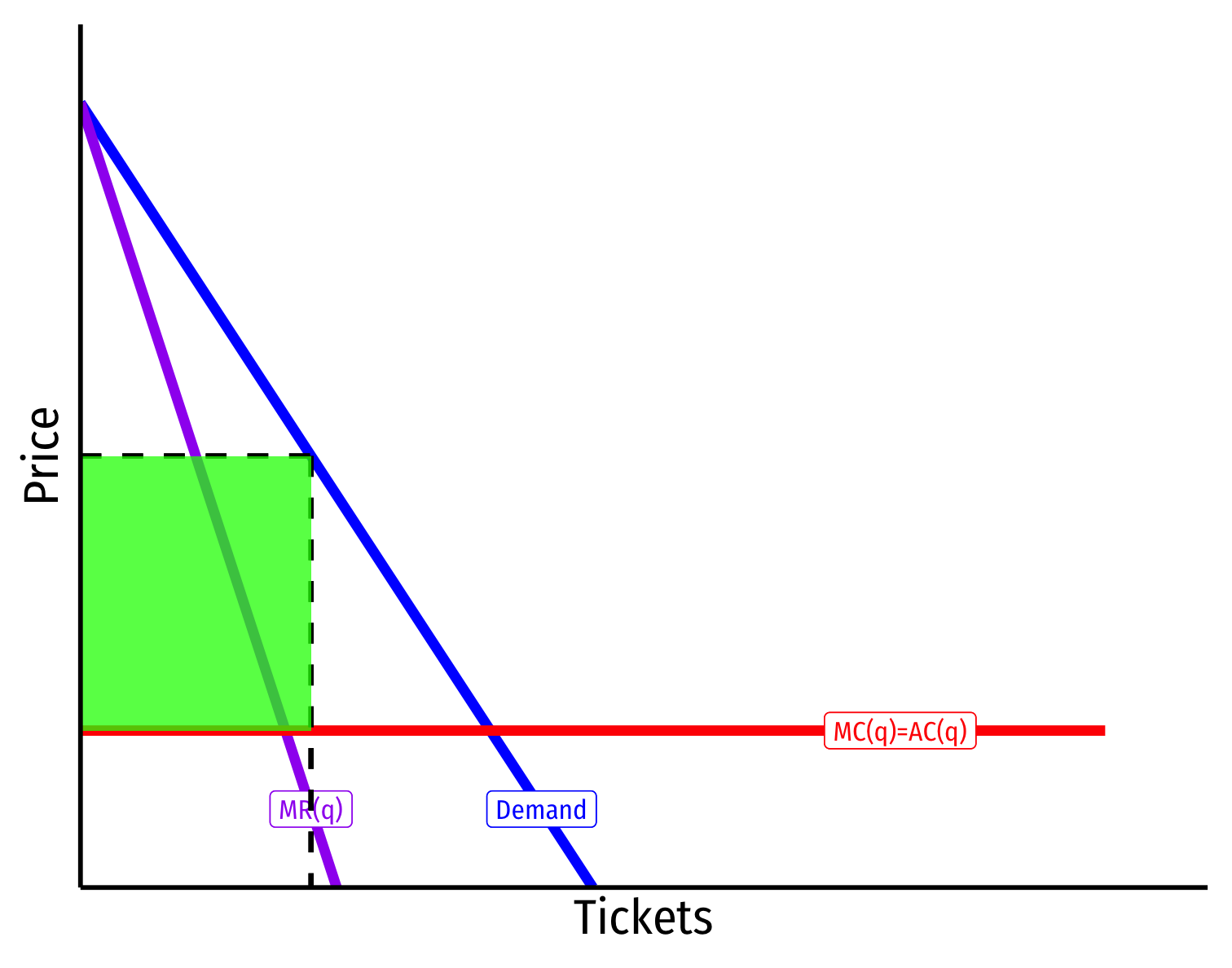

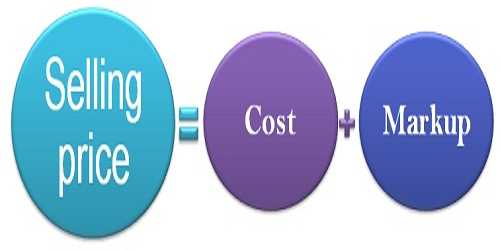

Pricing and Markup

How much should each segment be charged?

Firm treats each segment as a different market

- Find q*: MR(q)=MC(q)MR(q)=MC(q)

- Raise p* to maximum WTP (Demand)

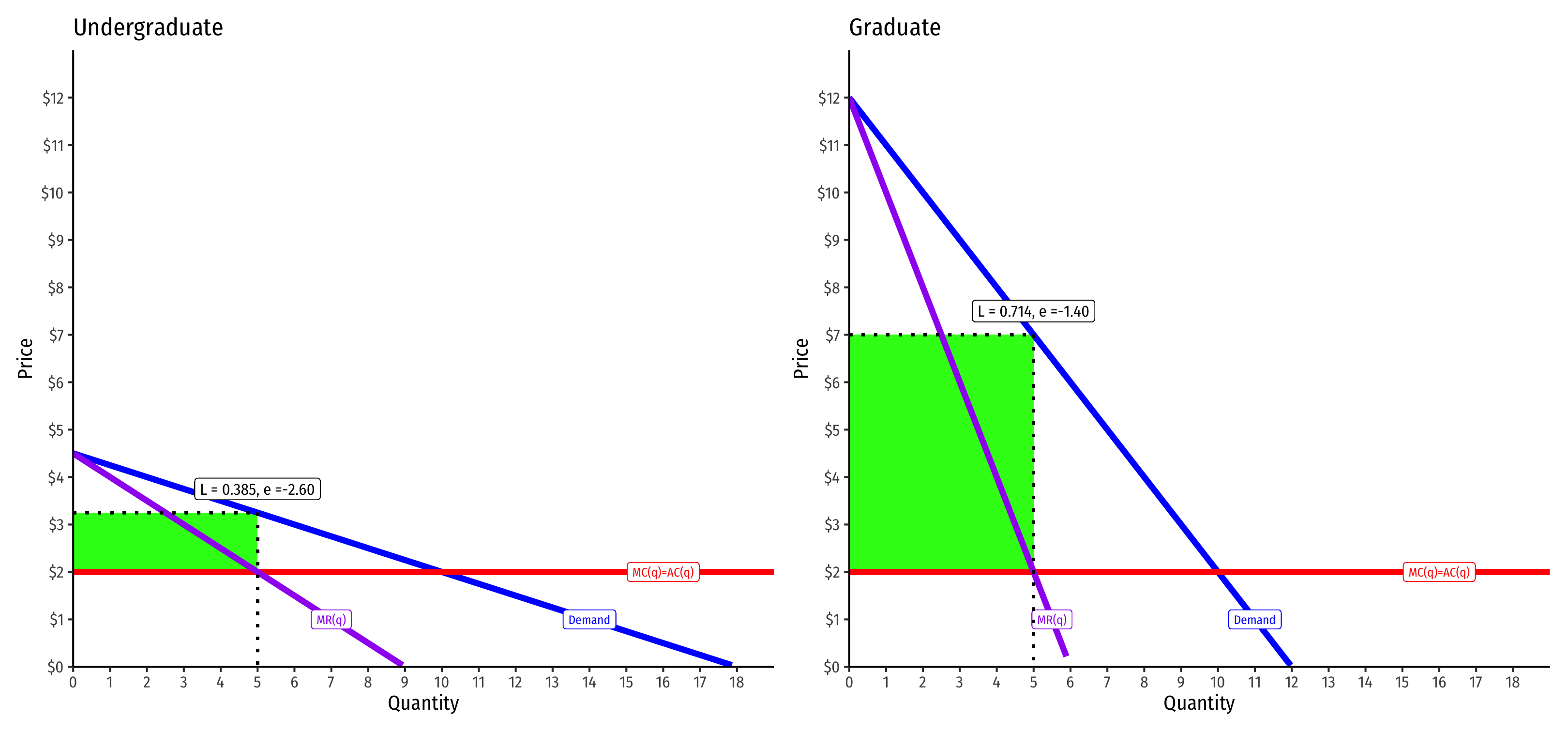

Lerner index implies optimal markup for each segment, again: p−MC(q)p⏟Markup % of Price=−1ϵ

3rd-Degree Price Discrimination: Numerical Example

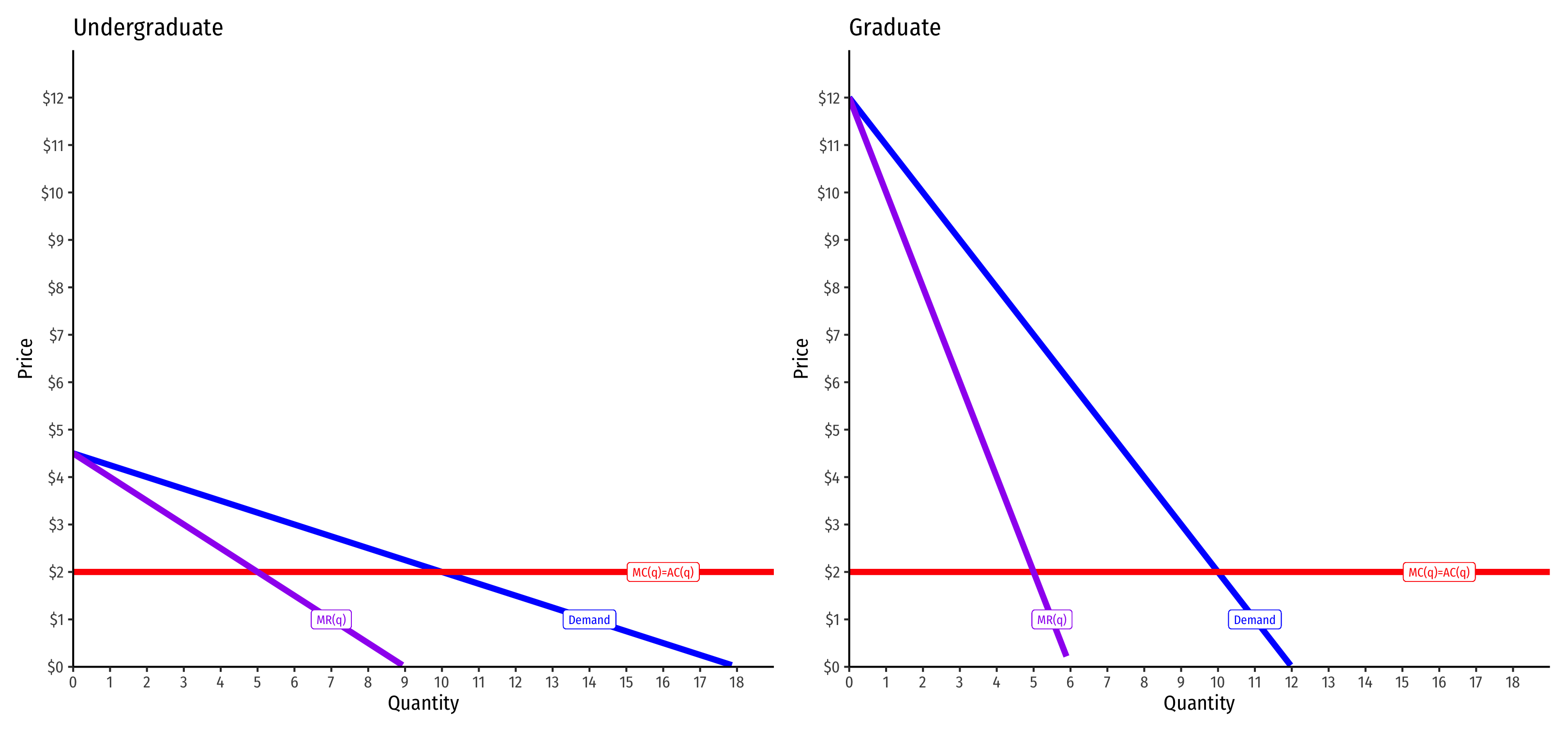

Example: Suppose you run a bar in downtown Frederick, and estimate the nightly demands for beer from undergraduates (U) and graduates (G) to be:

qU=18−4pUqG=12−pG

Assume the only cost of producing a beer is a constant marginal (and average) cost of $2.

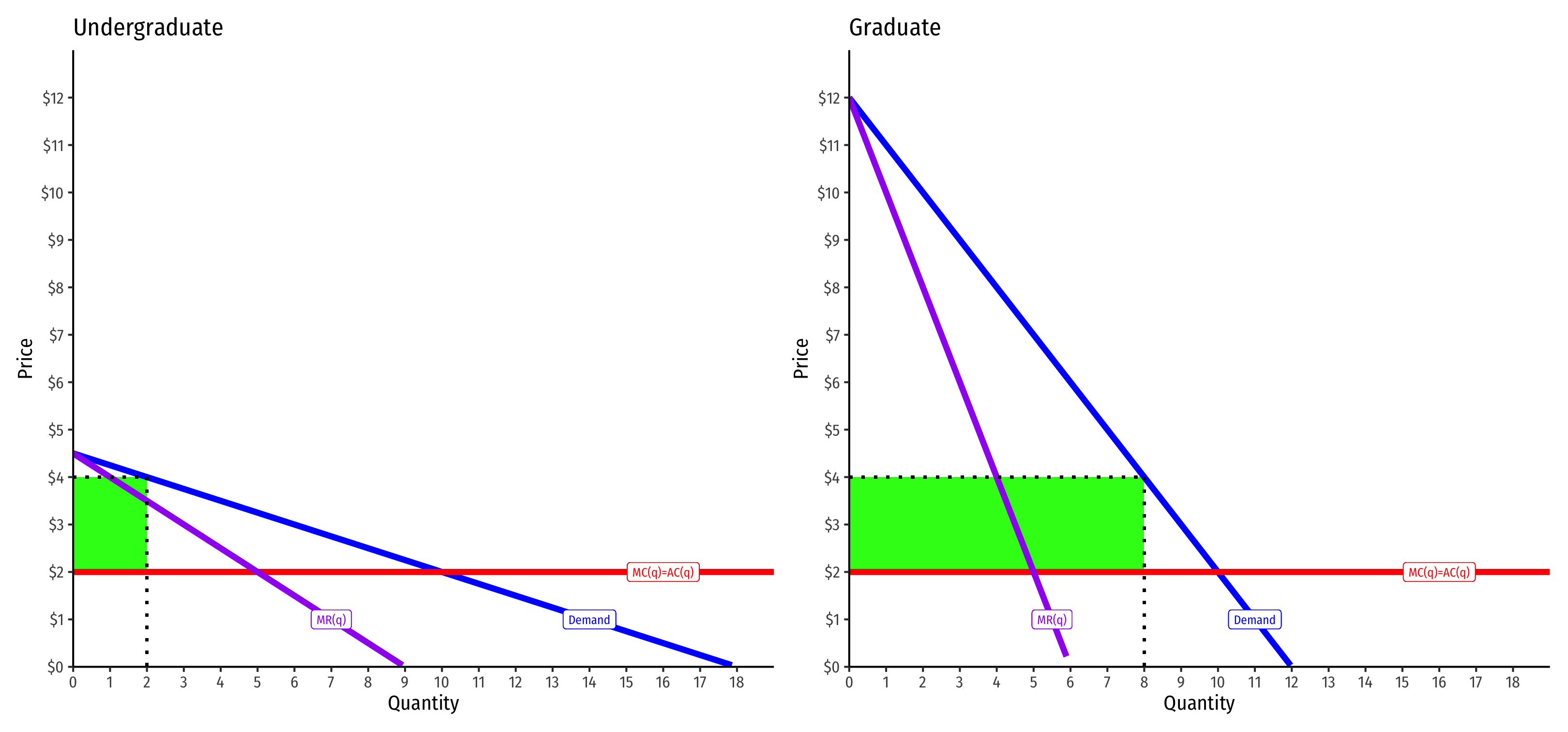

If your bar had to charge a uniform price for beer, how much profit would the bar earn?

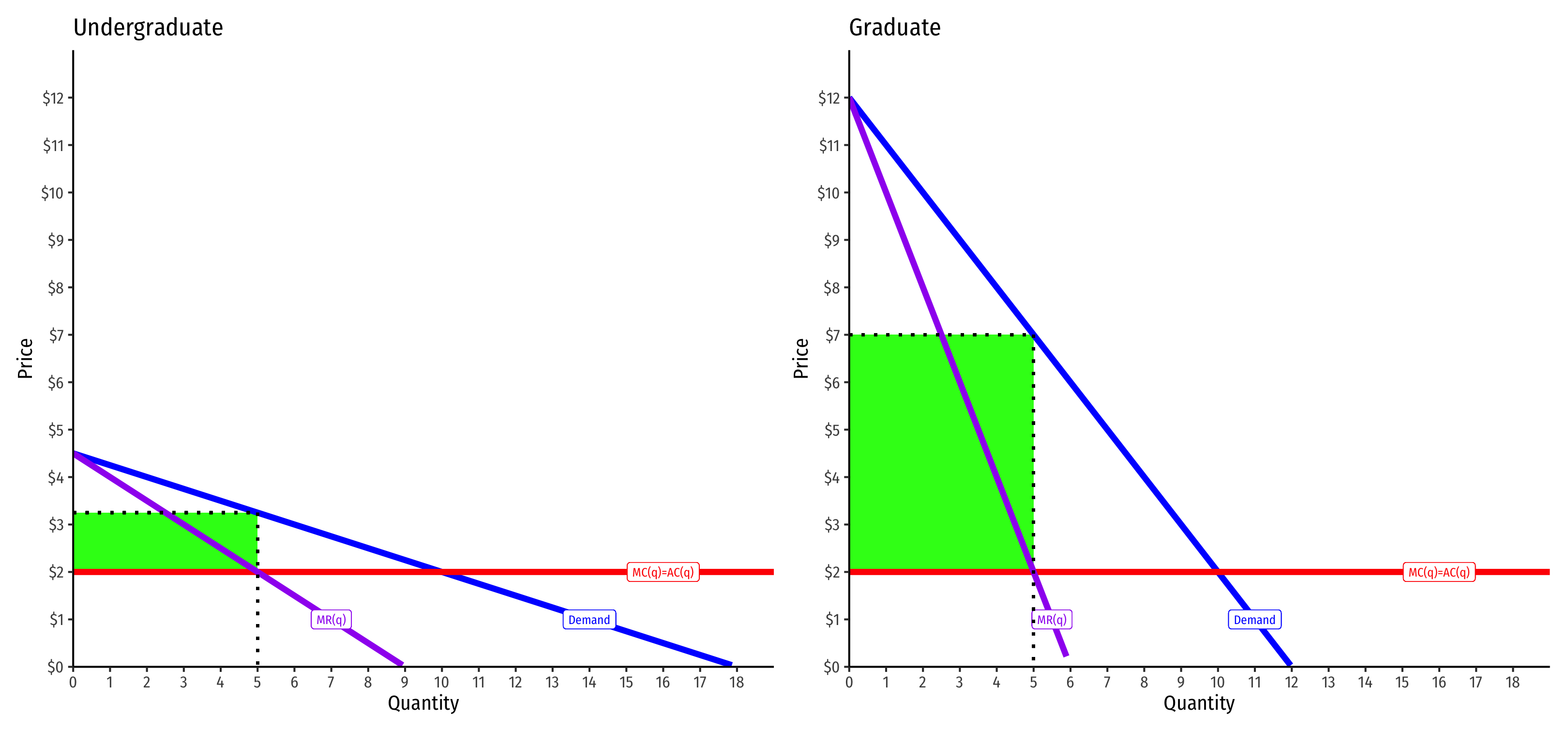

If you could price discriminate, how much profit would the bar earn?

3rd-Degree Price Discrimination: Numerical Example

3rd-Degree Price Discrimination: Numerical Example

- Charging a single price: $4, total profit of $20

3rd-Degree Price Discrimination: Numerical Example

- Charging $3.25 to Undergrads; $7.00 to grads; total profit of $31.25

3rd-Degree Price Discrimination: Numerical Example

- Charging $3.25 to Undergrads; $7.00 to grads; total profit of $31.25

Ways to Segment Markets

By customer characteristics

- Age

- Gender

Past purchase behavior

- repeat customers (more price sensitive)

By location

- local demand characteristics

Is Price Discrimination Good or Bad?

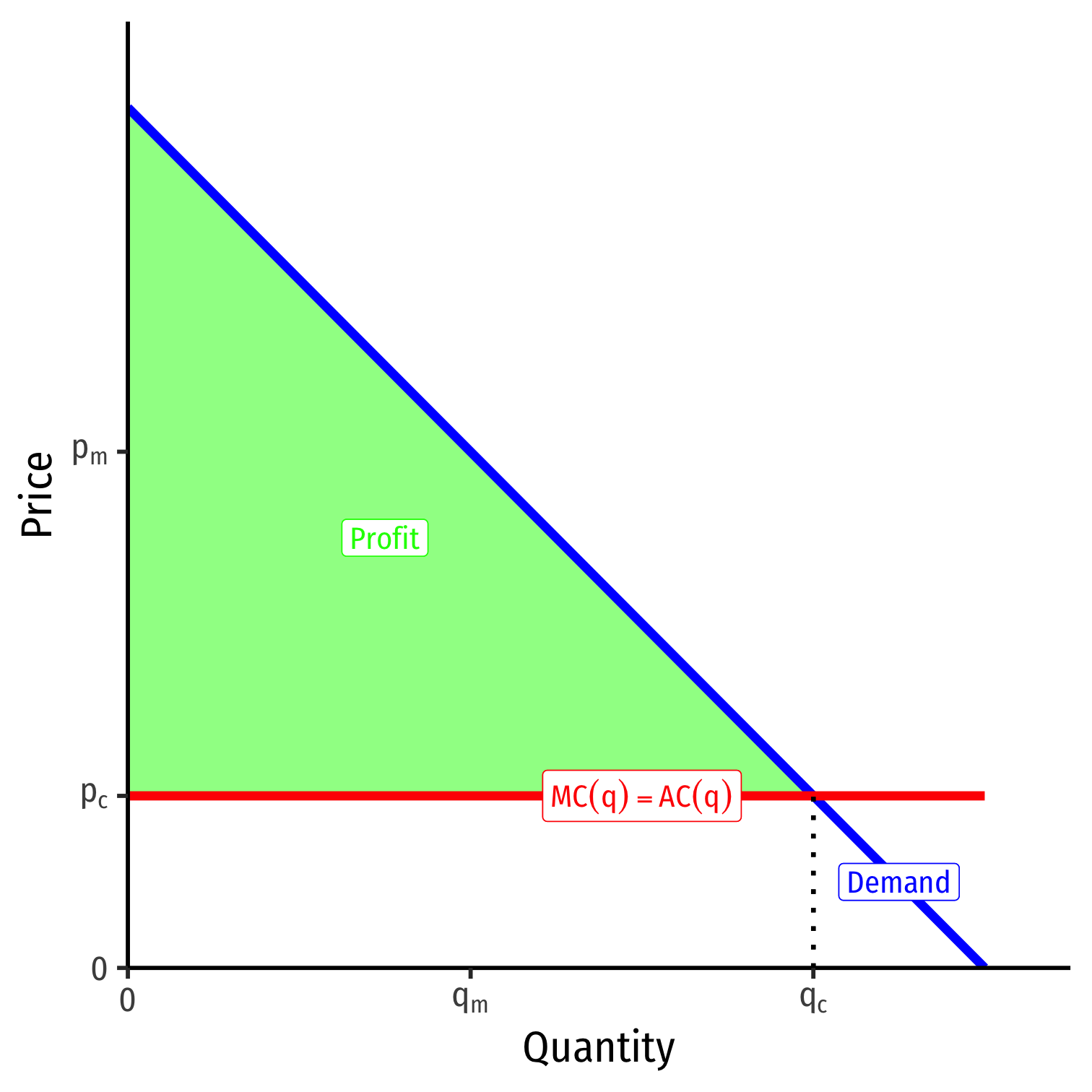

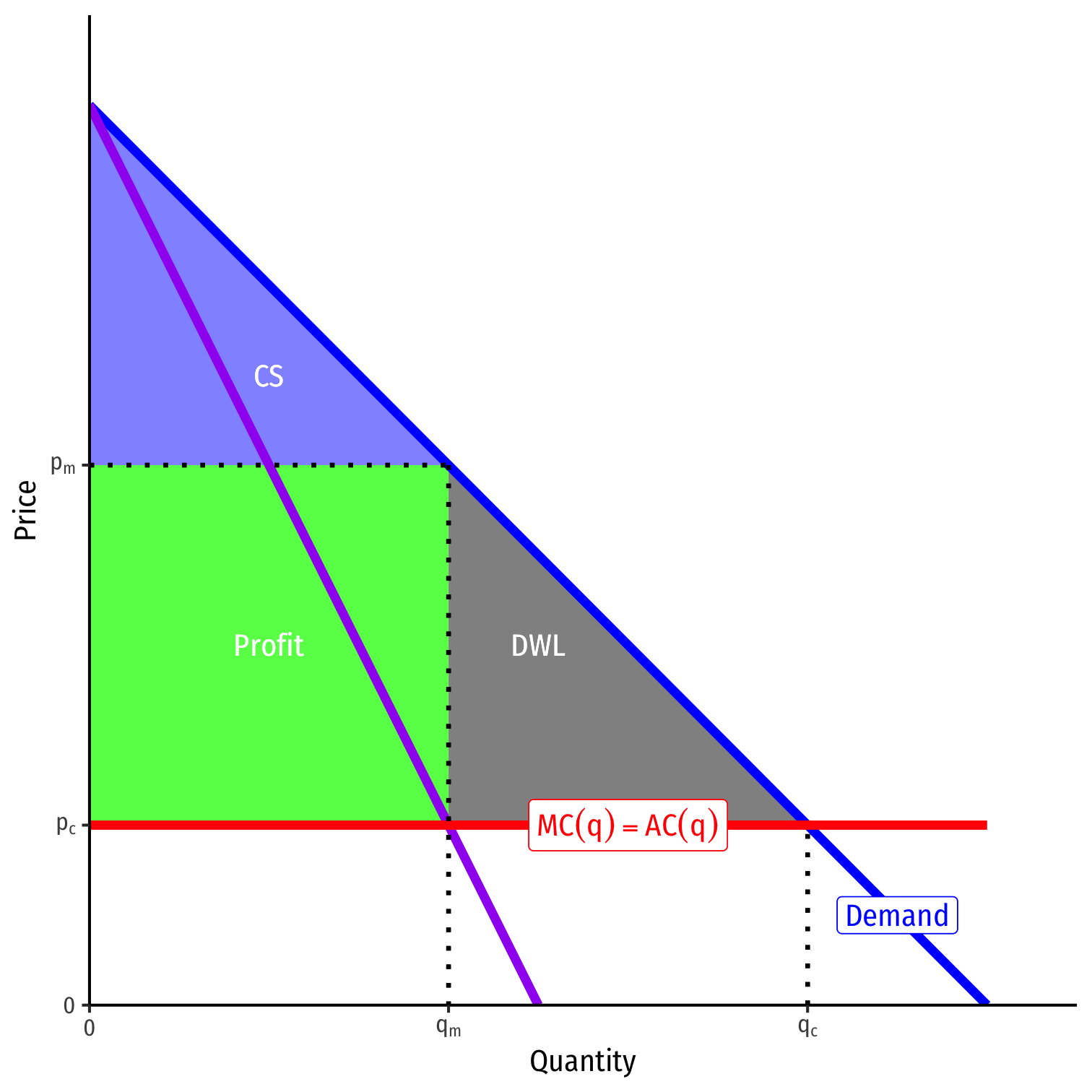

Is Price Discrimination Good or Bad? I

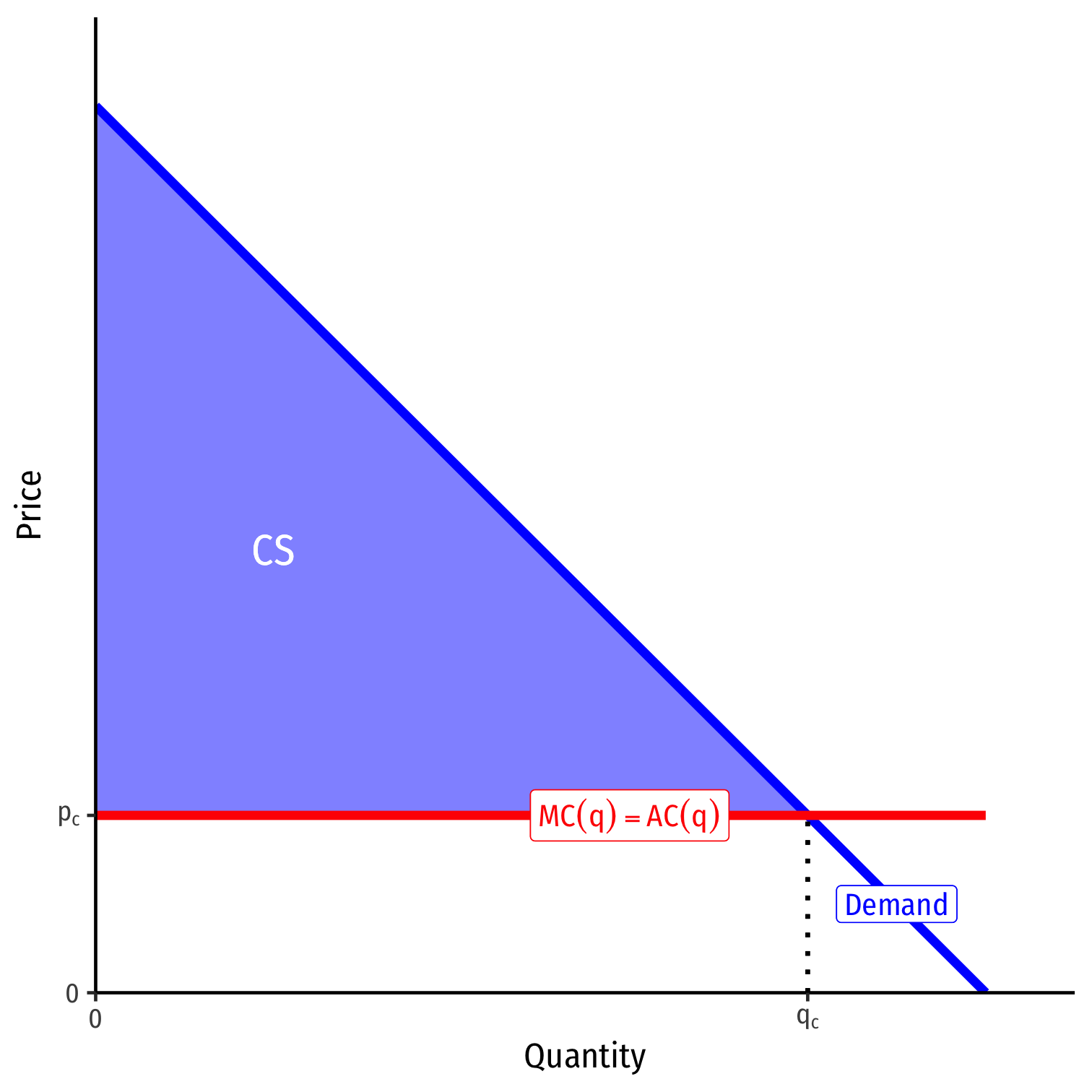

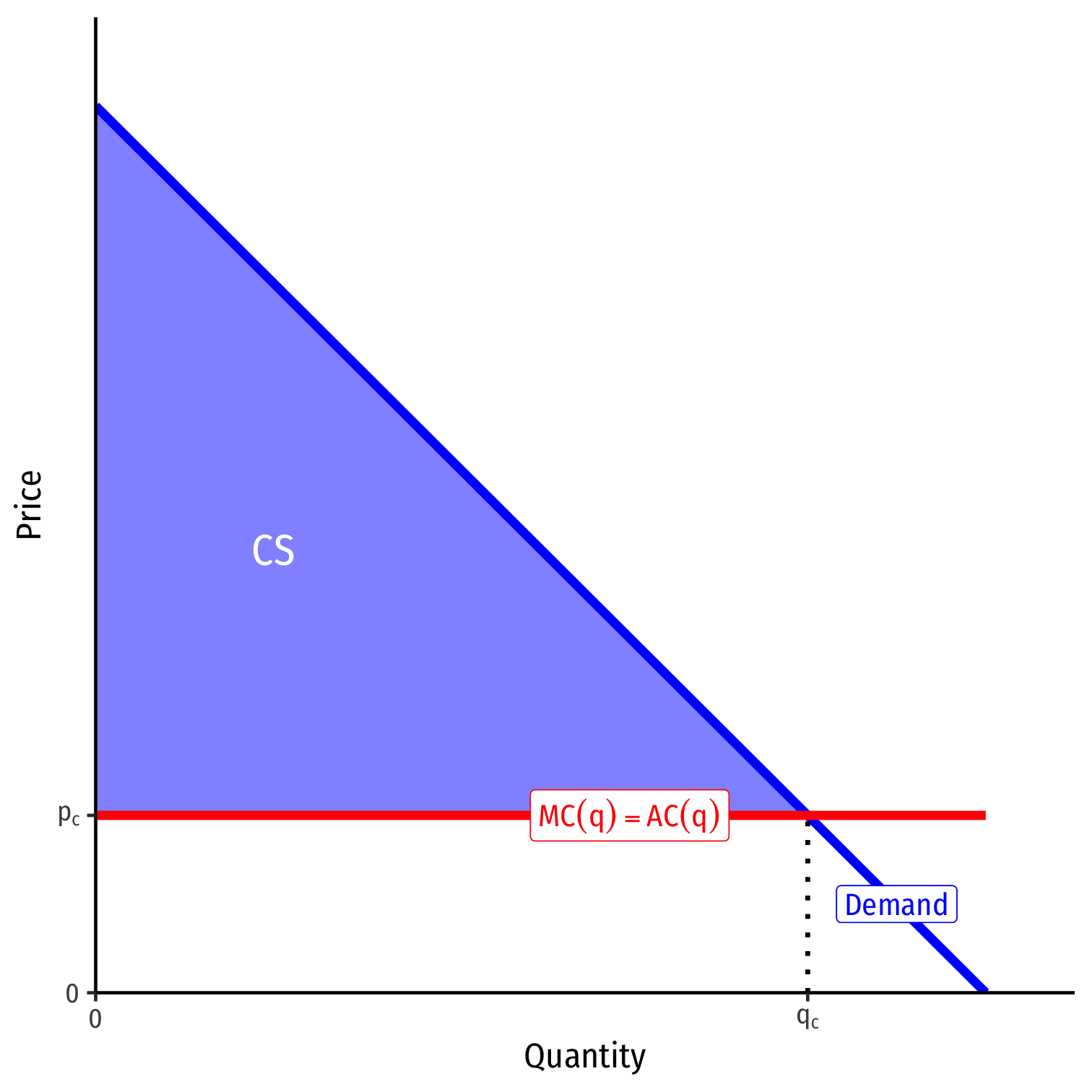

- Ideal competitive market, q∗ where pc=MC

Is Price Discrimination Good or Bad? I

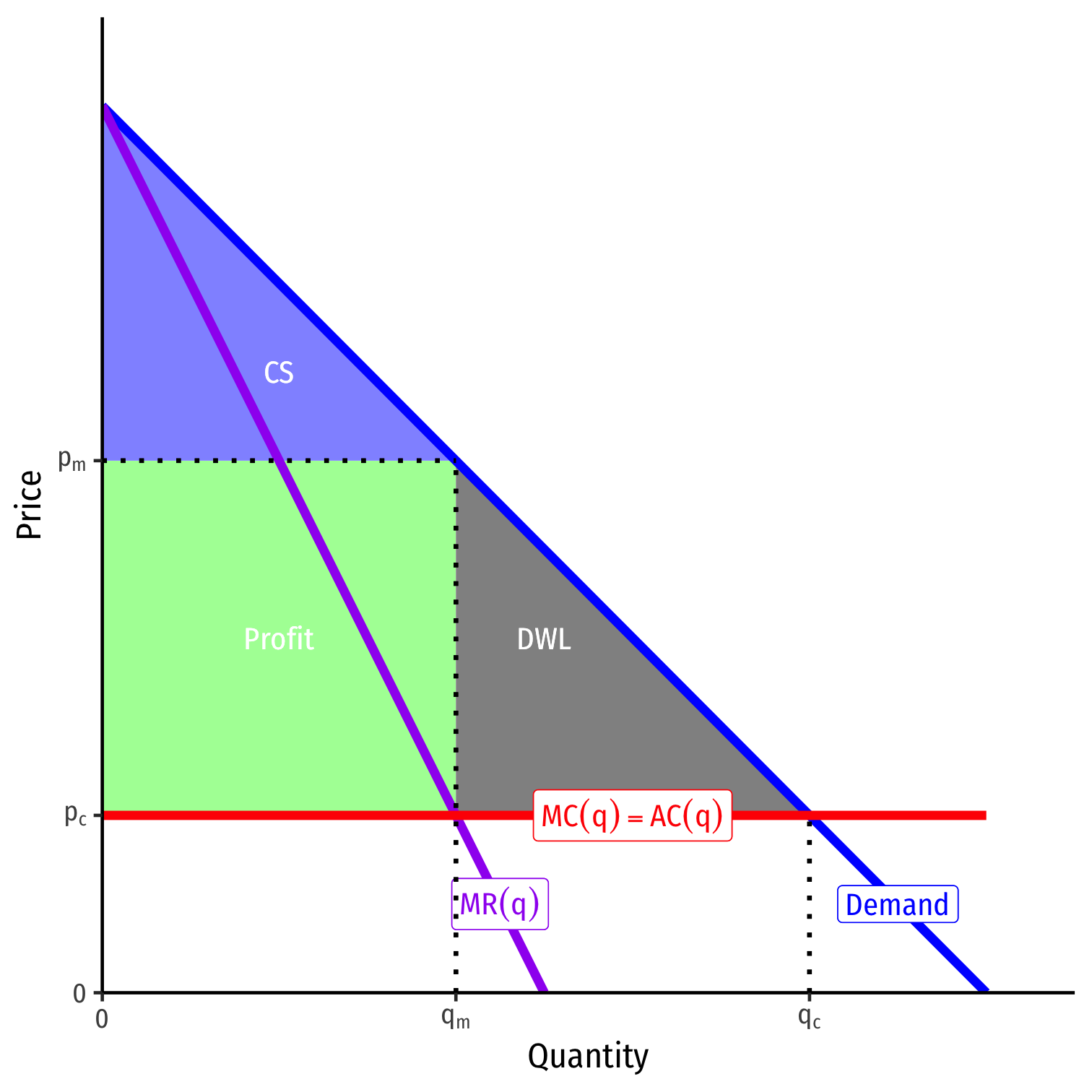

Ideal competitive market, qc where pc=MC

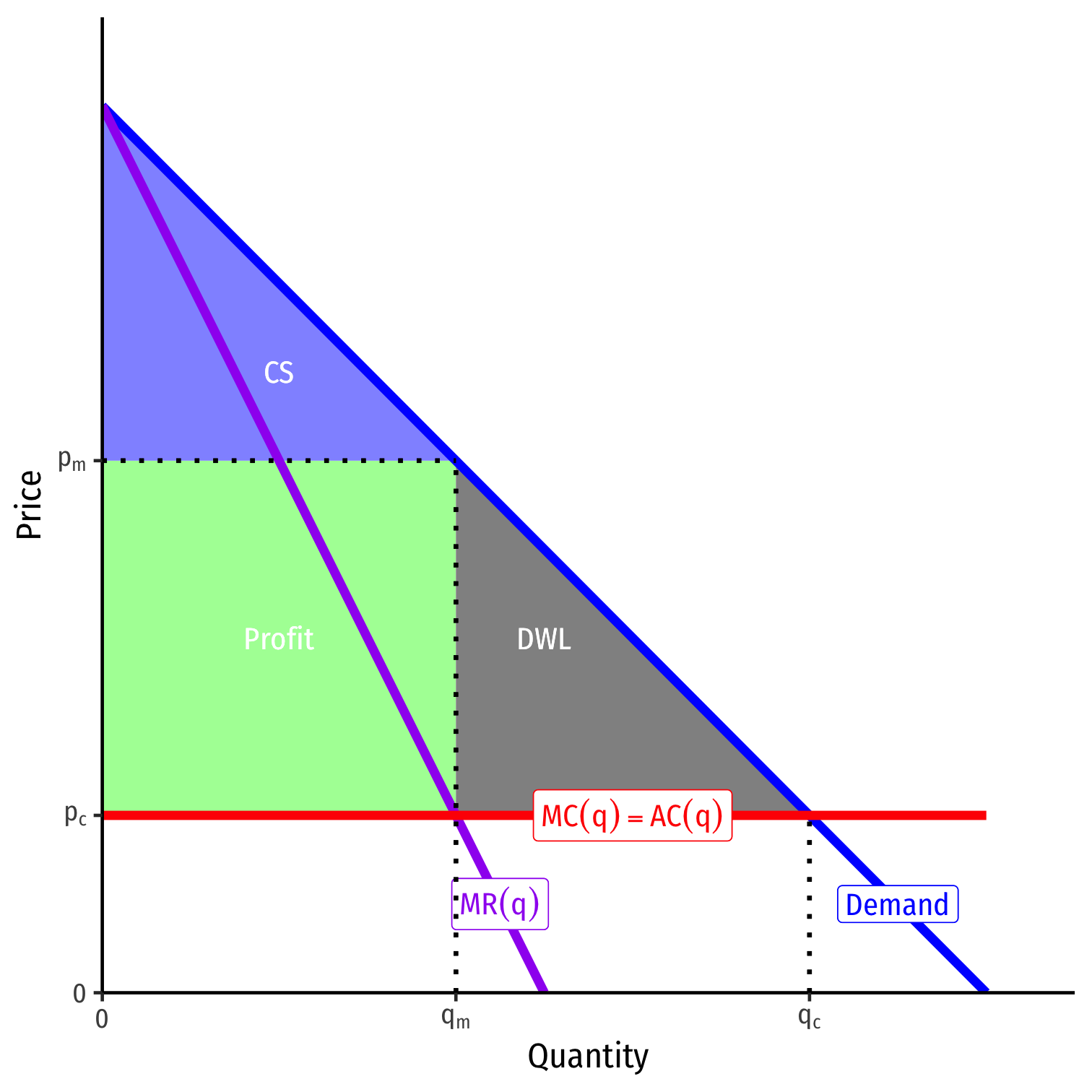

A pure monopolist would produce less qm at higher pm

- reduce consumer surplus and create deadweight loss

Transfer of some surplus from consumers to producers

Is Price Discrimination Good or Bad? I

A price-discriminating monopolist transfers MORE surplus from consumers to producers

But encourages monopolist to produce more than the pure monopoly level and reduce deadweight loss!

- At best, also produces at competitive output level!

Is Price Discrimination Good or Bad? II

Price-discrimination creates incentives for innovation and risk-taking

Firms with high fixed costs of investment earn greater profits with price discrimination, can recover their fixed costs

Might not invest or produce if they had to charge a uniform price

Is Price Discrimination Good or Bad? III

As with markups in general, price discrimination has everything to do with price elasticity of demand

If you are paying too much and losing consumer surplus, the real “problem” is that your demand is not very elastic

- fewer options, a particular brand, or a necessity, limited time, etc

If you want to pay less, buy generic (more elastic)

How to Be a Savvy Consumer

Realize that any “sales” and “discounts” are calculated to make the store more money

You can also be better off as a consumer too

Think about your consumer surplus!

If you were already planning to buy the product, a fall in price is a good deal for you

- Your demand is less elastic

If you weren’t going to buy the product before, and now you do, the sale was effective for the store, and you likely don’t get much surplus

- Your demand is more elastic

Behavioral Economics

Price Discrimination vs. Price Differences

Price discrimination is selling identical goods to people at different prices

But not everytime people pay different prices means it is price discrimination

Sometimes it is truly different goods that people are paying different prices for

- If costs to firm are different for different versions (color, size, etc.), it is a different good, not price discrimination

Price Discrimination vs. Price Differences

Example: bottled sparkling water often higher price than Coca Cola

Could be because sparkling water drinkers have less elastic demand than Coke drinkers

Or could be that it is more expensive to package sparkling water (economies of scale with greater number of Coke drinkers)

Price Discrimination vs. Price Differences

The best way to tell the difference is to see what happens if demand changes price elasticity (and costs do not change)

- Price discrimination requires market power, firm with market power marks up price based on 1ϵ

- Competitive firm only sets p=MC, so change in elasticity has no effect on price

See today’s class notes for a graphical demonstration

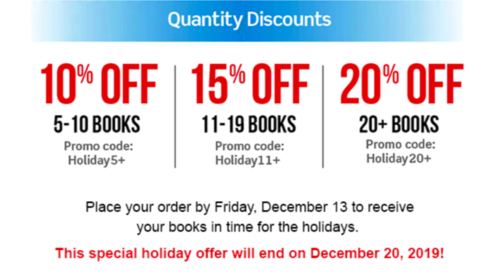

2nd-Degree Price Discrimination

2nd-Degree Price Discrimination I

If firm cannot identify customers' demands or types before purchase

Indirect or 2nd-degree price discrimination: firm offers difference price-quantity bundles and allows customers self-select (based on preferences)

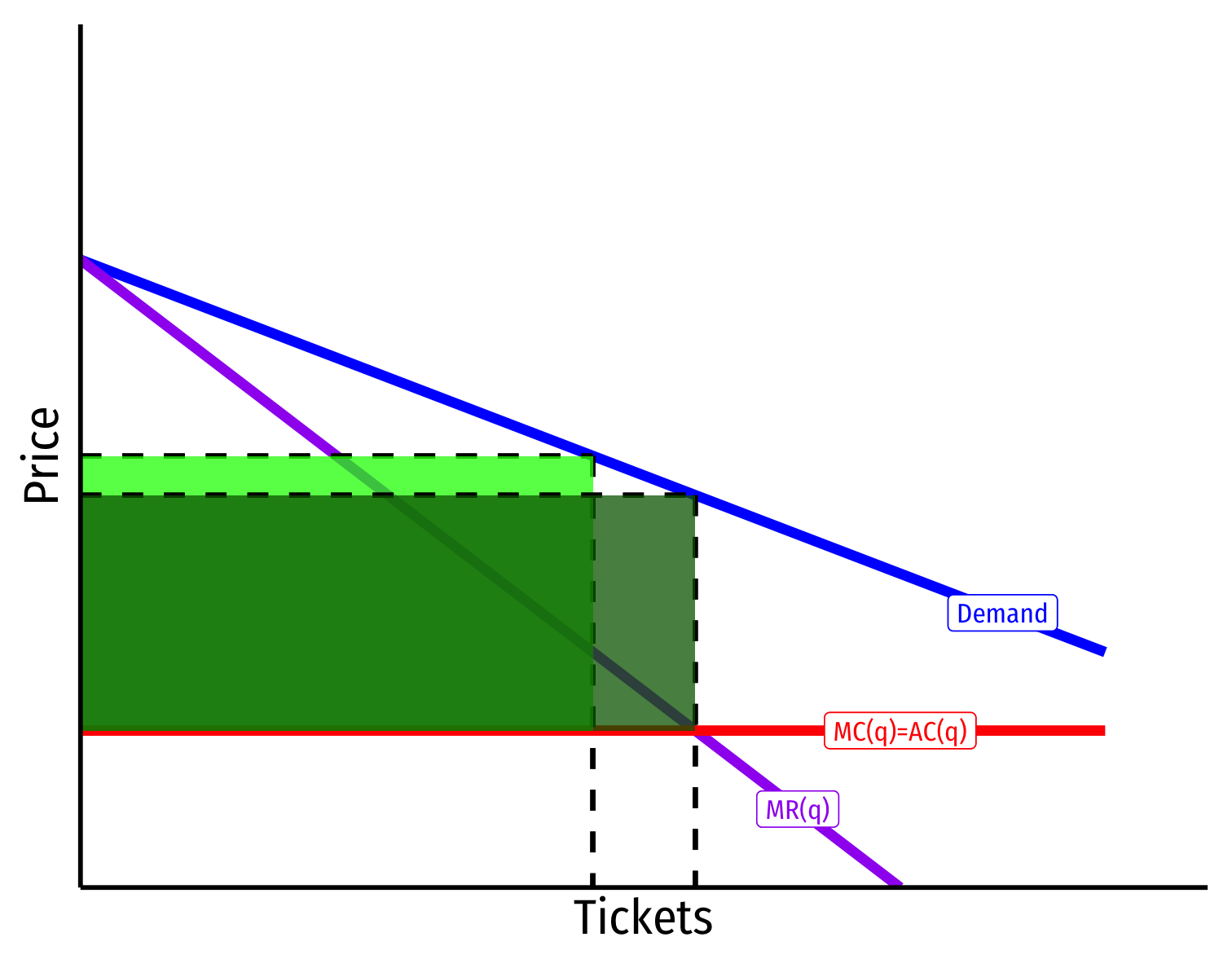

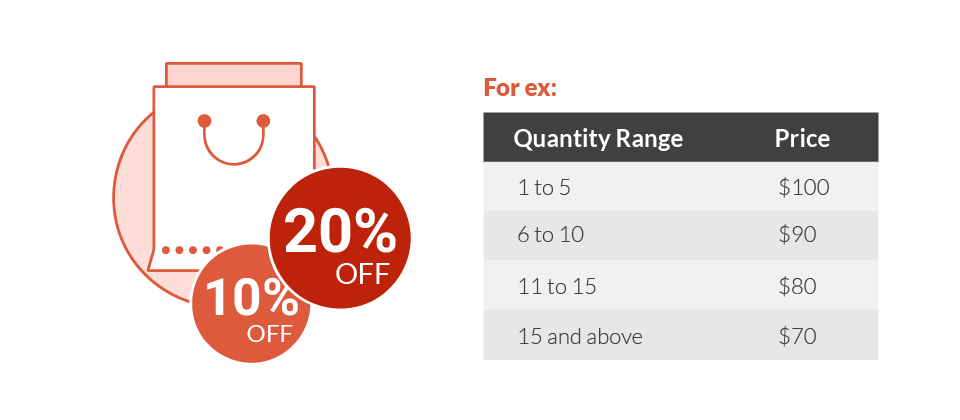

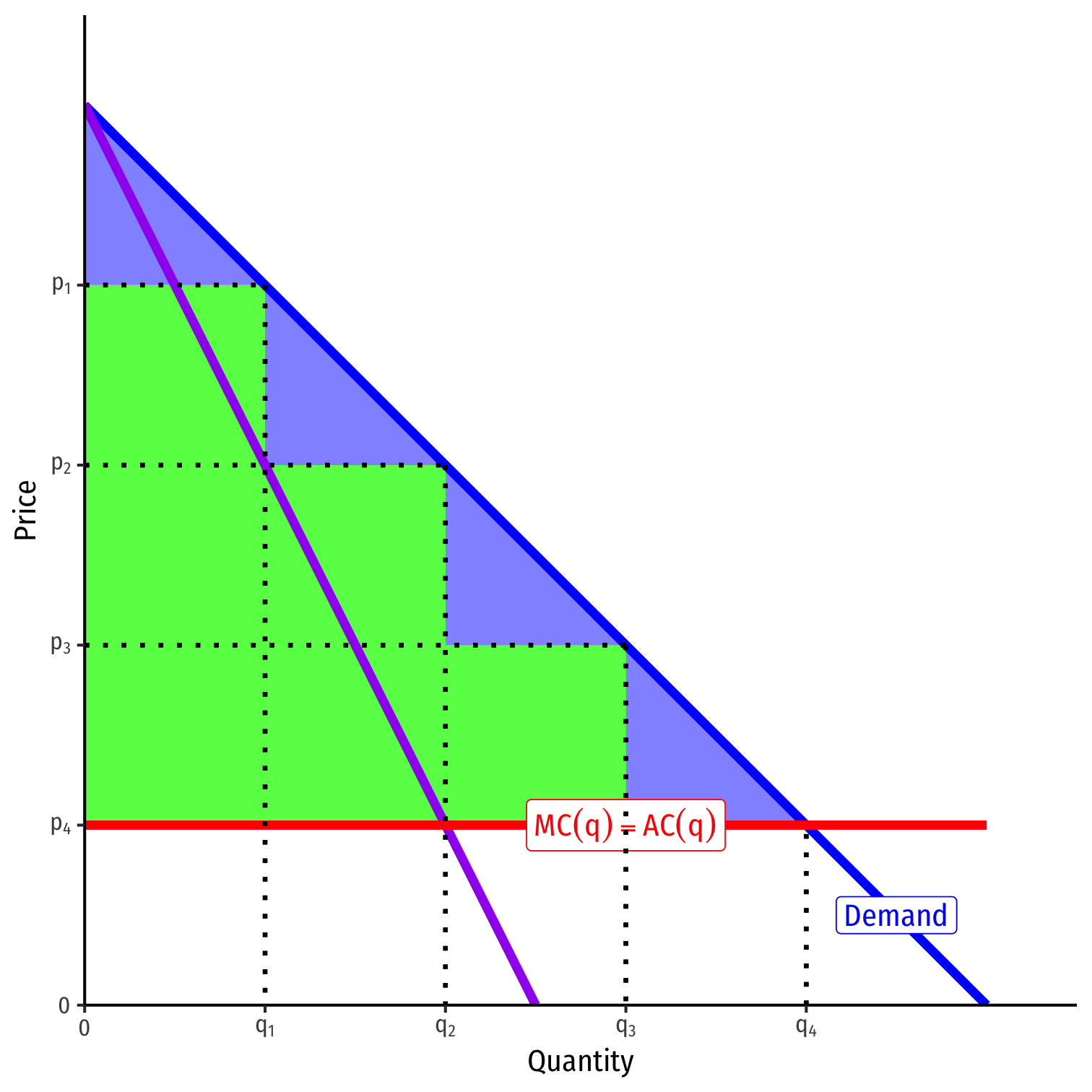

2nd-Degree Price Discrimination: Block Pricing

Block Pricing/Nonlinear pricing: offer different prices for different quantities that consumers can choose

quantity discounting: higher quantities offered at lower prices

2nd-Degree Price Discrimination: Block Pricing

- Example: instead of one profit-maximizing monopoly price of pm for qm units, offer:

2nd-Degree Price Discrimination: Block Pricing

Example: instead of one profit-maximizing monopoly price of pm for qm units, offer:

- p1/unit for q1 units

- p2/unit for q2 units

- p3/unit for q3 units

- p4/unit for q4 units

Converts DWL into CS and captures more of it as Profit

2nd-Degree Price Discrimination: Versioning

Versioning: offer different prices for different qualities of a good (instead of quantity)

- Higher (lower) prices offered for higher (lower) quality/more (fewer) features

Must make versions incentive-compatible so that each type of consumer chooses version that matches their preferences

- key: add/remove quality/features across versions to make those that have higher WTP buy more expensive version rather than cheaper version (and vice versa)

2nd-Degree Price Discrimination: Versioning

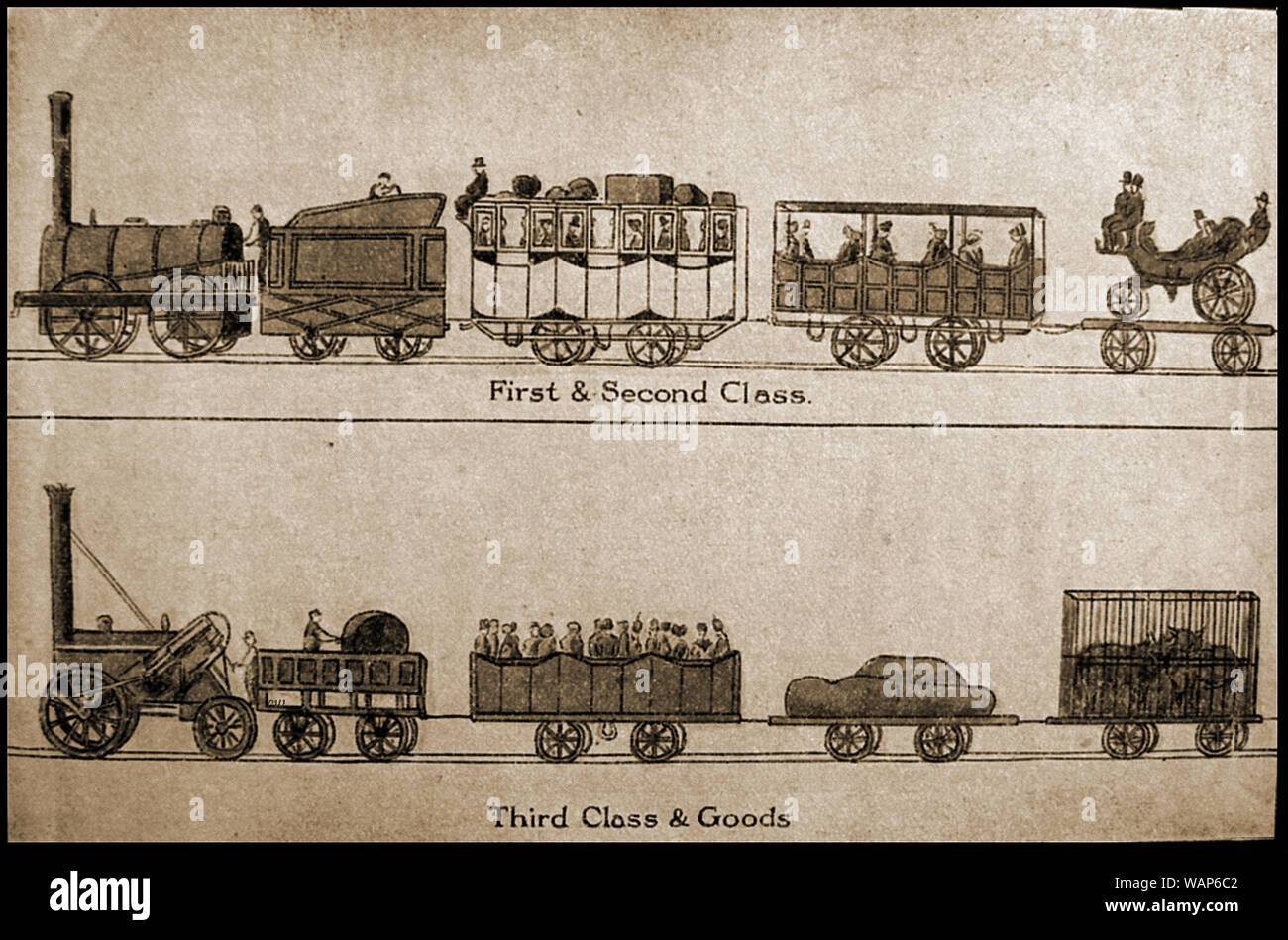

2nd-Degree Price Discrimination: Versioning

“It is not because of the few thousand francs which would have to be spent to put a roof over the third-class carriage or to upholster the third-class seats that some company or other has open carriages with wooden benches ... What the company is trying to do is prevent the passengers who can pay the second-class fare from traveling third class; it hits the poor, not because it wants to hurt them, but to frighten the rich ... And it is again for the same reason that the companies, having proved almost cruel to the third-class passengers and mean to the second-class ones, become lavish in dealing with first-class customers. Having refused the poor what is necessary, they give the rich what is superfluous.” — Jules Dupuit

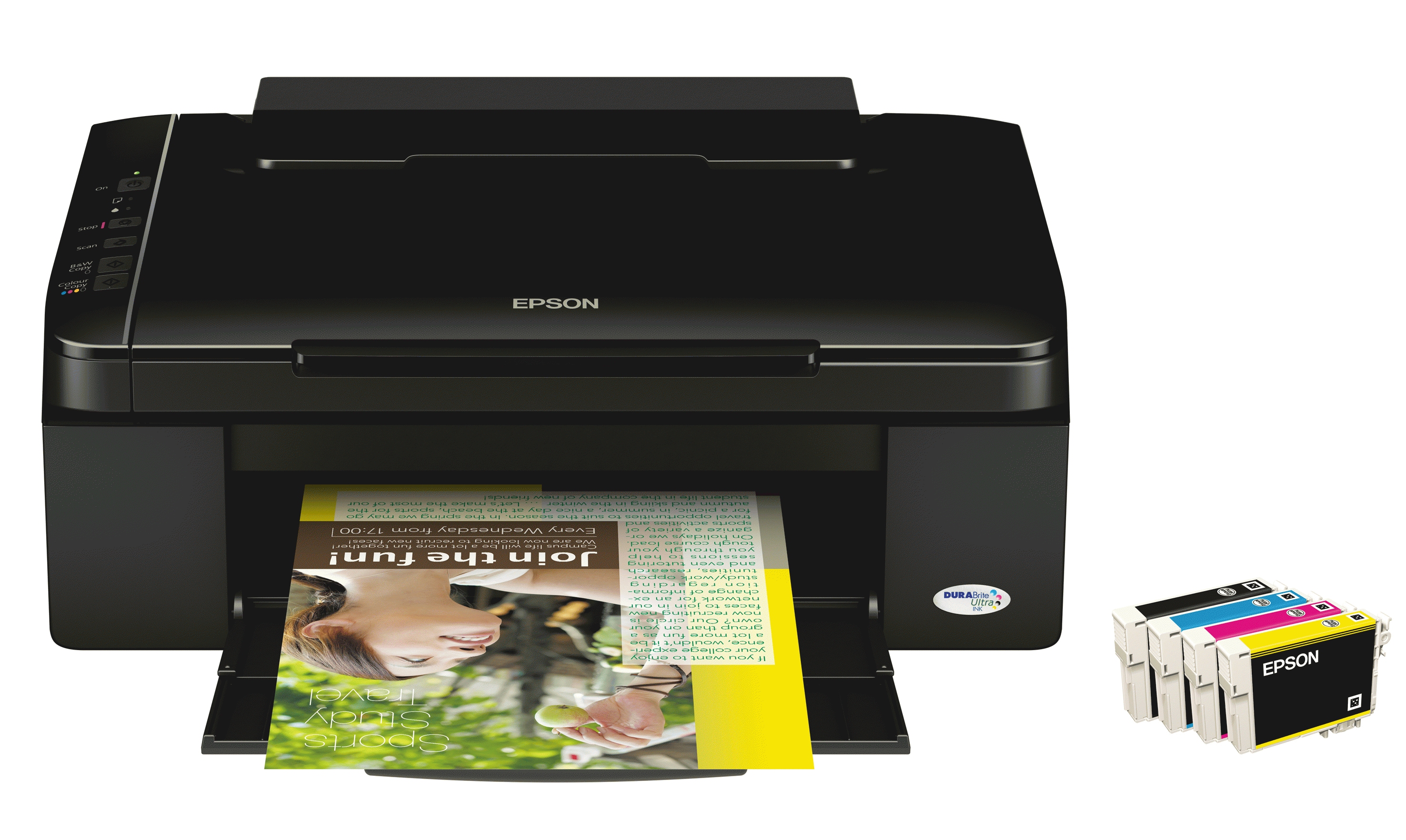

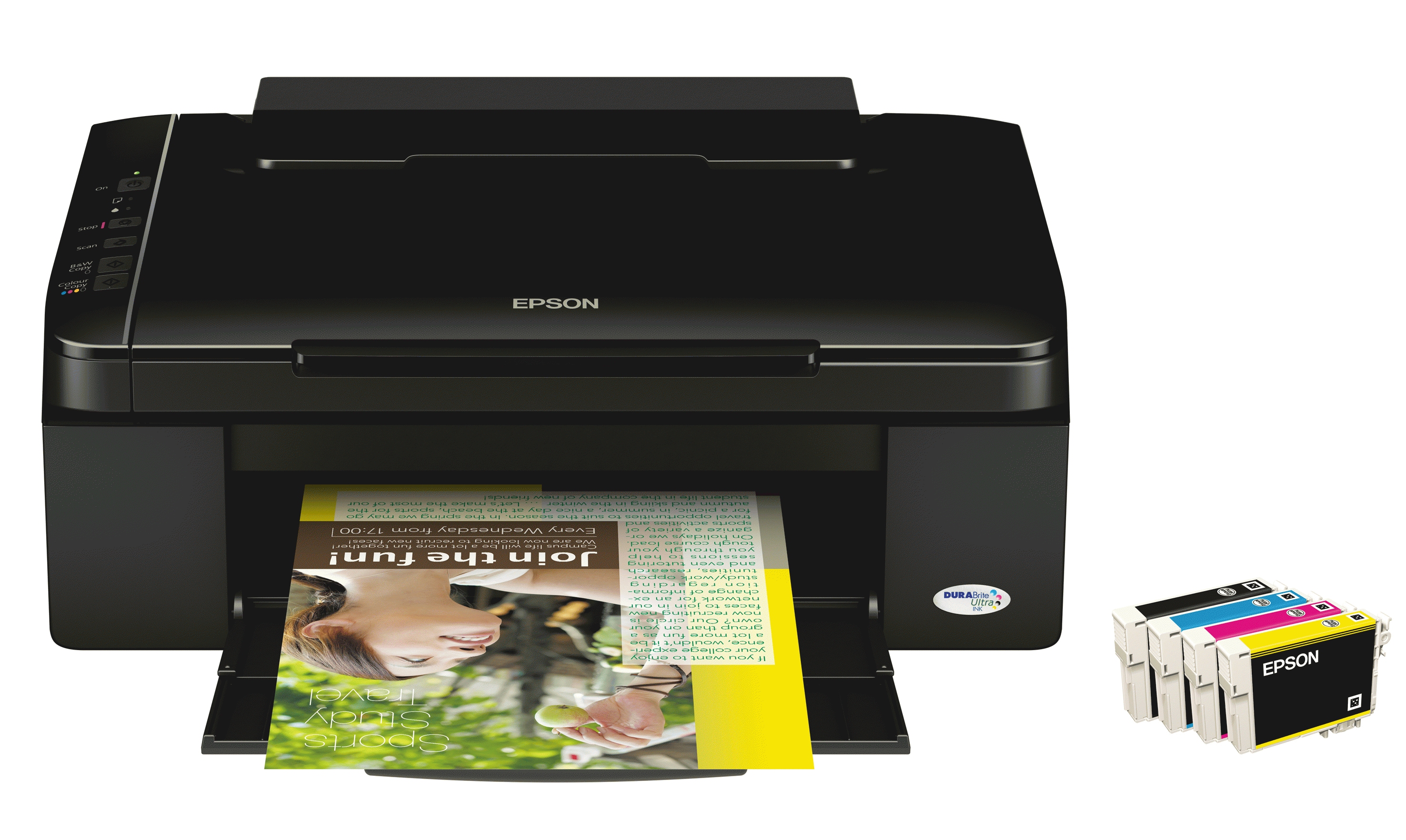

Tying I

Firms often tie multiple goods together, where you must buy both goods in order to consume the product

- One good often the “base” and the other are “refills” that you may need to buy more of

This is actually a method of intertemporal price-discrimination!

Tying II

Companies often sell printers at marginal cost (no markup) and sell the ink/refills at a much higher markup

Reduce arbitrage:

- printer requires specific ink

- ink only words with that specific printer

Tying II

- Segment the market into:

High-volume users: buy more ink over time; pay more per sheet printed

Low-volume users: buy less ink; pay less per sheet printed

- Indirect price-discrimination: firms don't know what kind of user you are in advance

Tying: Good or Bad?

Again, a tradeoff:

Increased profits and reduced consumer surplus, reduced deadweight loss

Spreads fixed cost of research & development over more users

Tying: Good or Bad?

If printers & ink were not tied:

- printers would be more expensive

- ink would be cheaper

High-volume users would keep buying ink and save money (vs. tied)

Low-volume users might not buy the (now expensive) printer at all!

Bundling I

Firms often bundle products together as a single package, and refuse to offer individual parts of the package

Often, consumers do not want all products in the bundle

Or, if they were able to buy just part of the bundle, they would not buy the other parts

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

- Microsoft could charge separate prices for MS Word and MS Excel

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Total revenues of individual sales: $180

Bundling II

Example: Consider two consumers, each have different reservation prices to buy components in Microsoft Office bundle

| Amy's WTP | Ben's WTP | |

|---|---|---|

| MS Word | $70 | $40 |

| MS Excel | $50 | $60 |

| Bundle | $120 | $100 |

Microsoft could charge separate prices for MS Word and MS Excel

MS Word: both would buy at $40, generating $80 of revenues

MS Excel: both would buy at $50, generating $100 of revenues

Total revenues of individual sales: $180

Microsoft can instead add their individual reservation prices and bundle products together to force both consumers to buy both products

Bundle: both buy at $100, generating $200 revenue

Bundling: Good or Bad?

Again, a tradeoff:

Increased profits and reduced consumer surplus, reduced deadweight loss

Spreads fixed cost of research & development over more users

Goods with high fixed costs and low marginal costs (software, TV, music) increase profits from bundling

- increases innovation and investment in these industries